Major Restructuring At TD Bank: 2% Workforce Reduction And $3 Billion Portfolio Wind-Down

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Announces Major Restructuring: 2% Workforce Reduction and $3 Billion Portfolio Wind-Down

TD Bank Group announced a significant restructuring plan today, impacting approximately 2% of its workforce and involving the wind-down of a $3 billion portfolio. This move, aimed at streamlining operations and enhancing profitability, sends ripples through the Canadian banking sector and highlights the ongoing challenges faced by financial institutions in a volatile economic climate.

The news, released this morning, immediately impacted TD Bank's stock price, causing a [mention percentage change and direction – this needs to be updated with real-time data at publishing]. The restructuring plan, detailed in a press release, outlines a multi-pronged approach focused on efficiency improvements and strategic portfolio adjustments.

Workforce Reduction: A Necessary but Difficult Decision

The bank confirmed that approximately 2% of its global workforce will be affected by the restructuring. This translates to [calculate the approximate number based on total workforce – needs to be updated with accurate data from the press release]. While the bank stated a commitment to supporting affected employees through severance packages and outplacement services, the announcement underscores the difficult decisions often required to navigate challenging economic conditions. The impacted roles are spread across various departments, with a focus on streamlining overlapping functions and reducing redundancy.

- Focus on Technology and Automation: The bank emphasized that these reductions are part of a broader initiative to leverage technology and automation to enhance efficiency and productivity.

- Employee Support: TD Bank reiterated its commitment to supporting employees affected by the restructuring, providing comprehensive severance packages and outplacement assistance to aid their transition.

- Long-Term Strategy: The bank highlighted that these changes are part of a larger long-term strategy to strengthen its financial position and adapt to the evolving banking landscape.

$3 Billion Portfolio Wind-Down: A Strategic Shift

In addition to the workforce reduction, TD Bank is initiating a wind-down of a $3 billion portfolio. While the specific details of this portfolio remain undisclosed, the bank indicated that this decision reflects a strategic realignment of its investment priorities. This shift suggests a focus on core business areas and potentially a move away from less profitable or higher-risk ventures. Further details regarding the nature of the portfolio and the expected timeline for its wind-down are expected to be released in the coming weeks. Analysts suggest this may indicate a response to changing market conditions or a proactive measure to mitigate potential risks.

Impact on the Banking Sector and Investors

This announcement has significant implications for both the Canadian banking sector and investors. Other major banks may face pressure to implement similar cost-cutting measures to maintain competitiveness. Investors will be closely monitoring TD Bank's performance in the coming quarters to assess the effectiveness of the restructuring plan. The long-term impact on profitability and shareholder value remains to be seen.

The restructuring at TD Bank underscores the challenges facing the financial services industry, particularly in the current environment of economic uncertainty and rising interest rates. The bank's strategic decisions, while difficult, are intended to position it for long-term success and stability. Further updates and clarifications are anticipated in the near future. We will continue to monitor this developing story and provide updates as they become available.

Keywords: TD Bank, Restructuring, Workforce Reduction, Portfolio Wind-Down, Canadian Banking, Economic Uncertainty, Financial Services, Layoffs, Investment Portfolio, Stock Price, Profitability, Efficiency, Automation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Restructuring At TD Bank: 2% Workforce Reduction And $3 Billion Portfolio Wind-Down. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

