Market-Beating Stock: Identifying And Capitalizing On High-Growth Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market-Beating Stock: Identifying and Capitalizing on High-Growth Potential

The quest for market-beating returns is a holy grail for many investors. While no strategy guarantees success, identifying and capitalizing on high-growth potential within the stock market offers a compelling path towards exceeding benchmark performance. This article delves into the strategies and considerations involved in finding these lucrative opportunities.

Understanding High-Growth Potential

Before diving into specific stock selection, it's crucial to define what constitutes "high-growth potential." This isn't solely about rapid price appreciation in the short term. Instead, it encompasses companies exhibiting strong, sustainable revenue growth, expanding market share, and possessing a robust competitive advantage. Look for companies with:

- Disruptive Innovation: Companies pioneering new technologies or business models often exhibit significant growth potential. Think of the early investors in Amazon or Google.

- Strong Management Team: Experienced and visionary leadership is critical for navigating challenges and capitalizing on opportunities.

- Scalable Business Model: The ability to expand operations efficiently and cost-effectively is key to sustained growth.

- Healthy Financial Position: While rapid growth can sometimes come with debt, a company's overall financial health is crucial for long-term sustainability. Examine metrics like debt-to-equity ratio and cash flow.

Identifying Market-Beating Stocks: A Multifaceted Approach

Pinpointing high-growth stocks requires a thorough and multifaceted approach. Here's a breakdown of key strategies:

1. Fundamental Analysis: This involves scrutinizing a company's financial statements, business model, competitive landscape, and management team. Key metrics to analyze include:

- Revenue Growth: Consistent and accelerating revenue growth is a primary indicator of a healthy, expanding business.

- Earnings Per Share (EPS): Rising EPS suggests profitability and efficiency.

- Return on Equity (ROE): A high ROE indicates the company is effectively utilizing its resources to generate profits.

- Debt Levels: Excessive debt can be a major risk factor.

2. Technical Analysis: While fundamental analysis focuses on the company's intrinsic value, technical analysis examines price trends and trading volume to identify potential entry and exit points. This approach involves charting patterns and using indicators to gauge market sentiment.

3. Sector Analysis: Identifying high-growth sectors is crucial. Emerging industries like renewable energy, biotechnology, and artificial intelligence often offer promising investment opportunities. However, remember that sector performance fluctuates; thorough research is essential.

4. Qualitative Factors: Don't underestimate the importance of qualitative factors, such as brand reputation, customer loyalty, and intellectual property. A strong brand and innovative products can provide a significant competitive edge.

Mitigating Risk: Diversification and Patience

Investing in high-growth stocks inherently carries higher risk. Significant price swings are common. To mitigate risk:

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across different sectors and companies.

- Invest for the long term: High-growth stocks may experience periods of volatility. Patience and a long-term perspective are crucial.

- Set realistic expectations: While aiming high is important, avoid unrealistic expectations of overnight riches.

Conclusion:

Identifying market-beating stocks requires diligent research, a combination of fundamental and technical analysis, and a long-term perspective. By focusing on companies exhibiting strong growth potential, robust business models, and sound financial management, investors can significantly improve their chances of exceeding market benchmarks. Remember that thorough due diligence and risk management are paramount to success in this exciting yet challenging area of investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market-Beating Stock: Identifying And Capitalizing On High-Growth Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Whats New In Entertainment Updates On Ginny And Georgia I Know What You Did Last Summer Fantastic Four And Weapons

May 12, 2025

Whats New In Entertainment Updates On Ginny And Georgia I Know What You Did Last Summer Fantastic Four And Weapons

May 12, 2025 -

The Chris Brown Texts A Story Of Misinterpretation

May 12, 2025

The Chris Brown Texts A Story Of Misinterpretation

May 12, 2025 -

Cavs On Brink After Pacers Upset Siakam Trade Talks Dominate Nba Headlines

May 12, 2025

Cavs On Brink After Pacers Upset Siakam Trade Talks Dominate Nba Headlines

May 12, 2025 -

Cyberattack Ransomware Spreads Via Compromised Monitoring Software

May 12, 2025

Cyberattack Ransomware Spreads Via Compromised Monitoring Software

May 12, 2025 -

Ryan Mason Tottenham Coach Targeted By West Brom Facing Key Hurdle

May 12, 2025

Ryan Mason Tottenham Coach Targeted By West Brom Facing Key Hurdle

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

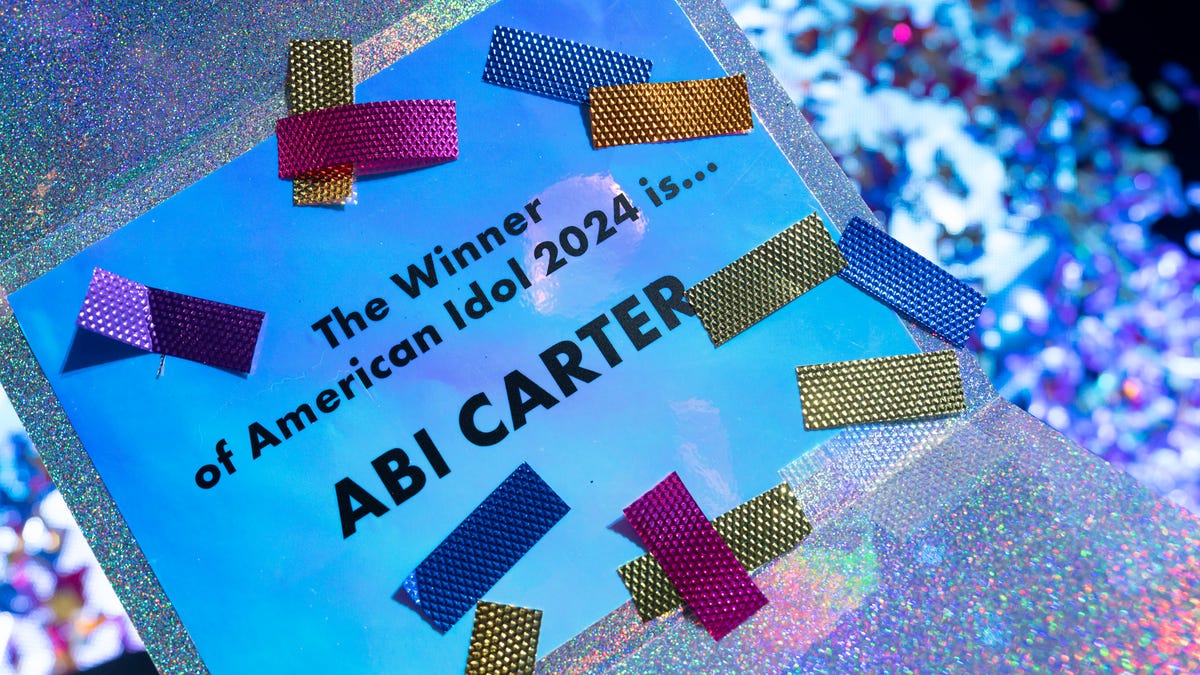

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025