Market Reacts To Trump Setback: Bull Flag Pattern Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reacts to Trump Setback: Bull Flag Pattern Analysis and Implications

The recent legal setbacks for Donald Trump have sent ripples through the financial markets, prompting analysts to scrutinize the implications for both short-term volatility and long-term investment strategies. While the immediate reaction has been mixed, a closer look at technical analysis, particularly the emergence of a bull flag pattern, offers insights into potential market movements.

Trump's Legal Troubles and Market Sentiment:

The ongoing legal battles facing the former president are undeniably impacting investor sentiment. Uncertainty surrounding potential policy shifts, regulatory changes, and even the broader political landscape contributes to market volatility. News cycles dominated by these developments can overshadow economic fundamentals, leading to short-term fluctuations. This isn't simply a matter of partisan politics; it's a significant factor influencing investor confidence and risk appetite. The market, inherently forward-looking, attempts to price in potential future outcomes.

Identifying the Bull Flag Pattern:

Technical analysts are observing a potential bull flag pattern forming in several key market indices. A bull flag is a continuation pattern characterized by a sharp upward price movement (the "flagpole") followed by a period of consolidation within a descending channel (the "flag"). This consolidation usually takes the form of relatively tight trading ranges, suggesting a temporary pause before a resumption of the upward trend.

-

What it signifies: The bull flag pattern generally suggests that the underlying bullish momentum remains intact. The consolidation period is viewed as a temporary pullback, offering a potential buying opportunity for investors. This pattern is often followed by a breakout above the flag's upper trendline, leading to further price appreciation.

-

Cautionary Note: It's crucial to remember that technical patterns are not foolproof. Other market forces, including unexpected economic data, geopolitical events, or shifts in investor sentiment unrelated to Trump's legal issues, can disrupt the pattern and invalidate the bullish prediction.

Implications for Investors:

The appearance of a bull flag pattern following the initial market reaction to Trump's legal troubles presents a complex scenario for investors. While the pattern itself suggests further upward movement, the underlying uncertainty stemming from the political situation warrants caution.

-

Conservative Approach: Investors with a risk-averse approach might consider waiting for a confirmation breakout above the upper trendline of the bull flag before taking a long position. This reduces the risk of entering a position during a temporary correction.

-

Aggressive Approach: More aggressive investors might see the current situation as a buying opportunity, particularly if they believe the market is overreacting to the short-term political noise. They might consider entering positions at the lower end of the flag's trading range.

-

Diversification is Key: Regardless of the chosen investment strategy, diversification remains crucial. Spreading investments across different asset classes mitigates the risk associated with exposure to any single factor, including political uncertainty.

Conclusion:

The market's reaction to Trump's legal setbacks highlights the interconnectedness of politics and finance. While the emergence of a bull flag pattern suggests potential upside, investors should approach the situation cautiously, considering both the technical analysis and the underlying fundamental uncertainty. Careful risk management and diversification remain paramount in navigating this dynamic environment. Further observation of market behavior and confirmation signals will be crucial in assessing the validity of the bullish forecast.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reacts To Trump Setback: Bull Flag Pattern Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alcatraz Expansion Details Of Trumps Plan To Reopen And Expand The Historic Prison

May 06, 2025

Alcatraz Expansion Details Of Trumps Plan To Reopen And Expand The Historic Prison

