Major US Banks Explore Joint Stablecoin Project: A Quiet Revolution?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major US Banks Explore Joint Stablecoin Project: A Quiet Revolution?

The US banking landscape is quietly simmering with a potential revolution. Forget the flashy crypto headlines; a far more significant shift may be brewing behind closed doors. Major US banks are reportedly exploring a joint venture to create a stablecoin, a cryptocurrency pegged to the value of the US dollar. This move, if successful, could dramatically reshape the financial system and challenge the dominance of existing payment networks.

This isn't just another cryptocurrency project. The involvement of established banking giants lends this initiative unprecedented weight and credibility. The potential impact on the financial technology (FinTech) sector, and indeed the global economy, is immense. But what exactly does this mean, and what are the implications?

The Allure of a Bank-Backed Stablecoin

The allure of a stablecoin issued by major US banks is multifaceted. For consumers, it promises:

- Faster and cheaper transactions: Traditional banking systems often suffer from slow processing times and high transaction fees. A bank-backed stablecoin could offer a significant improvement.

- Enhanced security: Backed by the financial strength of major institutions, such a stablecoin would likely enjoy greater security and trust than many existing cryptocurrencies.

- Seamless integration: The potential for smooth integration with existing banking infrastructure would make adoption easier for both consumers and businesses.

- Increased financial inclusion: Stablecoins could potentially provide access to financial services for underserved populations.

Challenges and Potential Roadblocks

While the potential benefits are considerable, several hurdles must be overcome:

- Regulatory uncertainty: The regulatory landscape surrounding stablecoins is still evolving. Securing regulatory approval from bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC) will be crucial. Navigating complex compliance requirements will be a major undertaking.

- Competition: Existing payment networks and other stablecoin projects pose a significant competitive threat. The new venture will need a compelling value proposition to gain market share.

- Technological hurdles: Developing and implementing a robust and scalable stablecoin infrastructure requires significant technological expertise. Ensuring security and preventing fraud will be paramount.

- Public perception: Overcoming public skepticism towards cryptocurrencies will be essential for widespread adoption. Transparency and clear communication will be key.

A Paradigm Shift in Payments?

The development of a bank-backed stablecoin represents a significant departure from traditional financial models. It signals a growing acceptance of blockchain technology within the established banking sector. If successful, this project could pave the way for a more efficient, transparent, and inclusive financial system. It could also accelerate the adoption of other blockchain-based solutions within the financial industry.

This isn't merely an incremental change; it's a potential paradigm shift. The coming months and years will be crucial in determining the success or failure of this ambitious venture. The implications for consumers, businesses, and the global financial landscape are profound. This quiet revolution in the making warrants close attention. The future of finance may well depend on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major US Banks Explore Joint Stablecoin Project: A Quiet Revolution?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nao Perca Agora Ao Vivo Reuniao Anual Da Berkshire Hathaway 2024 Cobertura Completa Info Money

May 24, 2025

Nao Perca Agora Ao Vivo Reuniao Anual Da Berkshire Hathaway 2024 Cobertura Completa Info Money

