Major Retail Development: Hudson's Bay's 28 Store Lease Sale Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major Retail Shakeup: Hudson's Bay Sells 28 Store Leases – What it Means for the Future of Retail

Hudson's Bay Company (HBC), a Canadian retail giant, has made headlines with the announcement of the sale of leases for 28 of its department stores. This significant move signals a major shift in the retail landscape and raises crucial questions about the future of brick-and-mortar stores in an increasingly digital world. This article breaks down the key details of the sale and analyzes its potential implications.

The Sale: Key Details

HBC announced the sale of its leases to a real estate investment trust (REIT) in a deal valued at [Insert Value if available, otherwise remove sentence or replace with estimate and source]. This transaction doesn't involve the sale of the stores themselves, but rather the long-term leases that HBC holds on these properties. This allows HBC to free up capital while still maintaining a presence in these locations through a lease-back agreement. The 28 stores are strategically located across [Insert geographic locations, e.g., Canada and the United States], representing a significant portion of HBC's overall footprint. While the specific locations haven't all been publicly disclosed, reports suggest [Include specific locations if known from reputable sources].

Why the Lease Sale? A Strategic Shift for HBC

HBC's decision to sell these leases is part of a broader strategic repositioning. The company has been facing increasing pressure from online competitors and changing consumer shopping habits. By selling the leases, HBC aims to:

- Reduce debt and improve its financial position: The proceeds from the sale will help alleviate HBC's debt burden and strengthen its financial stability. This is crucial in a challenging retail environment.

- Focus on core businesses and omnichannel strategies: By freeing up capital, HBC can invest more in its e-commerce platforms and other growth initiatives. This shift towards an omnichannel approach is becoming increasingly important for retailers to stay competitive.

- Enhance operational efficiency: By streamlining its real estate portfolio, HBC can reduce overhead costs and improve its overall operational efficiency.

Impact on Consumers and Employees

The impact of this sale on consumers is likely to be minimal in the short term. HBC will continue to operate in these locations under lease agreements. However, the long-term effects remain to be seen. The future of the specific stores will ultimately depend on the new landlord's plans.

Regarding employees, HBC has stated that it intends to maintain its workforce at these locations. However, any potential changes in ownership or management could lead to future adjustments.

The Future of Brick-and-Mortar Retail

HBC's move highlights the ongoing challenges faced by traditional brick-and-mortar retailers. The retail landscape is constantly evolving, and companies must adapt to survive. The sale of these leases represents a strategic response to these challenges, demonstrating a willingness to embrace change and explore new business models. This move could serve as a model for other retailers looking to optimize their real estate portfolios and navigate the complexities of the modern retail environment.

Looking Ahead:

This major retail development warrants close observation. The success of HBC's strategy will depend on its ability to effectively implement its omnichannel strategy and capitalize on the capital generated from the lease sale. Further announcements from HBC will provide more clarity on the long-term implications of this significant transaction. We will continue to update this article as more information becomes available. Stay tuned for further analysis and updates on this evolving story.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Retail Development: Hudson's Bay's 28 Store Lease Sale Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Friday May 23rd Euro Millions Draw Check Your Numbers And Thunderball Results

May 24, 2025

Friday May 23rd Euro Millions Draw Check Your Numbers And Thunderball Results

May 24, 2025 -

2025 Afl Round 11 In Depth Fremantle Vs Port Adelaide Preview And Expert Tips

May 24, 2025

2025 Afl Round 11 In Depth Fremantle Vs Port Adelaide Preview And Expert Tips

May 24, 2025 -

Kanye Wests Antisemitism Controversy A Shifting Narrative

May 24, 2025

Kanye Wests Antisemitism Controversy A Shifting Narrative

May 24, 2025 -

End Of An Era Garlick Leaving Storm At The End Of 2025

May 24, 2025

End Of An Era Garlick Leaving Storm At The End Of 2025

May 24, 2025 -

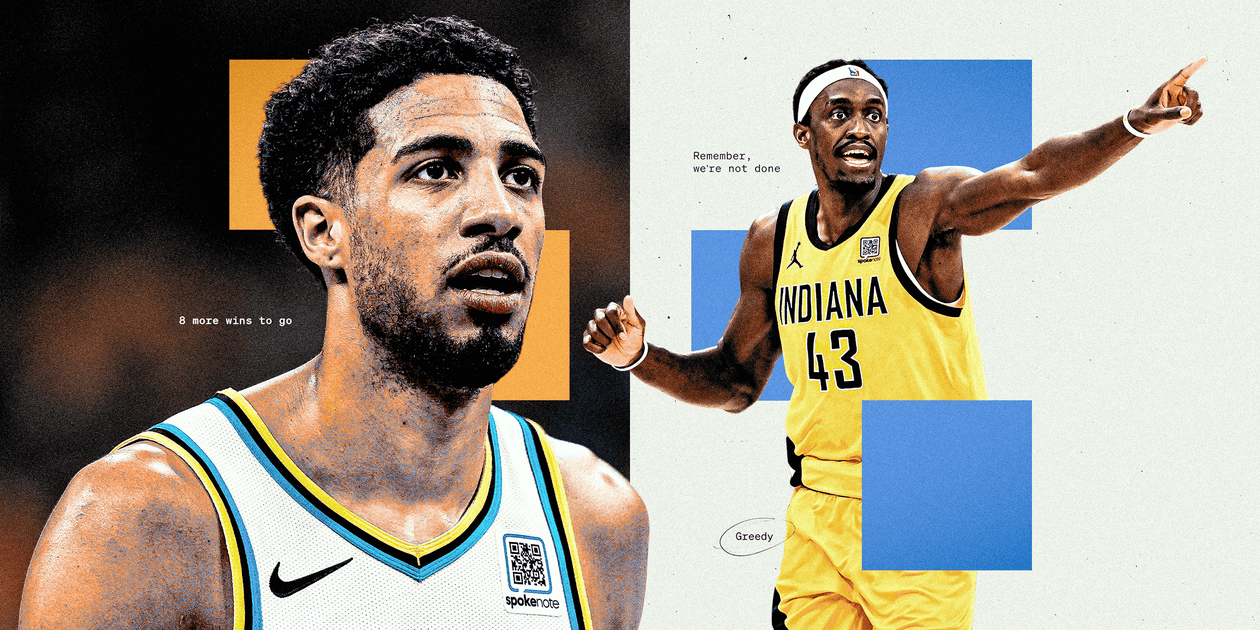

Pacers Unprecedented Opportunity A Realistic Shot At The Championship

May 24, 2025

Pacers Unprecedented Opportunity A Realistic Shot At The Championship

May 24, 2025