Macroeconomic Uncertainty Prompts Analyst Predictions Of Q1 Guidance Downgrades For DBS, OCBC, And UOB

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Macroeconomic Uncertainty Looms: Analysts Predict Q1 Downgrades for Singapore's Banking Giants

Singapore's banking sector, a cornerstone of the nation's economy, is bracing for a potential storm. Leading analysts are predicting downgrades to the first-quarter guidance from DBS, OCBC, and UOB, the country's three largest banks, citing escalating macroeconomic uncertainty as the primary driver. This forecast casts a shadow over the previously optimistic outlook for the sector, raising concerns about potential ripple effects across the Singaporean financial landscape.

The confluence of global economic headwinds, including persistent inflation, rising interest rates, and geopolitical instability, is creating a challenging operating environment for these banking giants. Analysts are particularly concerned about the impact on loan growth, net interest margins, and overall profitability.

H2: A Perfect Storm: Unpacking the Factors Affecting Q1 Performance

Several key factors are contributing to the anticipated downgrades:

-

Slowing Global Growth: The global economic slowdown is expected to dampen loan demand, impacting revenue streams for these banks heavily reliant on regional and international business. This decreased demand is particularly impactful on areas like trade finance and corporate lending.

-

Rising Interest Rates: While rising interest rates generally benefit banks through increased net interest margins (NIMs), the current environment presents a double-edged sword. Higher rates can also lead to increased credit risks and potentially higher loan defaults, particularly impacting consumer lending segments. The delicate balance between benefiting from higher rates and mitigating potential losses is a major challenge.

-

Geopolitical Uncertainty: The ongoing war in Ukraine, escalating US-China tensions, and other geopolitical risks create significant uncertainty, making accurate financial forecasting exceptionally difficult. This uncertainty is impacting investor confidence and leading to more conservative lending practices.

-

Inflationary Pressures: Persistent inflation continues to erode purchasing power and impacts consumer spending, potentially leading to higher loan defaults and lower consumer lending activity. This factor weighs heavily on the outlook for retail banking segments.

H2: DBS, OCBC, and UOB: Specific Concerns

While all three banks face similar challenges, individual factors may exacerbate the impact on their Q1 performance. For instance, DBS’s significant international exposure makes it potentially more vulnerable to global economic slowdowns. OCBC’s regional focus might expose it to specific economic vulnerabilities within Southeast Asia. UOB's strong presence in wealth management could be affected by decreased investor sentiment.

H2: What's Next for Investors and the Singaporean Economy?

The anticipated downgrades represent a significant shift from the previously more positive outlook for the Singaporean banking sector. Investors are likely to react cautiously, potentially leading to adjustments in stock valuations. The potential for reduced lending activity could also have broader implications for economic growth in Singapore, affecting businesses reliant on bank financing.

The coming weeks will be crucial as the banks release their Q1 results. These results will provide crucial insights into the actual impact of macroeconomic headwinds and inform future investment strategies. Close monitoring of these announcements is critical for investors and economists alike, providing a vital barometer of the health of the Singaporean economy and the broader regional financial landscape. Further analysis will be needed to determine the long-term implications of this challenging economic environment on the nation's financial institutions and its overall economy.

Keywords: DBS, OCBC, UOB, Singapore banks, Q1 guidance, macroeconomic uncertainty, interest rates, inflation, global growth, geopolitical risks, loan defaults, net interest margins, NIM, Singapore economy, banking sector, financial markets, investor sentiment, credit risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Macroeconomic Uncertainty Prompts Analyst Predictions Of Q1 Guidance Downgrades For DBS, OCBC, And UOB. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

