Market Panic: Pakistan's Military Action Sends Sensex Cratering 500 Points

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Panic: Pakistan's Military Action Sends Sensex Cratering 500 Points

A sudden escalation of tensions between India and Pakistan sent shockwaves through the Indian stock market today, with the Sensex plummeting a staggering 500 points. The dramatic fall reflects investor anxieties over the potential for regional instability and its impact on the Indian economy. This significant market downturn underscores the interconnectedness of global affairs and domestic financial markets.

The news broke early this morning, triggering immediate selling pressure. Pakistan's military action, the details of which are still emerging, has raised concerns about a potential wider conflict. This uncertainty is precisely what spooked investors, leading to a frantic sell-off across various sectors.

Sensex Plunge: A Detailed Look

The benchmark Sensex index, a key indicator of the Indian stock market's health, experienced its sharpest single-day decline in weeks. The 500-point drop represents a significant percentage decrease, wiping billions of rupees off market capitalization. This dramatic fall reflects the deep-seated concerns among investors about the potential economic fallout from escalating geopolitical tensions.

Key contributing factors to the Sensex crash include:

- Geopolitical Uncertainty: The unpredictable nature of the situation between India and Pakistan is the primary driver of the market panic. Investors are averse to uncertainty and are reacting by divesting from riskier assets.

- Impact on Trade and Investment: Any prolonged conflict could severely disrupt trade routes and deter foreign investment in India, leading to slower economic growth.

- Oil Price Volatility: The situation could also impact global oil prices, further impacting India's already vulnerable economy. Increased oil prices directly affect inflation and consumer spending.

- Currency Fluctuations: The Indian Rupee's value is sensitive to geopolitical events. Increased uncertainty could lead to further depreciation, impacting imports and overall economic stability.

Sector-Specific Impacts

The decline wasn't uniform across all sectors. Financials, IT, and consumer durables were particularly hard hit, reflecting investor pessimism about future prospects. However, the defensive sectors, such as pharmaceuticals and FMCG, also experienced some downward pressure due to the overall market sentiment.

Expert Opinions and Market Outlook

Analysts are cautioning investors to remain vigilant and adopt a wait-and-see approach. The short-term outlook remains uncertain, with the market's direction heavily dependent on further developments in the India-Pakistan situation. Several experts suggest that the market may remain volatile in the coming days until clarity emerges regarding the situation. However, others point to the historical resilience of the Indian economy and predict a gradual recovery once the geopolitical dust settles.

Long-Term Implications and Investor Strategies

While the immediate impact is undoubtedly negative, the long-term implications remain to be seen. The Indian economy has demonstrated resilience in the past, recovering from various crises. However, investors need to carefully consider their risk tolerance and adjust their portfolios accordingly. Diversification remains crucial, and investors should consult with financial advisors to make informed decisions.

Keywords: Sensex crash, Pakistan military action, India-Pakistan tensions, stock market crash, market volatility, geopolitical risk, Indian economy, investment strategy, market outlook, rupee fluctuation, oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Panic: Pakistan's Military Action Sends Sensex Cratering 500 Points. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Julie Fragar Wins 2024 Archibald Prize Live Updates And Reactions

May 09, 2025

Julie Fragar Wins 2024 Archibald Prize Live Updates And Reactions

May 09, 2025 -

Confirmed Ukrainian Drone Downed Russian Su 30 In Black Sea

May 09, 2025

Confirmed Ukrainian Drone Downed Russian Su 30 In Black Sea

May 09, 2025 -

Shadow Force Plot Cast And Release Date Information

May 09, 2025

Shadow Force Plot Cast And Release Date Information

May 09, 2025 -

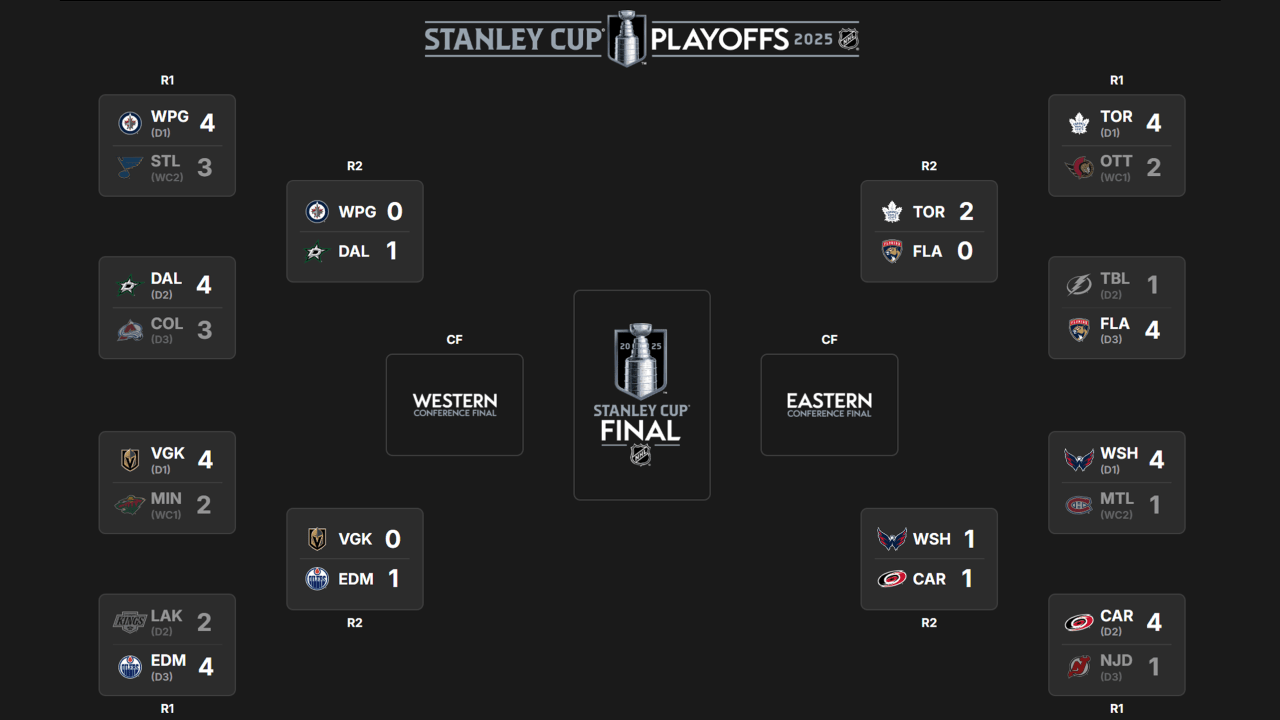

Complete Guide 2025 Stanley Cup Playoffs Second Round Schedule

May 09, 2025

Complete Guide 2025 Stanley Cup Playoffs Second Round Schedule

May 09, 2025 -

Nba Playoffs Magic Johnsons Public Show Of Support For Steve Kerr

May 09, 2025

Nba Playoffs Magic Johnsons Public Show Of Support For Steve Kerr

May 09, 2025