Market Decline: Why Panicking Now Is Worse Than The Downturn

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Decline: Why Panicking Now Is Worse Than the Downturn Itself

The stock market's recent dip has sent ripples of anxiety through investors. Headlines scream of impending doom, and social media is ablaze with panicked predictions. But before you join the stampede for the exits, consider this: panicking now could be far more damaging to your financial future than the downturn itself. This isn't about ignoring the market's challenges; it's about understanding the psychology of investing and making rational, informed decisions.

Understanding the Market's Cyclical Nature

Market fluctuations are an inherent part of the investment landscape. History repeatedly demonstrates that periods of decline are inevitably followed by periods of growth. While predicting the exact timing of these cycles is impossible, understanding their cyclical nature is crucial. Focusing solely on short-term volatility blinds you to the long-term potential for growth. Instead of succumbing to fear, view this downturn as a potential opportunity for strategic long-term investors.

The Dangers of Emotional Investing

Fear is a powerful motivator, often leading to rash decisions. Selling assets in a panic, driven by emotional responses to negative news, can lock in losses and prevent you from participating in the eventual market recovery. This is precisely why disciplined investing, based on a long-term strategy, is far superior to reactive, emotion-driven trading.

What to Do Instead of Panicking:

- Review Your Investment Strategy: This downturn is a perfect time to reassess your long-term goals and ensure your investment portfolio aligns with them. Is your asset allocation appropriate for your risk tolerance and time horizon? If not, now is the time to make adjustments, not to sell off everything in a panic.

- Focus on the Fundamentals: Instead of getting caught up in daily market noise, concentrate on the fundamental strength of your investments. Are the underlying companies performing well? Do they have strong growth prospects? A temporary market dip shouldn't overshadow the long-term value of fundamentally sound investments.

- Dollar-Cost Averaging: Consider using this strategy, which involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This mitigates risk by averaging out your purchase price over time.

- Seek Professional Advice: If you're feeling overwhelmed or uncertain about your next steps, consulting a qualified financial advisor can provide invaluable support and guidance. A professional can help you create a personalized strategy based on your circumstances.

- Stay Informed, But Don't Obsess: Stay updated on market news, but avoid constant monitoring that can fuel anxiety. Regularly check your portfolio, but don't let daily fluctuations dictate your emotional state.

Long-Term Vision vs. Short-Term Noise:

The key to navigating market downturns successfully lies in maintaining a long-term perspective. Short-term market volatility is often a distraction from the larger picture. Remember that investing is a marathon, not a sprint. Panicking and making impulsive decisions driven by fear will likely only exacerbate your losses in the long run. By staying disciplined, focusing on fundamentals, and maintaining a long-term vision, you can weather this storm and emerge stronger on the other side.

Keywords: Market decline, stock market downturn, investing, financial advice, long-term investing, emotional investing, dollar-cost averaging, market volatility, investment strategy, financial planning, portfolio management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Decline: Why Panicking Now Is Worse Than The Downturn. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Resurgent Matildas Continue World Cup Momentum Against South Korea

Apr 08, 2025

Resurgent Matildas Continue World Cup Momentum Against South Korea

Apr 08, 2025 -

Desastre No Rs Balanco Preliminar Apontar 75 Mortes E Quase 1 3 Milhoes Atingidos

Apr 08, 2025

Desastre No Rs Balanco Preliminar Apontar 75 Mortes E Quase 1 3 Milhoes Atingidos

Apr 08, 2025 -

Civil War And Earthquake Myanmars Road To Recovery

Apr 08, 2025

Civil War And Earthquake Myanmars Road To Recovery

Apr 08, 2025 -

Dbs And Bank Of China Singapore Customer Data Compromised In Ransomware Attack

Apr 08, 2025

Dbs And Bank Of China Singapore Customer Data Compromised In Ransomware Attack

Apr 08, 2025 -

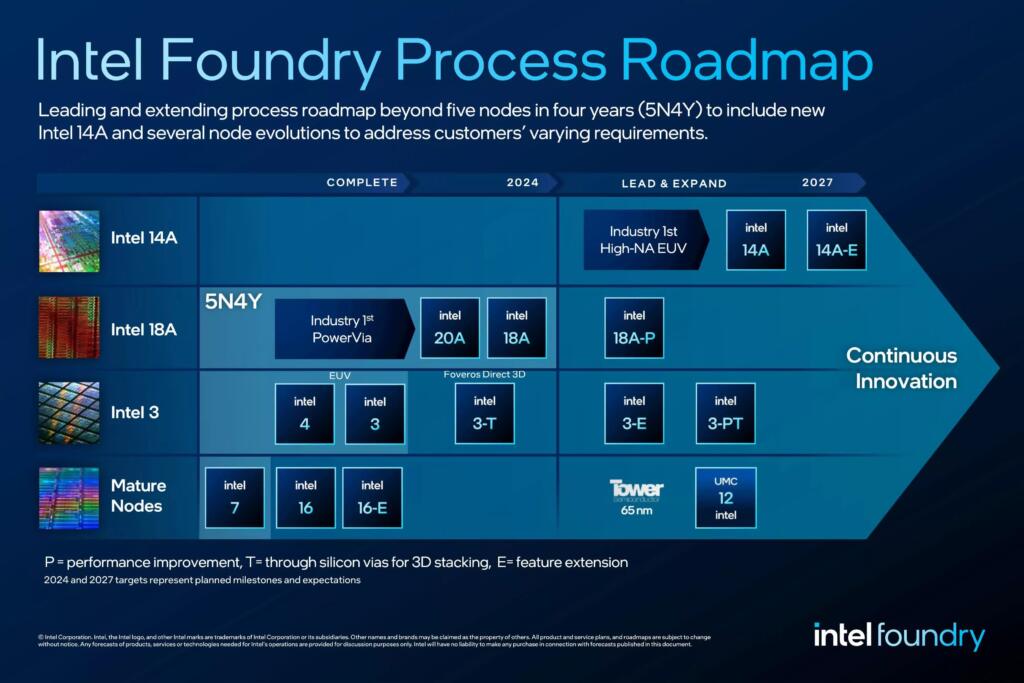

Intels Return To The Forefront 18 Angstrom Chips Poised For Mass Production

Apr 08, 2025

Intels Return To The Forefront 18 Angstrom Chips Poised For Mass Production

Apr 08, 2025