Market Reaction: DBS Stock Soars After Exceeding Earnings Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reaction: DBS Stock Soars After Exceeding Earnings Expectations

DBS Group Holdings, Southeast Asia's largest bank, saw its stock price surge following the release of its latest financial results, which significantly exceeded analysts' expectations. The strong performance sparked a positive market reaction, boosting investor confidence and highlighting the bank's resilience in a challenging global economic climate.

The announcement sent ripples through the Singapore Exchange (SGX), with DBS shares experiencing a notable increase. This robust performance underscores the bank's strategic positioning and its ability to navigate complex macroeconomic headwinds. Let's delve deeper into the key factors contributing to this impressive market reaction.

Exceeding Expectations: Key Highlights of DBS's Earnings Report

DBS reported a net profit that comfortably surpassed analysts' forecasts. Several key factors contributed to this outstanding performance:

- Strong Loan Growth: A significant increase in loan demand across various sectors fueled the bank's impressive bottom line. This growth points to a healthy economic outlook in key markets where DBS operates.

- Robust Wealth Management Performance: The wealth management division delivered exceptional results, driven by strong asset under management (AUM) growth and increased client activity. This segment continues to be a key driver of DBS's overall profitability.

- Effective Cost Management: Despite inflationary pressures, DBS demonstrated its ability to efficiently manage operating costs, contributing to improved profitability margins. This showcases the bank's financial discipline and strategic cost-cutting measures.

- Improved Net Interest Margin (NIM): The bank's net interest margin saw a positive expansion, reflecting the impact of rising interest rates on its lending activities. This is a critical indicator of profitability within the banking sector.

Market Reaction and Analyst Commentary

The positive earnings surprise triggered an immediate and significant positive market reaction. Analysts have lauded DBS's performance, highlighting its strong fundamentals and its potential for continued growth. Many have revised their price targets upwards, reflecting increased confidence in the bank's long-term prospects.

"DBS's results exceeded our expectations on several fronts," commented [Name of Analyst], a leading banking analyst at [Name of Investment Bank]. "[Quote highlighting positive aspects of the results]." This sentiment was echoed by other analysts, further cementing the positive market outlook for DBS.

Implications for Investors and the Broader Market

The robust performance of DBS sends a positive signal for the broader financial sector in Singapore and the region. It underscores the resilience of well-managed financial institutions even amid global economic uncertainties. For investors, the exceeding earnings expectations confirm DBS as a strong contender within its sector, making it an attractive investment opportunity for those seeking exposure to the Southeast Asian banking market.

Looking Ahead: Future Outlook for DBS

While the current results are undeniably positive, it’s important to note that the global economic landscape remains uncertain. Geopolitical risks and potential economic slowdowns could impact future performance. However, DBS's proven ability to adapt and navigate challenging conditions suggests a strong position for continued success. The bank's strategic investments in technology and its focus on digital transformation will be key drivers of its future growth and further bolster its market position.

Keywords: DBS, DBS Group Holdings, Singapore Exchange (SGX), Earnings Report, Stock Price, Market Reaction, Banking Sector, Southeast Asia, Net Profit, Loan Growth, Wealth Management, Asset Under Management (AUM), Net Interest Margin (NIM), Analyst Commentary, Investment, Stock Market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reaction: DBS Stock Soars After Exceeding Earnings Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

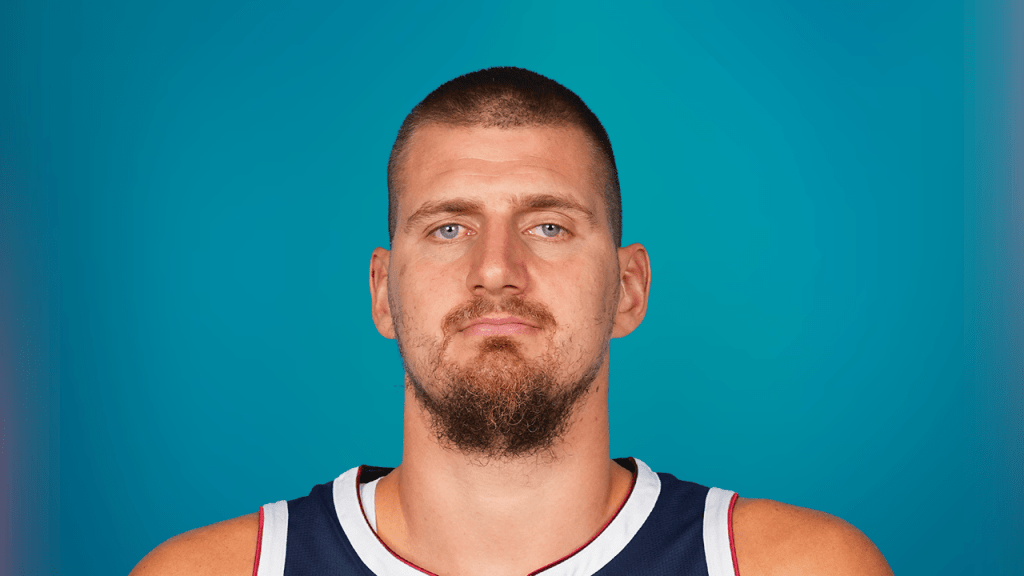

Jokics Relaxed Response To Free Throw Merchant Jeers A Look At The Incident

May 08, 2025

Jokics Relaxed Response To Free Throw Merchant Jeers A Look At The Incident

May 08, 2025 -

Free Shadow Force Tickets Win Now

May 08, 2025

Free Shadow Force Tickets Win Now

May 08, 2025 -

Behind The Scenes Of Andor Analyzing Mon Mothmas Speech And Its Canon Implications

May 08, 2025

Behind The Scenes Of Andor Analyzing Mon Mothmas Speech And Its Canon Implications

May 08, 2025 -

Final Score Celtics Defeat Knicks 91 90 In Thrilling Playoff Game

May 08, 2025

Final Score Celtics Defeat Knicks 91 90 In Thrilling Playoff Game

May 08, 2025 -

Russian Su 30 Fighter Jet Shot Down By Ukrainian Navy Drone Details Emerge

May 08, 2025

Russian Su 30 Fighter Jet Shot Down By Ukrainian Navy Drone Details Emerge

May 08, 2025

Latest Posts

-

No Bitcoin Reserve For The Uk Official Statement Explains Rationale

May 08, 2025

No Bitcoin Reserve For The Uk Official Statement Explains Rationale

May 08, 2025 -

Jaylin Williams Exploring The Okc Thunders Arkansas Forward

May 08, 2025

Jaylin Williams Exploring The Okc Thunders Arkansas Forward

May 08, 2025 -

Science In War Zones An Essential Perspective Episode 3

May 08, 2025

Science In War Zones An Essential Perspective Episode 3

May 08, 2025 -

Final Destination Bloodlines Oldest Person Ever Set On Fire In A Film

May 08, 2025

Final Destination Bloodlines Oldest Person Ever Set On Fire In A Film

May 08, 2025 -

Deeply Undermining Trust Googles Response To Dojs Antitrust Scrutiny

May 08, 2025

Deeply Undermining Trust Googles Response To Dojs Antitrust Scrutiny

May 08, 2025