Major Compliance Investment: TD Allocates $1 Billion Over Two Years

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Invests $1 Billion in Compliance Over Two Years: A Proactive Approach to Regulatory Scrutiny

Toronto, ON – October 26, 2023 – TD Bank Group (TD) announced a significant investment of $1 billion over the next two years dedicated to enhancing its compliance infrastructure and bolstering its regulatory oversight capabilities. This substantial commitment underscores the bank's proactive approach to navigating the increasingly complex regulatory landscape and maintaining the highest standards of ethical conduct. The move comes at a time of heightened scrutiny for financial institutions globally, and signals TD's commitment to prioritizing compliance above all else.

This massive investment represents a considerable increase in TD's commitment to compliance and reflects a growing trend among major financial institutions to prioritize regulatory adherence. The financial services sector faces ever-evolving regulations, and failure to comply can result in substantial fines, reputational damage, and loss of customer trust. TD's proactive approach aims to mitigate these risks effectively.

What Will the $1 Billion Be Used For?

TD's investment will be strategically allocated across several key areas:

- Technology Upgrades: A significant portion of the funds will be directed towards upgrading existing technology and implementing new systems designed to improve the accuracy and efficiency of compliance monitoring and reporting. This includes investment in advanced analytics, artificial intelligence (AI), and machine learning (ML) to enhance fraud detection and regulatory reporting capabilities.

- Enhanced Workforce: TD plans to expand its compliance workforce, hiring specialized professionals with expertise in areas such as anti-money laundering (AML), know-your-customer (KYC) regulations, and data privacy. This expansion will ensure adequate staffing levels to manage the increased complexity of regulatory requirements.

- Strengthened Training Programs: The bank will invest heavily in comprehensive training programs for employees across all levels, emphasizing the importance of ethical conduct and compliance with all applicable regulations. This will ensure a culture of compliance permeates the entire organization.

- Improved Data Security: A significant focus will be placed on enhancing data security measures and improving data governance frameworks. This includes investing in advanced cybersecurity technologies and bolstering internal controls to protect sensitive customer data and prevent breaches.

Why This Investment is Crucial in Today's Climate

The financial services industry is subject to intense regulatory scrutiny globally. Recent high-profile cases of non-compliance have resulted in significant penalties, highlighting the critical importance of robust compliance programs. TD's proactive investment demonstrates a commitment to:

- Preventing Regulatory Violations: By investing in advanced technologies and personnel, TD aims to proactively identify and address potential compliance risks before they escalate into significant problems.

- Protecting Customer Data: The investment in enhanced data security measures reinforces TD's commitment to protecting the privacy and security of its customers' information.

- Maintaining Reputational Integrity: A strong compliance program is crucial for maintaining public trust and protecting the bank's reputation.

Looking Ahead: A Commitment to Long-Term Compliance

This $1 billion investment represents a long-term commitment to maintaining the highest standards of compliance at TD. The bank's proactive approach demonstrates a commitment to responsible banking practices and sets a precedent for other financial institutions to follow. By investing in technology, personnel, and training, TD is positioning itself for continued success in a dynamic and ever-evolving regulatory environment. This significant investment in compliance, regulatory technology, AML, and KYC will undoubtedly strengthen TD's position as a leader in the financial services industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Compliance Investment: TD Allocates $1 Billion Over Two Years. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Arbitrum Arb Price Surge Chart Pattern Hints At 44 Potential Rally

May 23, 2025

Arbitrum Arb Price Surge Chart Pattern Hints At 44 Potential Rally

May 23, 2025 -

Sydney Homeless Kitchen Faces Eviction During Vibrant Vivid Festival

May 23, 2025

Sydney Homeless Kitchen Faces Eviction During Vibrant Vivid Festival

May 23, 2025 -

750k A Season Galvin Weighs Up Nrl Offers From Parramatta And Canterbury

May 23, 2025

750k A Season Galvin Weighs Up Nrl Offers From Parramatta And Canterbury

May 23, 2025 -

Japanese And Asian Intellectual Property Rights Head To Web3 Via Animoca Brands And Astar Network

May 23, 2025

Japanese And Asian Intellectual Property Rights Head To Web3 Via Animoca Brands And Astar Network

May 23, 2025 -

Coast Guards New Force Design A Focus On Integrated Maritime Surveillance Capabilities

May 23, 2025

Coast Guards New Force Design A Focus On Integrated Maritime Surveillance Capabilities

May 23, 2025

Latest Posts

-

Up To 200 Off Your Energy Bills Octopus Energys Latest Tariff Offer

May 24, 2025

Up To 200 Off Your Energy Bills Octopus Energys Latest Tariff Offer

May 24, 2025 -

Ballerina Film Review Roundup Mayhem And Excitement

May 24, 2025

Ballerina Film Review Roundup Mayhem And Excitement

May 24, 2025 -

Fujifilm X Half Exploring Its Quirky Film Photography Capabilities And Retro Appeal