May 24, 2025 -

High Yield Energy Cibc Analysts Top Recommendations In Infrastructure And Power

May 24, 2025

High Yield Energy Cibc Analysts Top Recommendations In Infrastructure And Power

May 24, 2025 -

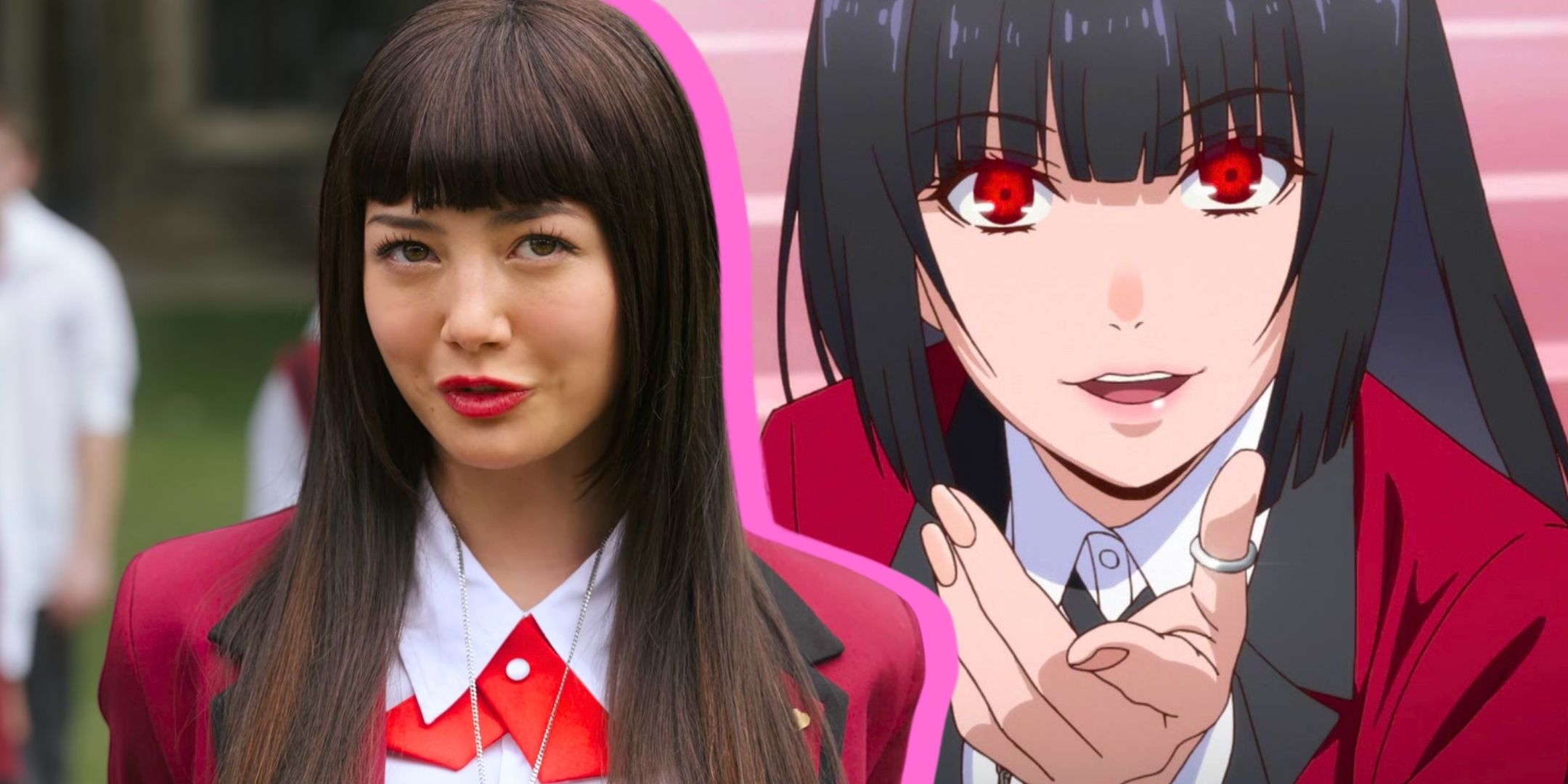

Netflixs Live Action Anime Adaptation A Streaming Success Despite Critic Reviews

May 24, 2025

Netflixs Live Action Anime Adaptation A Streaming Success Despite Critic Reviews

May 24, 2025 -

Controversy Dale Thomass Accidental Age Comment And Fagan Apology

May 24, 2025

Controversy Dale Thomass Accidental Age Comment And Fagan Apology

May 24, 2025 -

Labubu Doll Recall Sparks Outrage Among Collectors

May 24, 2025

Labubu Doll Recall Sparks Outrage Among Collectors

May 24, 2025