Market Analysis: Trump Stock Price Faces Critical Resistance Level

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Analysis: Trump Stock Price Faces Critical Resistance Level

Donald Trump's post-presidency business ventures are under the market microscope, as his company's stock price grapples with a significant resistance level. The fluctuating value of Trump-related investments has become a key indicator of investor sentiment towards his brand and future prospects, making this a crucial moment for market analysts and those with a stake in his various enterprises.

The recent performance of Trump-branded stocks has been marked by volatility, reflecting both the enduring power of his brand and the persistent challenges he faces. While some sectors show signs of growth, others struggle to maintain momentum. Understanding the forces driving these trends is key to navigating this complex investment landscape.

What's Fueling the Stock Price Fluctuations?

Several factors contribute to the current uncertainty surrounding Trump's stock price:

-

Political Landscape: Trump's continued involvement in politics, despite no longer holding office, significantly influences market sentiment. His public statements and endorsements can trigger positive or negative reactions from investors. Any potential legal challenges also cast a long shadow over investment decisions.

-

Brand Reputation: The Trump brand itself remains a divisive force. While it retains a loyal following, negative perceptions persist, impacting consumer confidence and, consequently, the value of related businesses. This duality creates an unstable market environment.

-

Economic Conditions: Broader economic trends, such as inflation and interest rate hikes, also affect Trump's stock performance. These macroeconomic factors are external but exert considerable influence on investor behavior and risk appetite.

-

Competition: The market is fiercely competitive. Trump's businesses face challenges from established players with significant market share, impacting profitability and ultimately the stock price.

The Critical Resistance Level: A Key Hurdle

Analysts have identified a specific price point acting as a major resistance level for Trump-related stocks. This level represents a psychological barrier – a price point where selling pressure often outweighs buying pressure, preventing further upward momentum. Breaking through this resistance would signal a significant shift in investor confidence. Failure to do so, however, could lead to further price declines.

Analyzing the Technical Indicators

Technical analysis tools, such as moving averages and relative strength index (RSI), provide further insights into the short-term and medium-term trends. These indicators can help investors anticipate potential price movements and adjust their strategies accordingly. However, it’s crucial to remember that technical analysis is not a foolproof predictor and should be used in conjunction with fundamental analysis.

Looking Ahead: Potential Scenarios

The future trajectory of Trump-related stocks remains uncertain. Several scenarios are plausible:

-

Breakthrough: A successful breach of the resistance level could trigger a substantial price increase, driven by renewed investor optimism.

-

Consolidation: The price may remain range-bound for a period, indicating uncertainty and indecision amongst investors.

-

Decline: Failure to overcome the resistance level could lead to a further decline in price, reflecting waning investor confidence.

Conclusion: Navigating the Volatility

Investing in Trump-related stocks requires a cautious and well-informed approach. The inherent volatility demands careful consideration of the various factors influencing the market. Investors should conduct thorough due diligence, stay updated on market trends and news, and diversify their portfolios to mitigate risk. The current situation highlights the importance of robust risk management strategies in navigating this unpredictable investment landscape. The coming weeks and months will be critical in determining the long-term trajectory of Trump's stock price and the overall health of his business empire.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Analysis: Trump Stock Price Faces Critical Resistance Level. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Major Developments Teslas Robotaxi Optimus And Dojo 2 Receive Key Upgrades

May 22, 2025

Major Developments Teslas Robotaxi Optimus And Dojo 2 Receive Key Upgrades

May 22, 2025 -

East Enders The Car Crash Victims A Struggle For Life

May 22, 2025

East Enders The Car Crash Victims A Struggle For Life

May 22, 2025 -

Aoc Addresses Death Threats In Wake Of Offensive Baseball Video Controversy

May 22, 2025

Aoc Addresses Death Threats In Wake Of Offensive Baseball Video Controversy

May 22, 2025 -

Analyzing The Revised Us China Trade Agreement Tariff Implications

May 22, 2025

Analyzing The Revised Us China Trade Agreement Tariff Implications

May 22, 2025 -

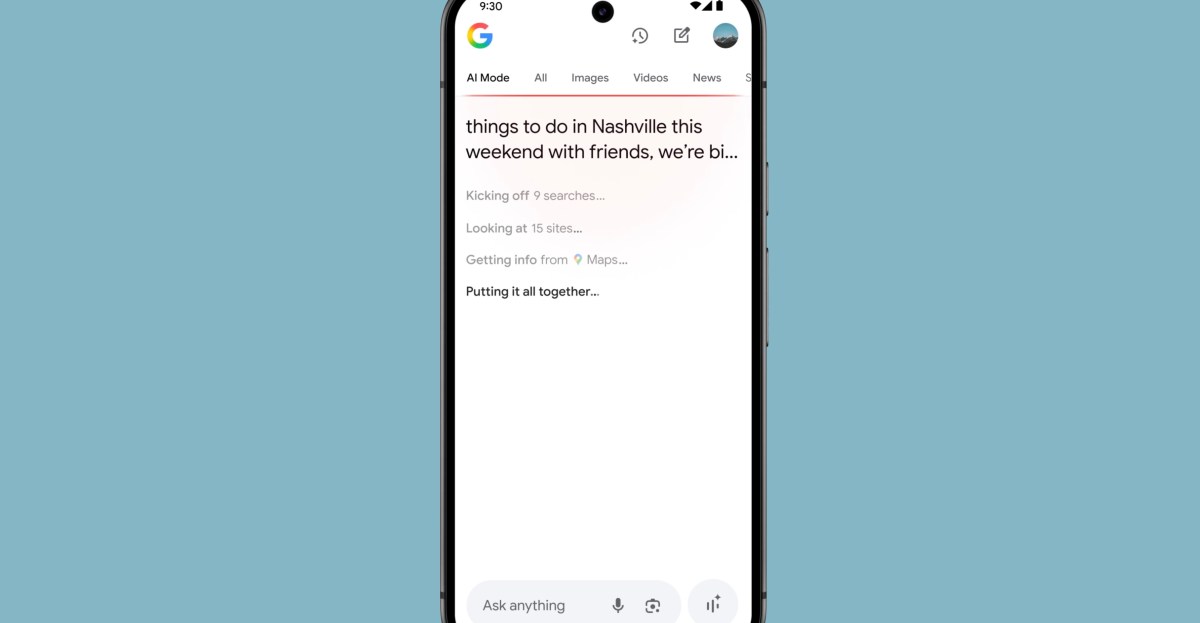

Understanding Ai Mode Google Searchs Next Generation Of Technology

May 22, 2025

Understanding Ai Mode Google Searchs Next Generation Of Technology

May 22, 2025