Market Reaction: FTSE 100 Performance Driven By Retail And Energy News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reaction: FTSE 100 Performance Driven by Retail and Energy News

The FTSE 100 experienced significant fluctuation today, largely driven by contrasting performances in the retail and energy sectors. While positive news boosted energy giants, a more pessimistic outlook for retail sales dampened overall market enthusiasm. This complex interplay highlights the diverse factors currently shaping the UK's leading stock market index.

Retail Sector Slowdown Casts Shadow on FTSE 100

Recent retail sales figures released this morning painted a less-than-rosy picture for the sector. A slowdown in consumer spending, attributed to persistent inflation and the ongoing cost of living crisis, sent shares in several major retailers tumbling. Companies heavily reliant on discretionary spending were particularly hard hit. Analysts predict further challenges for the retail sector in the coming months, with potential implications for the broader FTSE 100 performance.

- Key Players Affected: Shares in [Insert names of affected retail companies, e.g., Next, Tesco, Marks & Spencer] experienced notable declines following the release of the data.

- Impact on Consumer Confidence: The sluggish retail sales figures further underscore weakening consumer confidence, raising concerns about the overall health of the UK economy.

- Future Outlook: Experts suggest that the retail sector will continue to face headwinds unless inflation eases significantly and consumer confidence improves.

Energy Sector Buoyancy Provides Partial Offset

In contrast to the retail sector's downturn, the energy sector enjoyed a positive day. Rising oil prices, fuelled by [mention specific geopolitical events or factors driving oil price increases, e.g., geopolitical tensions in the Middle East, OPEC+ production cuts], boosted the share prices of major energy companies listed on the FTSE 100. This sector's strong performance partially mitigated the negative impact of the retail sector's struggles.

- Rising Oil Prices: The increase in oil prices significantly impacted the performance of energy giants such as [Insert names of affected energy companies, e.g., BP, Shell].

- Geopolitical Influence: Ongoing global events continue to exert a significant influence on energy markets and consequently, the FTSE 100.

- Long-Term Uncertainty: While the current rise in oil prices is beneficial for energy companies, the long-term outlook remains uncertain, subject to fluctuating global demand and supply.

FTSE 100 Closing Performance and Analyst Commentary

The FTSE 100 closed at [Insert closing value] today, reflecting the tug-of-war between the positive energy sector performance and the negative impact of weak retail sales figures. Analysts remain divided on the overall market outlook, with some suggesting that the current volatility is temporary, while others express concern about the persistence of inflationary pressures and their potential impact on future economic growth.

Keywords: FTSE 100, Stock Market, Retail Sales, Energy Sector, Oil Prices, Inflation, Consumer Spending, Market Volatility, UK Economy, Investment, Stock Market Analysis, Financial News

Conclusion:

Today's FTSE 100 performance underscores the interconnectedness of different sectors within the UK economy. While the energy sector's strength provided some support, the weakness in retail sales highlights the ongoing challenges faced by the UK economy. Investors will be closely monitoring both sectors, along with wider macroeconomic factors, to gauge the future direction of the FTSE 100. The interplay between these sectors will continue to be a key factor influencing the index's performance in the coming weeks and months.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reaction: FTSE 100 Performance Driven By Retail And Energy News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Bitcoin Reach 500 000 Standard Chartereds Analysis And The Role Of Government Investment

May 23, 2025

Will Bitcoin Reach 500 000 Standard Chartereds Analysis And The Role Of Government Investment

