Market Meltdown: Trump Tariffs And The Rs 20.16 Lakh Crore Wipeout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Meltdown: Trump Tariffs and the ₹20.16 Lakh Crore Wipeout

The Indian stock market experienced a significant downturn, witnessing a staggering ₹20.16 lakh crore (approximately $245 billion USD) wipeout in investor wealth. This dramatic market meltdown is largely attributed to the re-emergence of US trade tensions under the shadow of Donald Trump's potential return to the White House. The ripple effect of escalating trade protectionism has sent shockwaves through global financial markets, and India, a significant player in international trade, is feeling the pinch.

Trump's Tariff Threat: A Looming Shadow

The potential return of Donald Trump to the presidency has reignited concerns about his protectionist trade policies. His previous administration imposed significant tariffs on various goods, disrupting global supply chains and impacting economies worldwide. The uncertainty surrounding potential future trade actions under a Trump presidency has created a climate of fear and uncertainty, prompting investors to adopt a risk-averse approach. This uncertainty is a key driver behind the recent market volatility.

Impact on Indian Markets: A Deep Dive

The ₹20.16 lakh crore loss represents a significant blow to investor confidence. Key sectors, including IT, pharmaceuticals, and textiles, which heavily rely on exports to the US, have been particularly hard hit. The fear of retaliatory tariffs and reduced export demand is causing widespread concern among businesses and investors. This situation highlights India's vulnerability to global trade dynamics and the importance of diversifying its export markets.

Analyzing the Market Fall:

- Increased Volatility: The market's response underscores the heightened sensitivity to geopolitical events and the unpredictable nature of trade policy under a potential Trump administration. This volatility makes long-term investment planning challenging for businesses and individuals alike.

- Investor Sentiment: Negative investor sentiment is a major contributing factor. The uncertainty surrounding future trade policies has eroded confidence, leading to a sell-off in the stock market.

- Global Implications: The impact extends beyond India. Global markets are interconnected, and the uncertainty surrounding US trade policy creates a ripple effect, affecting economies and businesses worldwide.

Looking Ahead: Mitigation Strategies

The Indian government needs to proactively address the challenges posed by potential future trade tensions. Strategies to mitigate the impact of potential tariffs include:

- Diversification of Export Markets: Reducing reliance on the US market by exploring and cultivating trade relationships with other countries is crucial.

- Strengthening Domestic Demand: Focusing on boosting domestic consumption and reducing reliance on exports can help cushion the blow from external shocks.

- Trade Negotiations: Engaging in proactive diplomatic efforts to navigate trade negotiations and potentially secure favorable trade agreements is vital.

- Promoting Investment in Diversified Sectors: Encouraging investment in sectors less vulnerable to trade wars can ensure economic resilience.

Conclusion: Navigating Uncertain Waters

The recent market meltdown serves as a stark reminder of the interconnectedness of global economies and the significant impact of geopolitical events on financial markets. While the future remains uncertain, proactive measures by the Indian government and a focus on diversification and resilience are crucial to navigating the challenges ahead and protecting investor wealth. The situation demands careful monitoring and strategic planning to ensure the long-term stability and growth of the Indian economy. The potential for further market fluctuations remains high, emphasizing the need for investors to stay informed and adapt their strategies accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Meltdown: Trump Tariffs And The Rs 20.16 Lakh Crore Wipeout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Barca Victoria Ajustada Analisis Del Partido Y Proximos Desafios

Apr 07, 2025

Barca Victoria Ajustada Analisis Del Partido Y Proximos Desafios

Apr 07, 2025 -

Malmoe Satsar Pa Hallbar Energi Med E On

Apr 07, 2025

Malmoe Satsar Pa Hallbar Energi Med E On

Apr 07, 2025 -

Starlink Secures Bangladesh License Expanding Global Broadband Coverage

Apr 07, 2025

Starlink Secures Bangladesh License Expanding Global Broadband Coverage

Apr 07, 2025 -

Is A Global Trade War Inevitable Experts Weigh In

Apr 07, 2025

Is A Global Trade War Inevitable Experts Weigh In

Apr 07, 2025 -

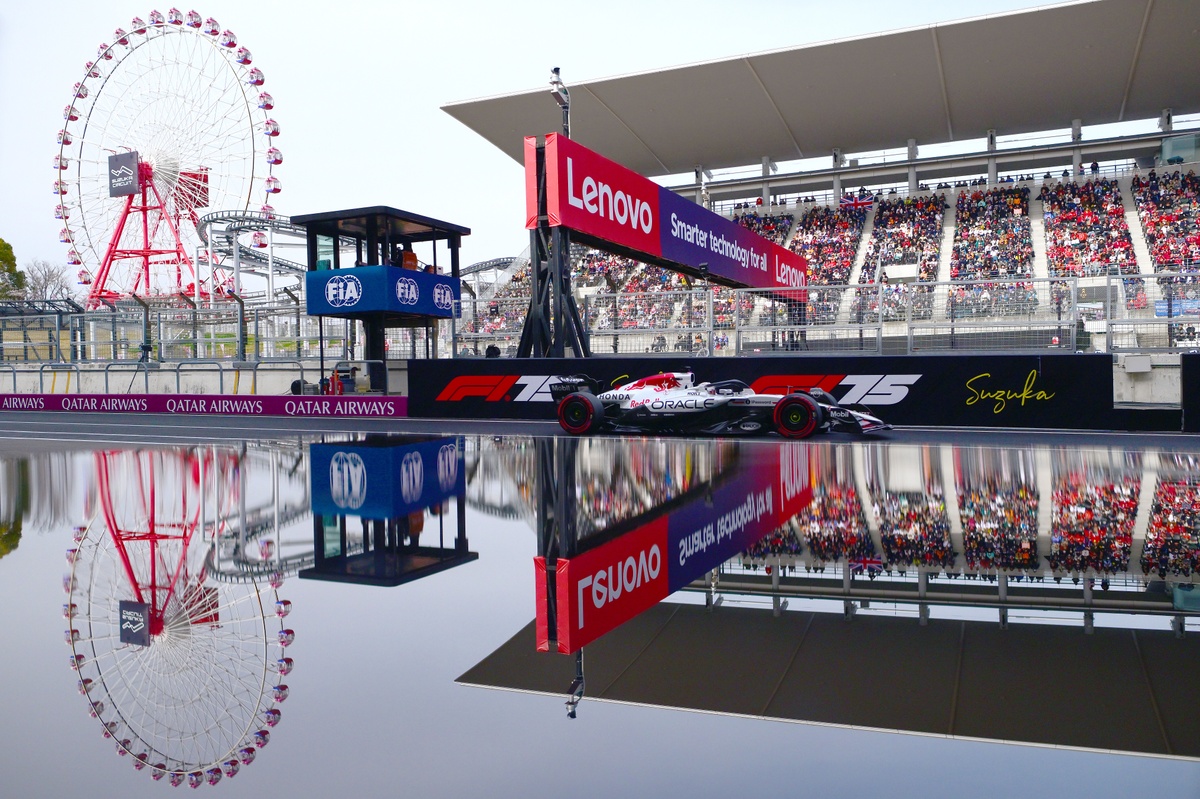

Japanese Grand Prix 2024 Live F1 Race Commentary And Updates

Apr 07, 2025

Japanese Grand Prix 2024 Live F1 Race Commentary And Updates

Apr 07, 2025