Market Pressure Mounts: A Wave Of SGX Delistings In 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Pressure Mounts: A Wave of SGX Delistings in 2024

Singapore Exchange (SGX) is bracing for a potential surge in delistings in 2024, as mounting market pressures force companies to reconsider their public listing status. This trend reflects a broader global phenomenon, impacting companies across various sectors and signifying a challenging economic climate. The implications for investors and the overall health of the SGX are significant and warrant close attention.

The Perfect Storm: Factors Driving Delistings

Several converging factors are contributing to this anticipated wave of SGX delistings:

-

Increased Compliance Costs: Maintaining a public listing on the SGX necessitates significant regulatory compliance, including financial reporting, corporate governance, and disclosure requirements. These costs can be substantial, particularly for smaller companies with limited resources. The ongoing regulatory changes further amplify these pressures.

-

Low Trading Volume and Liquidity: Many companies listed on the SGX experience persistently low trading volumes, making it difficult to attract investors and raise capital. This lack of liquidity can severely impact a company's ability to operate effectively and makes the cost of maintaining a listing disproportionately high.

-

Private Equity Interest: The current market environment has seen increased interest from private equity firms looking to acquire companies at attractive valuations. Going private offers companies an escape from the scrutiny and costs associated with public listing, providing greater operational flexibility.

-

Strategic Realignment: Some companies may choose to delist as part of a broader strategic realignment, focusing on long-term growth and potentially pursuing alternative funding routes. This may involve mergers, acquisitions, or a shift towards a different business model.

-

Economic Uncertainty: The global economic climate, characterized by inflation, rising interest rates, and geopolitical instability, creates uncertainty and makes it difficult for some companies to justify the expense of remaining publicly listed.

Impact on the SGX and Investors

The increasing number of delistings poses several challenges for the SGX:

-

Reduced Market Capitalization: A decline in listed companies directly impacts the overall market capitalization of the SGX, potentially affecting investor confidence and market liquidity.

-

Impact on Market Depth: Fewer listed companies reduce market depth and can lead to increased price volatility for remaining stocks.

-

Regulatory Implications: The SGX may need to adapt its regulatory framework to address the evolving needs of listed companies and maintain a healthy and vibrant market.

For investors, the implications are equally important:

-

Portfolio Restructuring: Investors holding shares in companies facing potential delisting need to reassess their portfolios and consider appropriate actions.

-

Reduced Investment Opportunities: Fewer listed companies could limit investment opportunities, especially for those focused on the SGX.

-

Valuation Challenges: Assessing the value of companies considering delisting can be complex, requiring careful due diligence.

Looking Ahead: What to Expect

While predicting the exact number of delistings in 2024 remains challenging, the confluence of factors discussed above suggests a significant increase is likely. Investors and market participants should carefully monitor company announcements, assess their portfolios, and remain informed about developments at the SGX. The SGX itself will likely need to adapt its strategies to attract new listings and support existing companies facing pressure. This wave of delistings underscores the dynamic nature of the market and highlights the need for proactive adaptation by both companies and investors. The coming year will be crucial in determining the long-term impact of these trends on the Singaporean capital market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Pressure Mounts: A Wave Of SGX Delistings In 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Who Made The Cut American Idol Announces Top 5

