Market In Freefall: 1300-Point Dow Drop Amidst Trump Tariff Crisis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market in Freefall: 1300-Point Dow Drop Amidst Trump Tariff Crisis

The US stock market experienced a dramatic plunge on Tuesday, with the Dow Jones Industrial Average plummeting over 1300 points, marking its worst single-day point drop since February 2018. This unprecedented freefall was triggered by escalating concerns surrounding President Trump's escalating trade war and the imposition of new tariffs on Chinese goods. The market's reaction underscores the growing anxiety surrounding global economic stability and the far-reaching consequences of protectionist trade policies.

The Tariff Trigger:

The immediate catalyst for Tuesday's market meltdown was the announcement of new tariffs on $300 billion worth of Chinese imports. This move, which effectively expands tariffs to encompass nearly all Chinese goods imported into the United States, sparked fears of a full-blown trade war with potentially devastating consequences for the global economy. Investors, already wary of slowing global growth, reacted with widespread panic selling.

Beyond the Tariffs: Underlying Market Weakness:

While the new tariffs served as the immediate trigger, the market's sharp decline reflects deeper underlying weaknesses. Concerns about slowing global economic growth, the ongoing US-China trade dispute, and inverted yield curves – all indicators of potential recession – have been weighing heavily on investor sentiment for months. Tuesday's drop can be seen as a culmination of these pre-existing anxieties.

Impact Across Sectors:

The market downturn wasn't limited to a single sector. Technology stocks, often seen as a bellwether for economic health, took a particularly hard hit. Financials, industrials, and consumer discretionary sectors also experienced significant losses. This broad-based decline points to a widespread loss of confidence in the current economic climate.

Expert Opinions & Market Predictions:

Financial analysts are divided on the market's immediate future. Some believe this sharp drop represents a necessary correction, clearing the way for a potential rebound. Others warn that this could be the beginning of a more protracted period of market volatility and potential recession. The uncertainty surrounding the ongoing trade negotiations and the broader global economic outlook makes accurate prediction incredibly difficult.

- Key concerns voiced by analysts include:

- The potential for retaliatory tariffs from China, further escalating the trade war.

- The impact of the trade war on corporate profits and consumer spending.

- The overall weakening of global economic growth.

What Investors Should Do:

For individual investors, the current market volatility underscores the importance of a well-diversified portfolio and a long-term investment strategy. Panic selling is rarely advisable. Instead, investors should carefully assess their risk tolerance and consider consulting with a financial advisor before making any rash decisions.

Looking Ahead:

The coming weeks will be crucial in determining the market's trajectory. The outcome of the ongoing trade negotiations between the US and China will play a significant role in shaping investor sentiment. Close monitoring of economic indicators, such as GDP growth and consumer spending, will also be essential in gauging the health of the global economy. The market's freefall serves as a stark reminder of the interconnectedness of global markets and the significant impact of geopolitical events on investor confidence. The situation remains fluid, and further market volatility is expected.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market In Freefall: 1300-Point Dow Drop Amidst Trump Tariff Crisis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

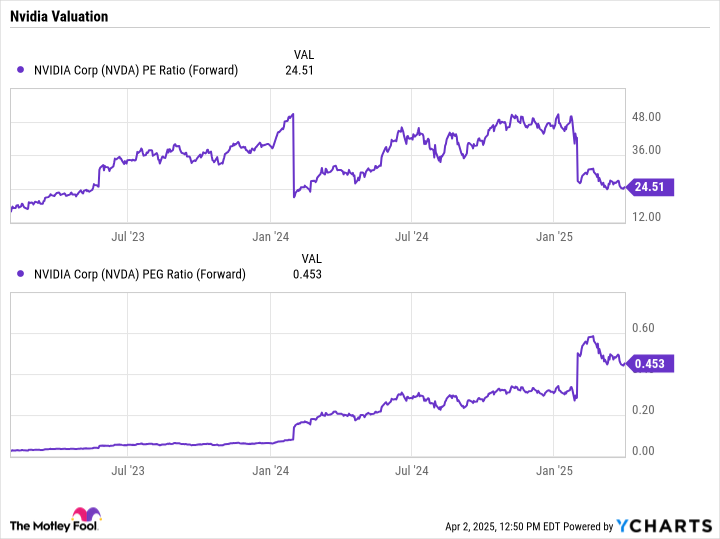

Nvidias Growth Potential 3 Reasons To Invest In Nvda Stock

Apr 07, 2025

Nvidias Growth Potential 3 Reasons To Invest In Nvda Stock

Apr 07, 2025 -

Elon Musks X 1 Billion Eu Fine For Disinformation Apple And Meta Also Sanctioned

Apr 07, 2025

Elon Musks X 1 Billion Eu Fine For Disinformation Apple And Meta Also Sanctioned

Apr 07, 2025 -

Receba Dividendos Empresas Que Pagam Nesta Semana E Como Investir

Apr 07, 2025

Receba Dividendos Empresas Que Pagam Nesta Semana E Como Investir

Apr 07, 2025 -

Family Time Takes A Backseat Gemma Atkinson On Gorka Marquez And The Strictly Curse

Apr 07, 2025

Family Time Takes A Backseat Gemma Atkinson On Gorka Marquez And The Strictly Curse

Apr 07, 2025 -

Can Myanmar Rebuild After Earthquake Amidst Ongoing Civil Conflict

Apr 07, 2025

Can Myanmar Rebuild After Earthquake Amidst Ongoing Civil Conflict

Apr 07, 2025