Market Meltdown: Dow Futures Tumble Amidst Continued Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Meltdown: Dow Futures Tumble Amidst Continued Sell-Off

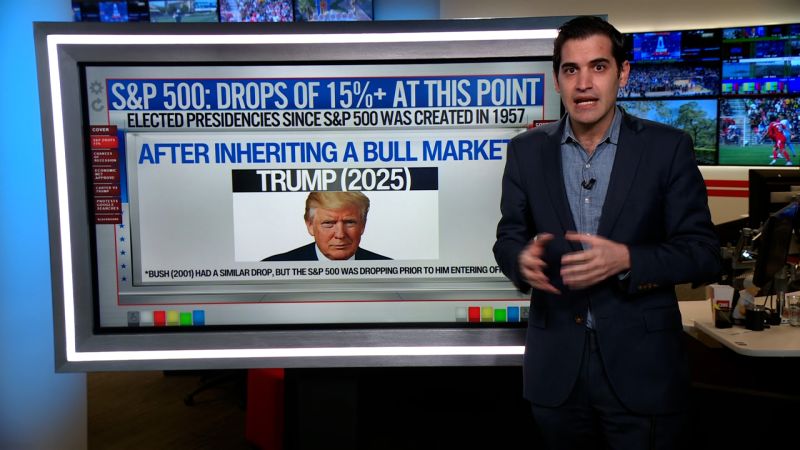

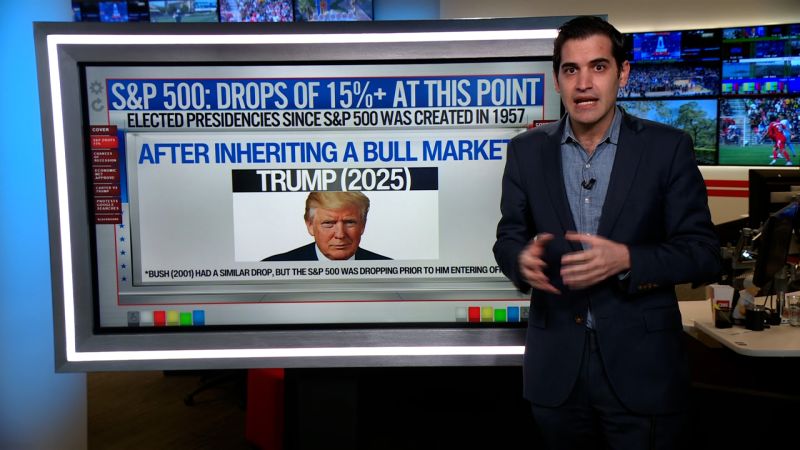

Wall Street braces for another brutal day as fears of a recession deepen. The global stock market continues its downward spiral, with Dow futures plunging sharply this morning, signaling another potential day of significant losses. This continued sell-off reflects growing concerns about inflation, rising interest rates, and the overall health of the global economy.

The dramatic drop in Dow futures follows a week of heavy losses across major indices. Investors are grappling with a confluence of negative factors, creating a perfect storm for market volatility. This article will delve into the key drivers behind this market meltdown and explore potential scenarios for the coming weeks.

Inflation Remains a Major Culprit

The persistent rise in inflation continues to be the elephant in the room. Stubbornly high inflation forces central banks, like the Federal Reserve, to maintain aggressive interest rate hikes. These hikes, while aimed at curbing inflation, also increase borrowing costs for businesses and consumers, potentially stifling economic growth and triggering a recession. The fear of a prolonged period of high inflation coupled with aggressive monetary policy is a potent cocktail for market uncertainty.

Rising Interest Rates Squeeze Businesses and Consumers

The impact of rising interest rates extends beyond just the cost of borrowing. Higher rates increase the cost of servicing existing debt, putting pressure on corporate balance sheets and potentially leading to reduced investment and hiring. For consumers, higher interest rates translate to increased mortgage payments, higher credit card interest, and reduced disposable income. This ripple effect throughout the economy is further fueling market anxieties.

Geopolitical Instability Adds to the Pressure

The ongoing geopolitical instability, particularly the war in Ukraine, adds another layer of complexity to the already fragile economic landscape. The conflict continues to disrupt global supply chains, contributing to inflationary pressures and creating further uncertainty for investors. The ripple effects of geopolitical events are unpredictable and add to the market's jitters.

What Does This Mean for Investors?

The current market downturn presents significant challenges for investors. Many are scrambling to protect their portfolios amid the uncertainty. However, seasoned investors often see market corrections as opportunities for long-term growth. It is crucial to remember that market volatility is a normal part of the economic cycle, and history has shown that markets eventually recover.

Strategies for Navigating Market Volatility

- Diversify your portfolio: Spreading investments across different asset classes can help mitigate risk.

- Rebalance your portfolio: Regularly reviewing and rebalancing your holdings can help you maintain your desired asset allocation.

- Consider long-term investing: Focusing on the long-term prospects of your investments can help you weather short-term market fluctuations.

- Consult a financial advisor: Seeking professional advice can help you develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

Looking Ahead: Uncertainty Remains

Predicting the market's future direction is impossible. However, the current climate suggests continued volatility in the short term. The ongoing struggle with inflation, aggressive interest rate hikes, and geopolitical instability all contribute to an environment ripe for uncertainty. Investors should remain vigilant, monitor market developments closely, and adjust their strategies accordingly. The coming weeks will be critical in determining the trajectory of the market recovery, and careful planning and professional advice are paramount during this period of economic turbulence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Meltdown: Dow Futures Tumble Amidst Continued Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Monte Carlo Masters Day 2 Expert Predictions For Lehecka Vs Korda And Other Key Matches

Apr 07, 2025

Monte Carlo Masters Day 2 Expert Predictions For Lehecka Vs Korda And Other Key Matches

Apr 07, 2025 -

Vale Percy Knight A Historical Perspective

Apr 07, 2025

Vale Percy Knight A Historical Perspective

Apr 07, 2025 -

Peoples Power Party To Contest Ang Mo Kio Grc In Upcoming General Election

Apr 07, 2025

Peoples Power Party To Contest Ang Mo Kio Grc In Upcoming General Election

Apr 07, 2025 -

Can Myanmar Rebuild After Earthquake Amidst Ongoing Civil Conflict

Apr 07, 2025

Can Myanmar Rebuild After Earthquake Amidst Ongoing Civil Conflict

Apr 07, 2025 -

Buffetts 300 Billion Cash Pile No Longer A Defense But A Strategic Asset

Apr 07, 2025

Buffetts 300 Billion Cash Pile No Longer A Defense But A Strategic Asset

Apr 07, 2025