Magnificent AI Stock Down 25%: Should You Buy Before April 17th?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Magnificent AI Stock Down 25%: Should You Buy Before April 17th?

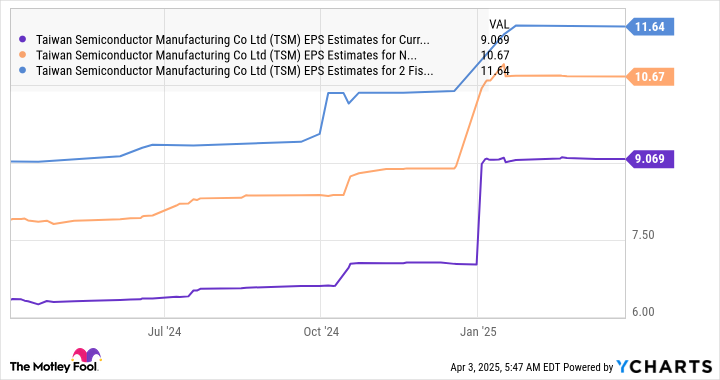

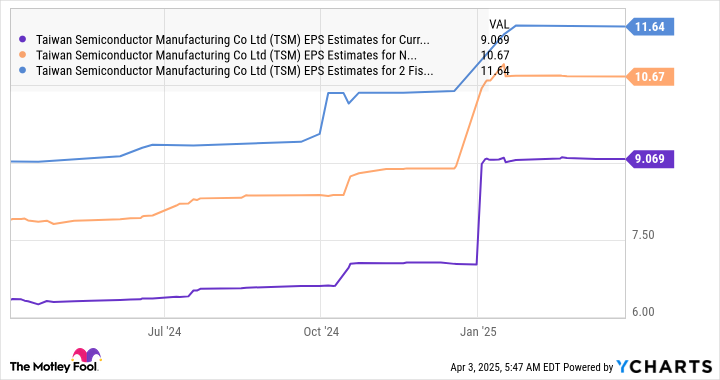

Magnificent AI, the darling of the tech world just a few months ago, has experienced a dramatic 25% drop in its stock price, leaving investors reeling and scrambling to understand the sudden downturn. With the crucial April 17th deadline looming – potentially marking a significant shift in the company's trajectory – many are asking: is this a buying opportunity, or a warning sign?

The recent plunge has sent shockwaves through the market, prompting intense speculation and analysis. While the company hasn't released any official statements directly attributing to the drop, several factors are being considered as potential culprits. Understanding these factors is crucial before making any investment decisions.

Potential Factors Contributing to the Stock Drop:

-

Increased Competition: The AI sector is rapidly evolving, with numerous competitors emerging and vying for market share. Magnificent AI's innovative edge, once a clear advantage, may be facing increased challenges from newer, more agile players. This heightened competition could be impacting investor confidence.

-

Profitability Concerns: While Magnificent AI has demonstrated impressive growth, concerns about its long-term profitability remain. Investors are increasingly scrutinizing the company's financial performance, looking for signs of sustainable earnings. The recent stock drop might reflect a growing unease regarding the company's path to profitability.

-

Market Volatility: The broader market's volatility cannot be ignored. Overall market downturns often disproportionately impact high-growth tech stocks like Magnificent AI, leading to amplified price swings.

-

Upcoming Earnings Report: The April 17th deadline likely refers to an upcoming earnings report or significant company announcement. The anticipation and uncertainty surrounding this event are likely contributing to the current market anxiety. Investors are holding their breath, waiting for clarity on the company's future performance.

Should You Buy Before April 17th?

This is the million-dollar question. The 25% drop presents a compelling opportunity for some investors, but it's crucial to proceed with caution. A thorough due diligence process is paramount before making any investment decisions.

Consider these factors:

-

Your Risk Tolerance: Investing in Magnificent AI at this juncture carries significant risk. The stock is highly volatile, and further price drops are possible. Only investors with a high-risk tolerance should consider purchasing.

-

Long-Term Outlook: Do you believe in Magnificent AI's long-term vision and potential? A short-term price fluctuation shouldn't overshadow the company's fundamental value and future prospects.

-

Diversification: Never put all your eggs in one basket. Diversifying your investment portfolio can mitigate the risk associated with individual stock volatility.

-

Expert Advice: Consider consulting a financial advisor before making any investment decisions. They can provide personalized advice based on your financial situation and risk tolerance.

The Bottom Line:

The 25% drop in Magnificent AI's stock price is a significant event, prompting serious consideration for investors. While the potential for significant returns exists, the risk is equally substantial. Before April 17th, thorough research, careful evaluation of your risk tolerance, and possibly expert financial advice are crucial steps in determining whether this dip represents a buying opportunity or a sign to steer clear. The upcoming announcement on April 17th will undoubtedly play a major role in shaping the future of Magnificent AI and its stock price. Stay informed and make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Magnificent AI Stock Down 25%: Should You Buy Before April 17th?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tuesdays Efl Match Predictions Expert Betting Tips And Odds Analysis

Apr 08, 2025

Tuesdays Efl Match Predictions Expert Betting Tips And Odds Analysis

Apr 08, 2025 -

The Worlds New Trade War Understanding The Implications

Apr 08, 2025

The Worlds New Trade War Understanding The Implications

Apr 08, 2025 -

Watch Bautista Agut Vs Nakashima Live 2025 Monte Carlo Masters Streaming Guide

Apr 08, 2025

Watch Bautista Agut Vs Nakashima Live 2025 Monte Carlo Masters Streaming Guide

Apr 08, 2025 -

Death Of A Unicorn Review A Hilarious Cynical Look At Big Pharma

Apr 08, 2025

Death Of A Unicorn Review A Hilarious Cynical Look At Big Pharma

Apr 08, 2025 -

Shopify Ceo Prove Ai Cant Do Your Job Before Requesting More Staff

Apr 08, 2025

Shopify Ceo Prove Ai Cant Do Your Job Before Requesting More Staff

Apr 08, 2025