May 23, 2025 -

Customer Payment Plans Klarnas Buy Now Pay Later For Electronics

May 23, 2025

Customer Payment Plans Klarnas Buy Now Pay Later For Electronics

May 23, 2025 -

Tesla Optimus Video A Closer Look At The Robots Capabilities In Home Tasks

May 23, 2025

Tesla Optimus Video A Closer Look At The Robots Capabilities In Home Tasks

May 23, 2025 -

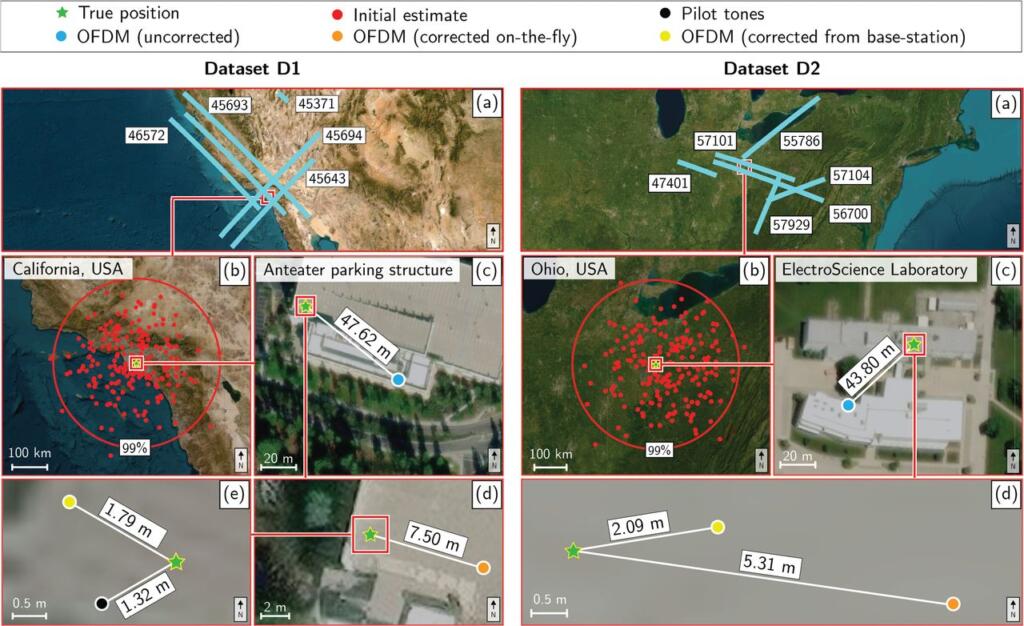

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

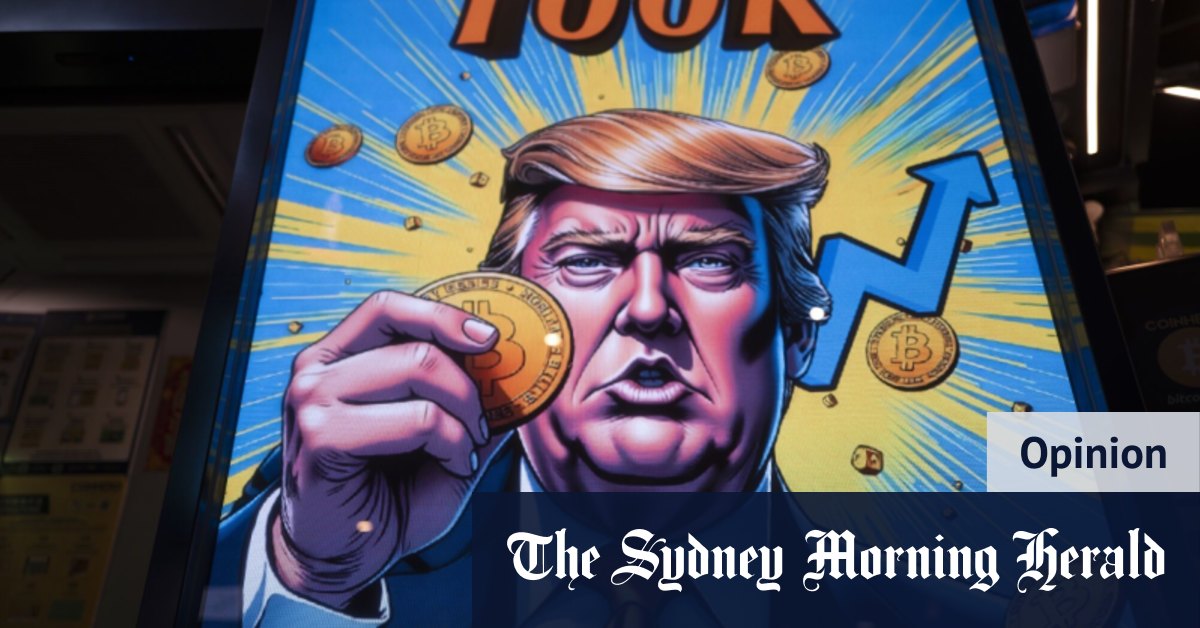

Trumps Influence Is Bitcoins Recent Surge A Signal To Invest Now

May 23, 2025

Trumps Influence Is Bitcoins Recent Surge A Signal To Invest Now

May 23, 2025

Latest Posts

-

Animoca Brands And Astar Network A Strategic Partnership To Onboard Asian Ips To Web3

May 24, 2025

Animoca Brands And Astar Network A Strategic Partnership To Onboard Asian Ips To Web3

May 24, 2025 -

Teslas Optimus Humanoid Robot Performs Chores Watch The Latest Video

May 24, 2025

Teslas Optimus Humanoid Robot Performs Chores Watch The Latest Video

May 24, 2025 -

Lucky Kentucky Lottery Ticket 150 000 Win Brings Financial Relief

May 24, 2025

Lucky Kentucky Lottery Ticket 150 000 Win Brings Financial Relief

May 24, 2025 -

Nyt Wordle Today Solution And Hints For May 22 Game 1433

May 24, 2025

Nyt Wordle Today Solution And Hints For May 22 Game 1433

May 24, 2025 -

2025 Nhl Playoffs Dallas Stars Shock Edmonton Oilers Complete Schedule And Results

May 24, 2025

2025 Nhl Playoffs Dallas Stars Shock Edmonton Oilers Complete Schedule And Results

May 24, 2025