Market Pressures Fuel SGX Delisting Wave: A Look At 16 Companies' Fate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Pressures Fuel SGX Delisting Wave: A Look at 16 Companies' Fate

The Singapore Exchange (SGX) is witnessing a surge in delistings, with sixteen companies bowing out in the first half of 2024 alone. This wave of departures underscores the intensifying market pressures faced by smaller companies, highlighting the challenges of maintaining a listing on a competitive exchange like the SGX. This article delves into the reasons behind this exodus and analyzes the implications for investors and the broader Singaporean market.

The Delisting Dilemma: Why are Companies Leaving the SGX?

Several factors contribute to this significant increase in SGX delistings. The most prominent include:

-

High Compliance Costs: Maintaining a listing on the SGX entails substantial compliance costs, including regulatory fees, audit expenses, and ongoing disclosure requirements. These costs can be particularly burdensome for smaller companies with limited resources. For many, the cost outweighs the benefits of remaining listed.

-

Low Trading Volume: Insufficient trading volume renders a listing less attractive. Companies with low trading activity often find it difficult to attract investors and raise capital, making a delisting a more financially viable option.

-

Private Equity Acquisitions: A significant number of delistings stem from private equity takeovers. These acquisitions often offer companies a faster route to growth and capital outside the constraints of public market regulations.

-

Strategic Restructuring: Some companies opt for delisting as part of a broader strategic restructuring plan, aiming for greater operational flexibility and a less demanding regulatory environment.

-

Market Volatility: The ongoing global economic uncertainty and market volatility add pressure on companies, making it challenging to meet investor expectations and maintain a listing.

The 16 Companies and Their Stories:

While specific details vary, the common thread among these sixteen companies is the struggle to navigate the complexities of the public market. Analyzing each case individually would require extensive research beyond the scope of this news piece, however, the overarching trend points to a challenging environment for smaller-cap companies on the SGX.

Impact on Investors and the SGX:

This delisting wave has implications for both investors and the SGX itself:

-

Investor Implications: Investors holding shares in delisted companies face the challenge of finding alternative investment avenues and potentially experiencing losses due to the reduced liquidity of their holdings. Due diligence and careful portfolio diversification become even more crucial in this dynamic market.

-

SGX Implications: The increasing number of delistings raises questions about the attractiveness of the SGX to smaller companies. The exchange may need to consider adjustments to its listing rules and regulations to attract and retain smaller businesses. This might involve streamlining compliance procedures or offering incentives to encourage listings.

Looking Ahead: Navigating the Changing Landscape:

The SGX delisting wave is a clear indicator of the evolving landscape of the Singaporean capital market. Companies are increasingly weighing the benefits of a public listing against the significant costs and complexities involved. This trend is likely to continue, requiring both companies and the SGX to adapt to this changing dynamic. Future regulatory changes and initiatives aimed at supporting smaller businesses will play a crucial role in shaping the future trajectory of listings on the SGX. For investors, staying informed about market trends and individual company performance will be key to managing risk and navigating this evolving environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Pressures Fuel SGX Delisting Wave: A Look At 16 Companies' Fate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sexual Assault Verdict Gerard Depardieu Found Guilty