May 13, 2025

Who Made The Cut American Idol Announces Top 5

May 13, 2025 -

Who Is Stars Name S Fiancee Exploring Her Family And Fortune

May 13, 2025

Who Is Stars Name S Fiancee Exploring Her Family And Fortune

May 13, 2025 -

From Retirement To Revival Nfl Players Career Restored By Tom Brady

May 13, 2025

From Retirement To Revival Nfl Players Career Restored By Tom Brady

May 13, 2025 -

Trump Welcomes White South African Refugees In Washington D C

May 13, 2025

Trump Welcomes White South African Refugees In Washington D C

May 13, 2025 -

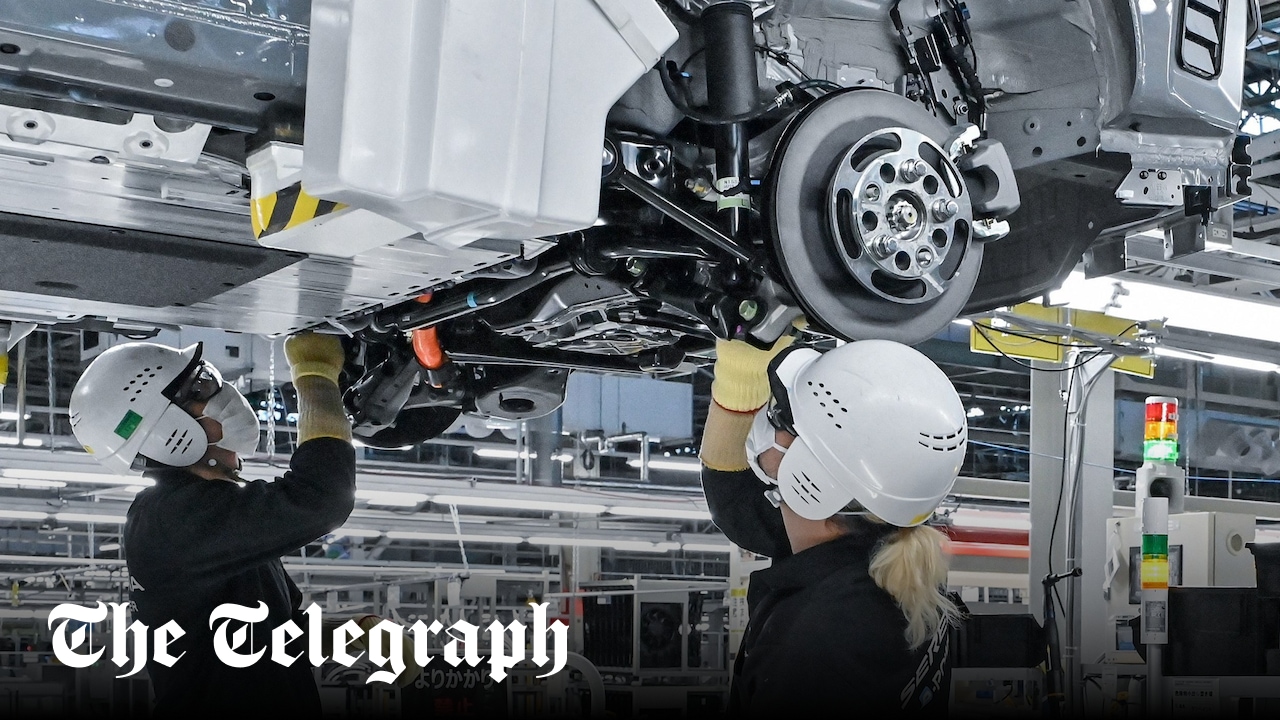

Analysis Honda Motors 76 Operating Profit Drop And Future Outlook

May 13, 2025

Analysis Honda Motors 76 Operating Profit Drop And Future Outlook

May 13, 2025

Latest Posts

-

Urgent Warning Large Fire Breaks Out In Barkerend Avoid The Area

May 14, 2025

Urgent Warning Large Fire Breaks Out In Barkerend Avoid The Area

May 14, 2025 -

20 000 Job Losses Announced At Nissan Impact On Global Operations

May 14, 2025

20 000 Job Losses Announced At Nissan Impact On Global Operations

May 14, 2025 -

Cannes Film Festivals New Dress Code Why The Emphasis On Clothing

May 14, 2025

Cannes Film Festivals New Dress Code Why The Emphasis On Clothing

May 14, 2025 -

Cannes Film Festivals New Nudity Rules A Reaction To The Ye And Bianca Censori Grammy Display

May 14, 2025

Cannes Film Festivals New Nudity Rules A Reaction To The Ye And Bianca Censori Grammy Display

May 14, 2025 -

Us Gulf Economic Relations Trumps Saudi Arabia Visit And Key Deal Negotiations

May 14, 2025

Us Gulf Economic Relations Trumps Saudi Arabia Visit And Key Deal Negotiations

May 14, 2025