May 24, 2025

Fujifilm X Half Exploring Its Quirky Film Photography Capabilities And Retro Appeal

May 24, 2025 -

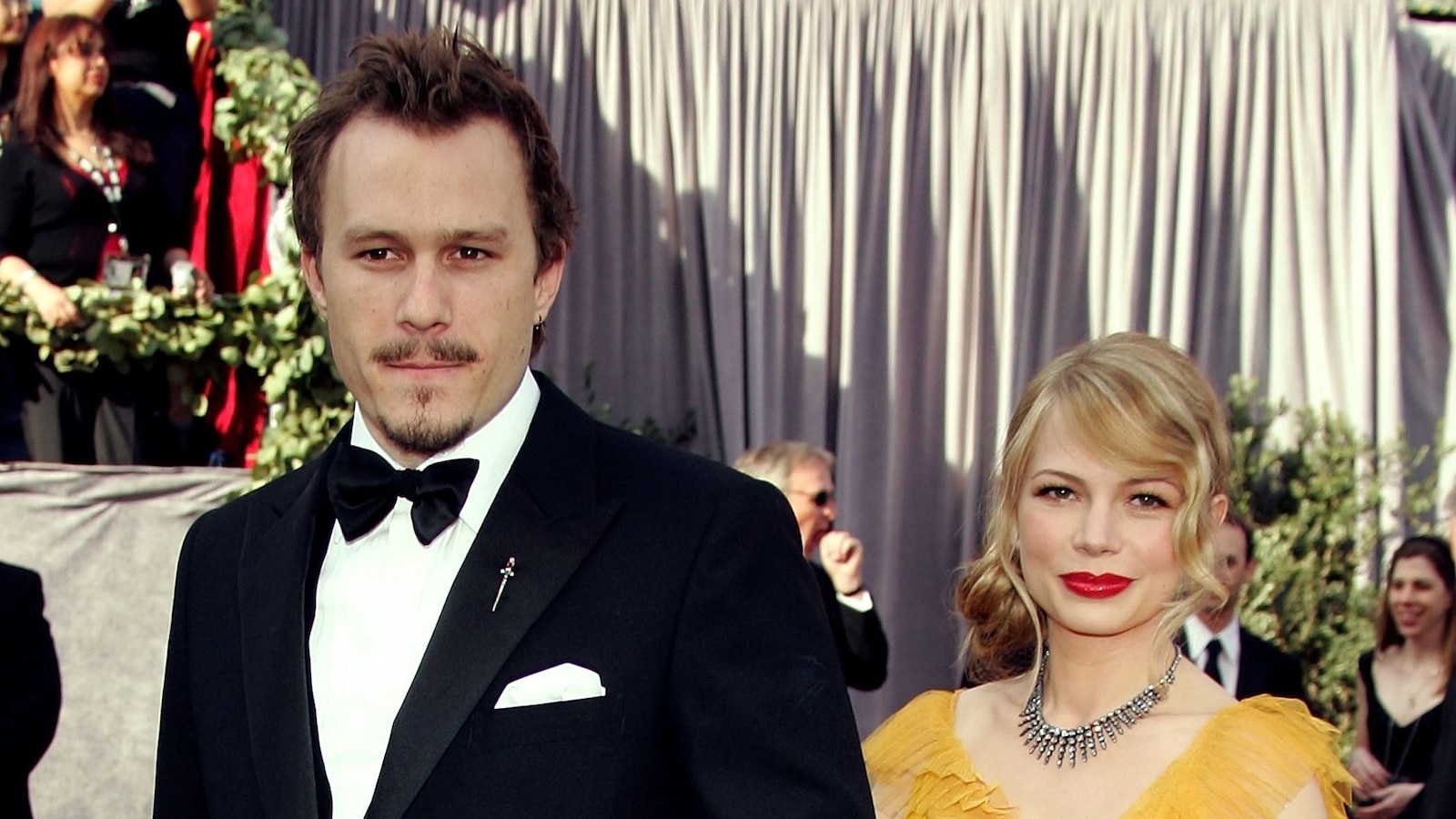

Emotional Interview Michelle Williams Remembers Heath Ledger

May 24, 2025

Emotional Interview Michelle Williams Remembers Heath Ledger

May 24, 2025 -

Ocean Gate Ceos Wifes Chilling Smile Unwitting Words Heard Before Titan Submersible Tragedy

May 24, 2025

Ocean Gate Ceos Wifes Chilling Smile Unwitting Words Heard Before Titan Submersible Tragedy

May 24, 2025