May 14, 2025

Sexual Assault Verdict Gerard Depardieu Found Guilty

May 14, 2025 -

After 2023 Tom Bradys Impact On An Nfl Players Career Revival

May 14, 2025

After 2023 Tom Bradys Impact On An Nfl Players Career Revival

May 14, 2025 -

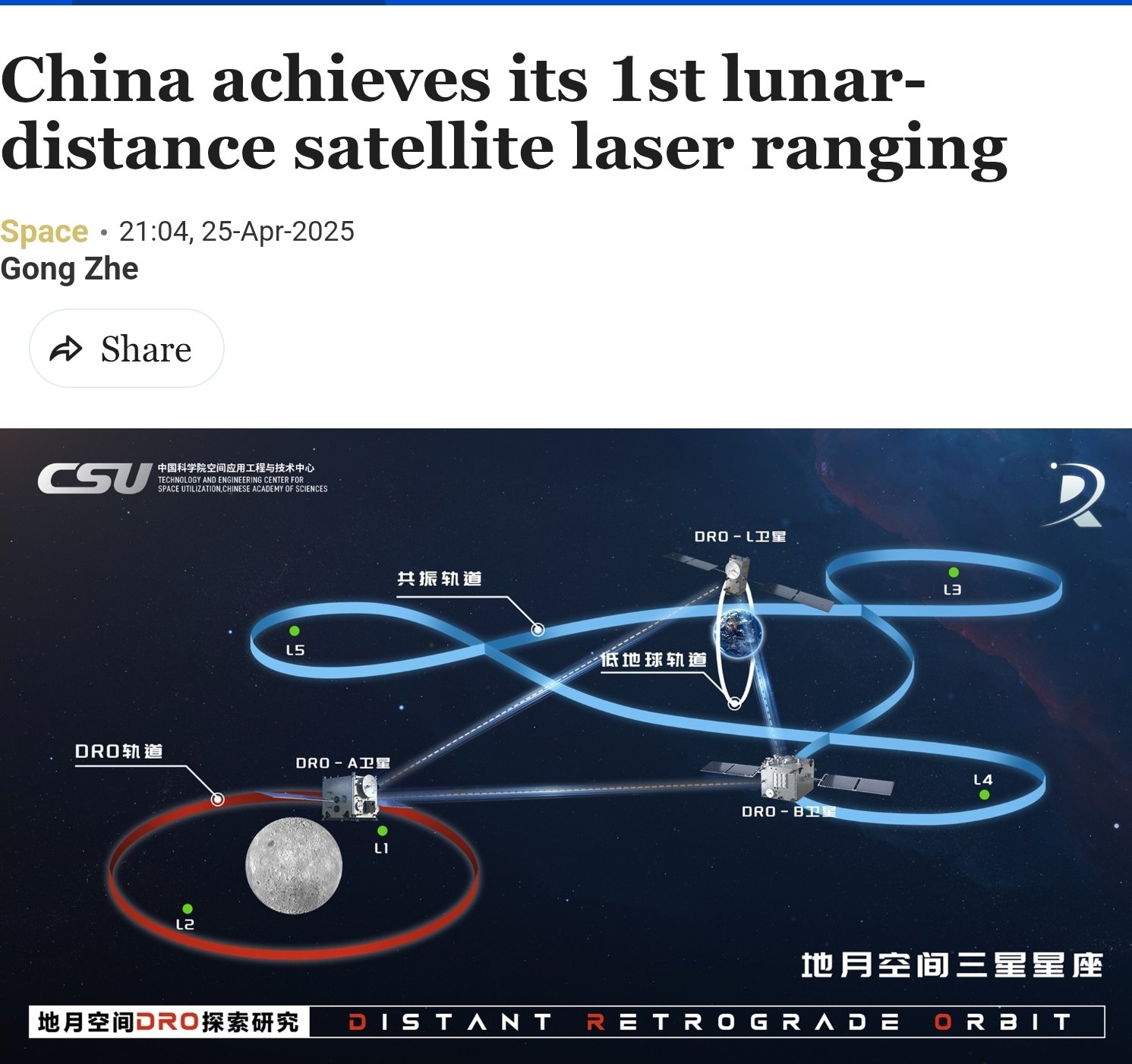

Lunar Orbit Laser Ranging A Chinese Technological Advancement

May 14, 2025

Lunar Orbit Laser Ranging A Chinese Technological Advancement

May 14, 2025 -

Monday Quordle Answers May 12 1204 Hints To Help You Win

May 14, 2025

Monday Quordle Answers May 12 1204 Hints To Help You Win

May 14, 2025 -

Spy Cloud Report Shocking Employee Data Exposure In Fortune 500 Phishing Attacks

May 14, 2025

Spy Cloud Report Shocking Employee Data Exposure In Fortune 500 Phishing Attacks

May 14, 2025

Latest Posts

-

Helldivers 2 Explore Super Earth Confront New Enemy Threats

May 14, 2025