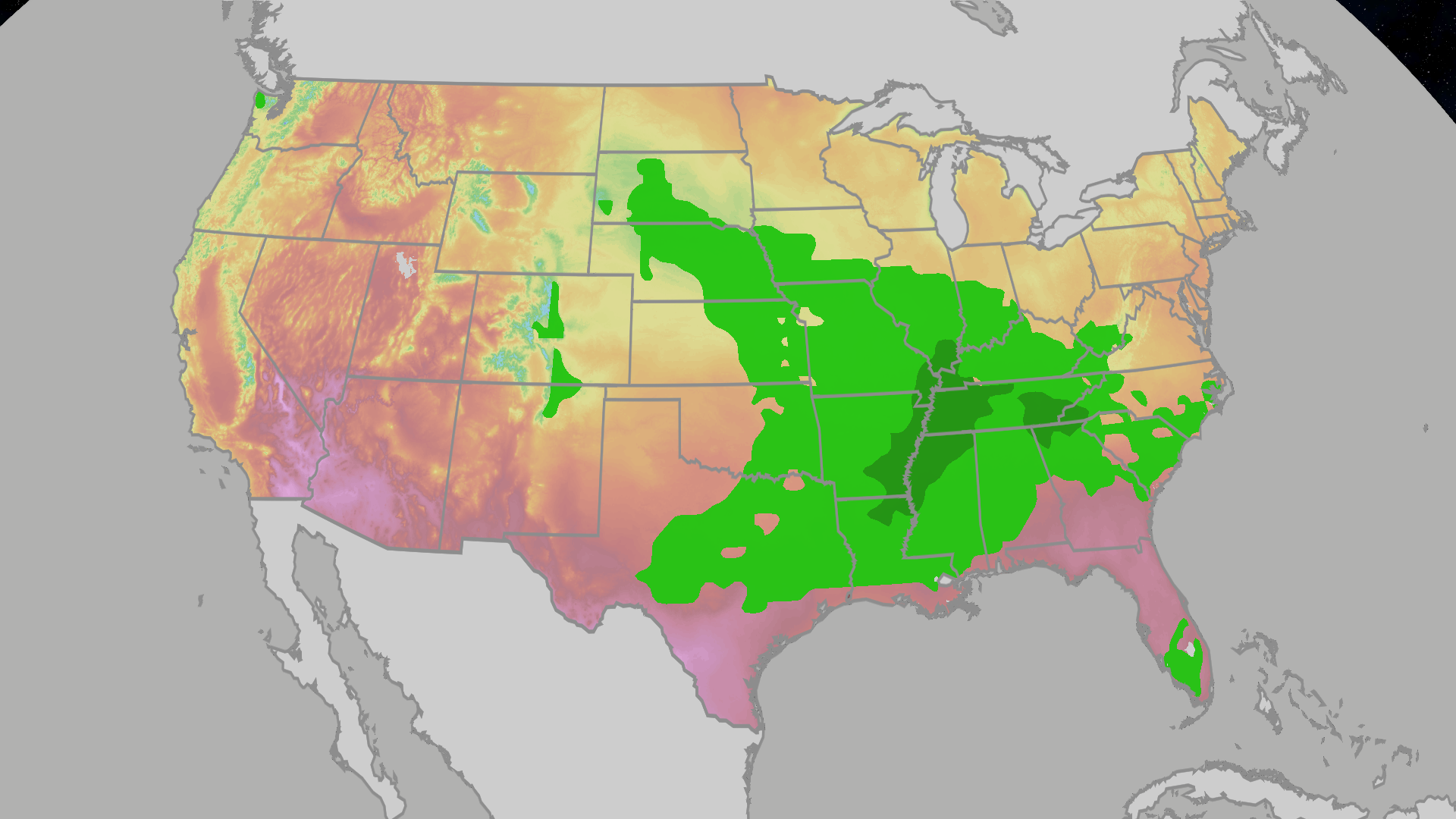

Memorial Day Weekend Forecast Prepare For Possible Soggy Weather

May 23, 2025

Memorial Day Weekend Forecast Prepare For Possible Soggy Weather

May 23, 2025 -

Bronson Garlick Signs With South Sydney Rabbitohs

May 23, 2025

Bronson Garlick Signs With South Sydney Rabbitohs

May 23, 2025 -

The Future Of Investing Kraken Brings Tokenized Equities To Wall Street

May 23, 2025

The Future Of Investing Kraken Brings Tokenized Equities To Wall Street

May 23, 2025 -

Brotherly Rivalry Alex Marquezs Silverstone Assessment And Marcs Dominance

May 23, 2025

Brotherly Rivalry Alex Marquezs Silverstone Assessment And Marcs Dominance

May 23, 2025 -

Open Source Llm Showdown Qwen 2 5 And Qwen 3 Surge Ahead

May 23, 2025

Open Source Llm Showdown Qwen 2 5 And Qwen 3 Surge Ahead

May 23, 2025

Latest Posts

-

Three Ton Stonehenge Blocks A Case For Reuse From Preexisting Structures

May 24, 2025

Three Ton Stonehenge Blocks A Case For Reuse From Preexisting Structures

May 24, 2025 -

Rugby League Star Tom Eisenhuth Calls Time On His Playing Career

May 24, 2025

Rugby League Star Tom Eisenhuth Calls Time On His Playing Career

May 24, 2025 -

Euphoria Season 3 Update Sydney Sweeney Reveals Cassies Flawed Future

May 24, 2025

Euphoria Season 3 Update Sydney Sweeney Reveals Cassies Flawed Future

May 24, 2025 -

Jony Ive And Open Ai A Partnership Focused On Ais Future Not Smartphones

May 24, 2025

Jony Ive And Open Ai A Partnership Focused On Ais Future Not Smartphones

May 24, 2025 -

Warren Buffett Disminuye Su Inversion En Apple En Un 13 Los Detalles De La Venta

May 24, 2025

Warren Buffett Disminuye Su Inversion En Apple En Un 13 Los Detalles De La Venta

May 24, 2025