Market Meltdown: 800-Point Dow Drop, Bitcoin's Record High Overshadowed By Treasury Yield Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Meltdown: 800-Point Dow Drop Overshadowed by Bitcoin's Record High and Treasury Yield Surge

The stock market experienced a dramatic plunge today, with the Dow Jones Industrial Average plummeting over 800 points, wiping out trillions in market capitalization. While Bitcoin soared to record highs, overshadowing the traditional market's turmoil for some, the underlying cause appears to be a significant surge in Treasury yields. This confluence of events has left investors reeling and analysts scrambling to decipher the market's future direction.

This unprecedented volatility highlights the interconnectedness of global markets and the increasing influence of macroeconomic factors on both traditional and cryptocurrency assets. The 800-point drop marks one of the most significant single-day declines in recent memory, raising concerns about a potential market correction or even a deeper downturn.

Understanding the Dow's Dramatic Fall:

The Dow's 800-point drop wasn't an isolated incident. Major indices across the globe experienced similar declines, indicating a broad-based market sell-off. Several factors contributed to this dramatic fall:

-

Rising Treasury Yields: The most significant factor driving the market downturn is the sharp increase in Treasury yields. Higher yields make bonds more attractive compared to stocks, prompting investors to shift their investments, leading to a sell-off in the equity markets. This flight to safety reflects growing concerns about inflation and the potential for future interest rate hikes.

-

Inflationary Pressures: Persistent inflationary pressures continue to fuel concerns about the Federal Reserve's monetary policy. Investors are anticipating further interest rate increases to combat inflation, which could negatively impact corporate earnings and overall market growth.

-

Geopolitical Uncertainty: Ongoing geopolitical tensions, particularly the conflict in Ukraine, continue to inject uncertainty into the global economy, contributing to market volatility.

Bitcoin's Record High Amidst the Chaos:

While the traditional stock market crumbled, Bitcoin reached a new all-time high. This seemingly contradictory performance highlights the growing divergence between traditional and digital assets. Many investors view Bitcoin as a hedge against inflation and a potential safe haven in times of economic uncertainty. However, the correlation between Bitcoin and broader market trends remains complex and not fully understood.

The Treasury Yield Surge: A Central Driver:

The surge in Treasury yields is the key factor driving the current market turmoil. This increase reflects a number of factors including:

-

Increased Inflation Expectations: Market participants are increasingly concerned about the persistence of high inflation, leading to a demand for higher yields on Treasury bonds to compensate for the erosion of purchasing power.

-

Federal Reserve Policy: The anticipated continuation of the Federal Reserve's tightening monetary policy is also pushing Treasury yields higher.

-

Stronger US Dollar: A stronger US dollar can also contribute to higher Treasury yields, as it makes US debt more attractive to foreign investors.

What Does This Mean for Investors?

The current market situation underscores the need for a diversified investment strategy and a long-term perspective. While the recent market downturn is concerning, it's crucial to avoid panic selling. Investors should carefully assess their risk tolerance and portfolio allocation, potentially consulting with a financial advisor to navigate this period of uncertainty. The situation warrants close monitoring of macroeconomic indicators and geopolitical developments.

Conclusion:

The 800-point Dow drop, Bitcoin's record high, and the surge in Treasury yields paint a complex picture of the current market landscape. Understanding the interplay between these factors is critical for investors seeking to navigate this period of heightened volatility. While short-term uncertainty prevails, a long-term perspective and a well-diversified portfolio remain crucial for weathering market storms. The coming weeks will be pivotal in determining the market's trajectory and whether this represents a temporary correction or a more significant shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Meltdown: 800-Point Dow Drop, Bitcoin's Record High Overshadowed By Treasury Yield Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Western Conference Final Oilers Stars Game 1 Preview And Betting Odds

May 23, 2025

Western Conference Final Oilers Stars Game 1 Preview And Betting Odds

May 23, 2025 -

Exploring The Latest Tech At Computex 2025

May 23, 2025

Exploring The Latest Tech At Computex 2025

May 23, 2025 -

House Vote Looms Unpacking The Key Elements Of The Republican Partys Sweeping Legislation

May 23, 2025

House Vote Looms Unpacking The Key Elements Of The Republican Partys Sweeping Legislation

May 23, 2025 -

Less Frustration More Productivity Googles Virtual Meeting Enhancements

May 23, 2025

Less Frustration More Productivity Googles Virtual Meeting Enhancements

May 23, 2025 -

Pete De Boer On The Evolution Of The Stars 2025 Wcf And Beyond

May 23, 2025

Pete De Boer On The Evolution Of The Stars 2025 Wcf And Beyond

May 23, 2025

Latest Posts

-

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025 -

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025 -

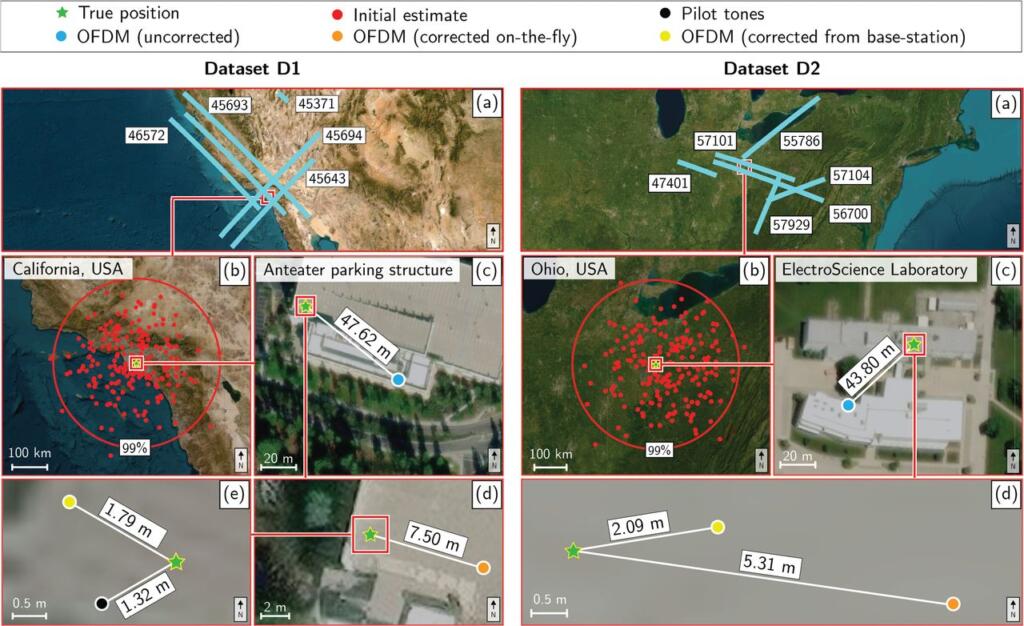

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025 -

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025