High Performance Computing Boosted Innodisks 128 Tb 14 G Bps Gen5 Ssd

May 05, 2025

High Performance Computing Boosted Innodisks 128 Tb 14 G Bps Gen5 Ssd

May 05, 2025 -

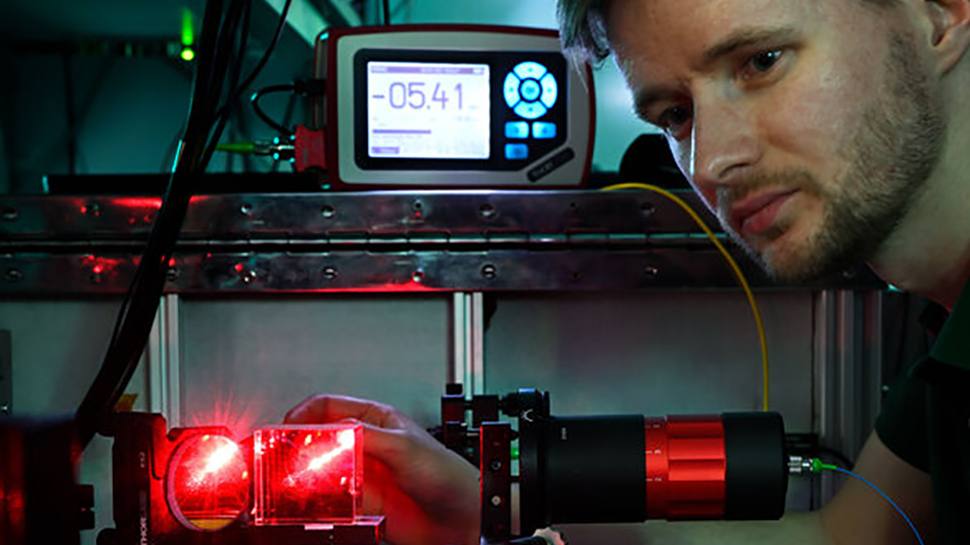

Infrared Light Delivers Nearly 2 Million Netflix Hd Streams Simultaneously A Wi Fi Revolution

May 05, 2025

Infrared Light Delivers Nearly 2 Million Netflix Hd Streams Simultaneously A Wi Fi Revolution

May 05, 2025 -

Watch Now American Idol Contestant Takes On James Taylor Classic

May 05, 2025

Watch Now American Idol Contestant Takes On James Taylor Classic

May 05, 2025 -

Jane Austens Life Through The Lens Of Pbss Miss Austen

May 05, 2025

Jane Austens Life Through The Lens Of Pbss Miss Austen

May 05, 2025 -

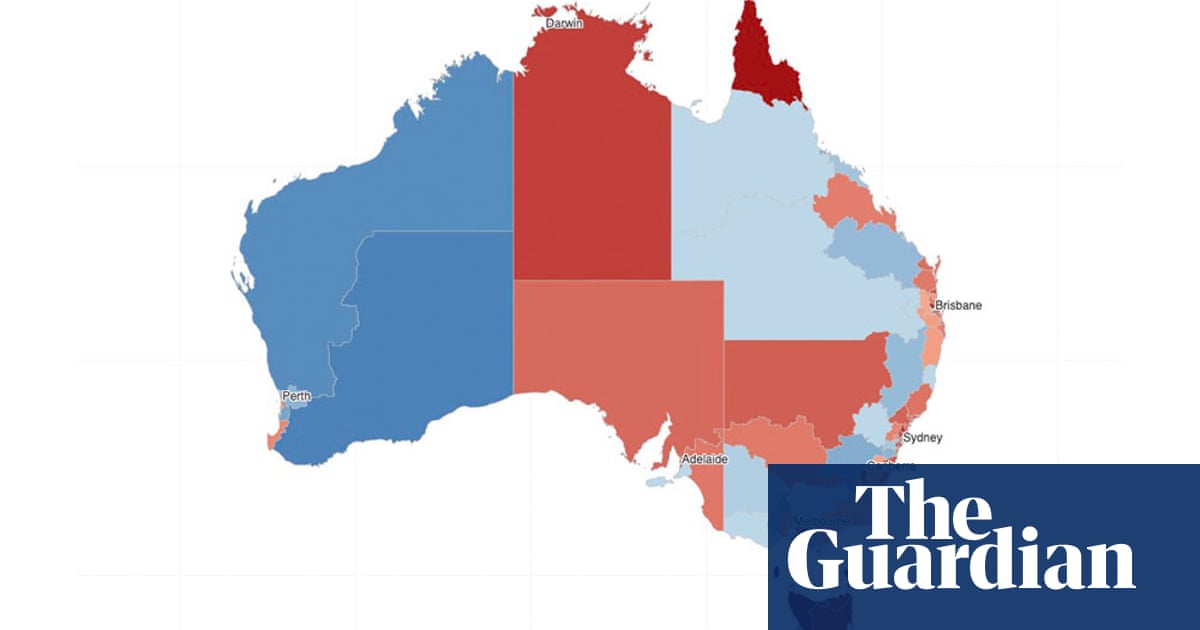

Four Charts Analyzing Australias Federal Election Results

May 05, 2025

Four Charts Analyzing Australias Federal Election Results

May 05, 2025