Helldivers 2 Explore Super Earth Confront New Enemy Threats

May 14, 2025 -

Japans Honda Plummeting Profits Directly Linked To Trumps Trade Policies

May 14, 2025

Japans Honda Plummeting Profits Directly Linked To Trumps Trade Policies

May 14, 2025 -

Moodengs All Time High Binance Alpha Listing Fuels Massive Price Rally

May 14, 2025

Moodengs All Time High Binance Alpha Listing Fuels Massive Price Rally

May 14, 2025 -

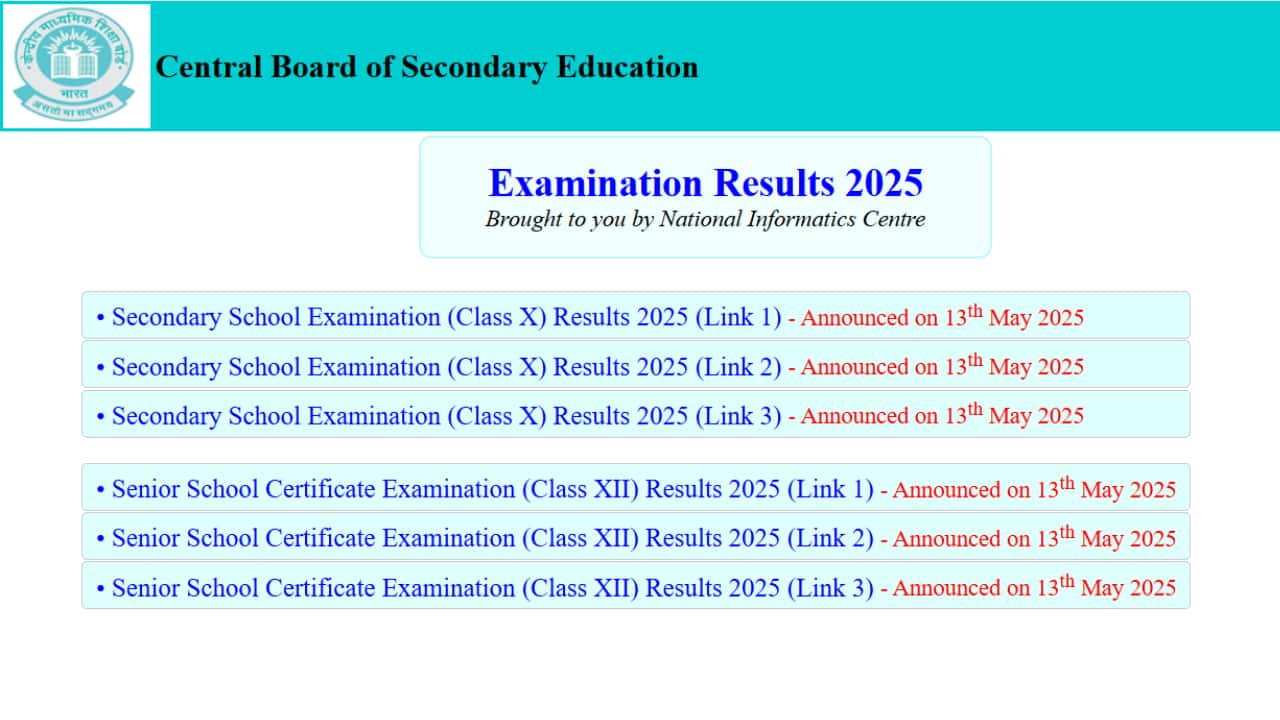

Cbse Results 2025 Live Updates Class 10th And 12th Exam Scores Digi Locker Access

May 14, 2025

Cbse Results 2025 Live Updates Class 10th And 12th Exam Scores Digi Locker Access

May 14, 2025 -

Nissans Restructuring Plan 20 000 Job Losses Plant Closures And Post 2026 Freeze

May 14, 2025

Nissans Restructuring Plan 20 000 Job Losses Plant Closures And Post 2026 Freeze

May 14, 2025