May 06, 2025 -

The Olympic Connection How Shared Experiences Forged Green And Pops Partnership

May 06, 2025

The Olympic Connection How Shared Experiences Forged Green And Pops Partnership

May 06, 2025 -

Hollywood In Crisis Analyzing The Impact Of Trumps Tariffs On The Film Industry

May 06, 2025

Hollywood In Crisis Analyzing The Impact Of Trumps Tariffs On The Film Industry

May 06, 2025 -

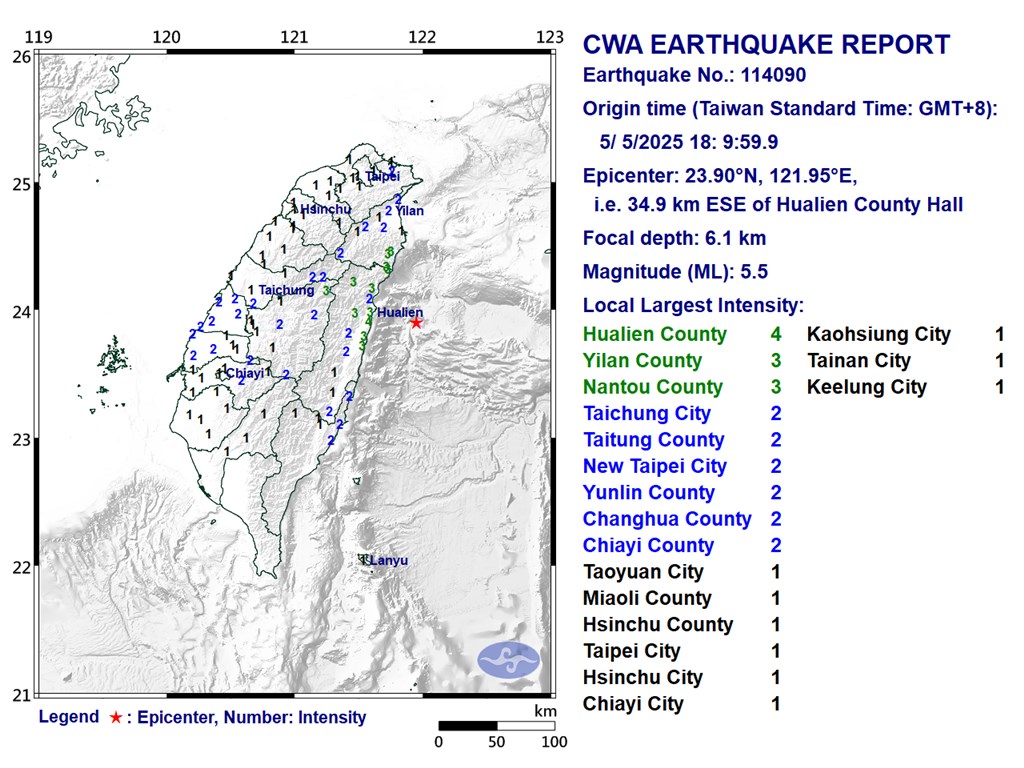

5 5 Magnitude Earthquake Jolts Eastern Taiwan Casualties And Damage Reports

May 06, 2025

5 5 Magnitude Earthquake Jolts Eastern Taiwan Casualties And Damage Reports

May 06, 2025 -

Okc Thunder Can They Avoid A Post Layoff Slump

May 06, 2025

Okc Thunder Can They Avoid A Post Layoff Slump

May 06, 2025

Latest Posts

-

Houston Astros Win Big 8 3 Victory Over Chicago White Sox 05 03 2025

May 06, 2025

Houston Astros Win Big 8 3 Victory Over Chicago White Sox 05 03 2025

May 06, 2025 -

Knicks Upset Celtics 108 105 In Playoff Thriller May 5th 2025 Recap

May 06, 2025

Knicks Upset Celtics 108 105 In Playoff Thriller May 5th 2025 Recap

May 06, 2025 -

Celtics Vs Knicks Prediction Team News And Form Guide

May 06, 2025

Celtics Vs Knicks Prediction Team News And Form Guide

May 06, 2025 -

Shai Gilgeous Alexanders Thunder Take On Jokic And The Nuggets Second Round Showdown

May 06, 2025

Shai Gilgeous Alexanders Thunder Take On Jokic And The Nuggets Second Round Showdown

May 06, 2025 -

Finding Value In Ai The Struggle For Global Businesses To Achieve Roi

May 06, 2025

Finding Value In Ai The Struggle For Global Businesses To Achieve Roi

May 06, 2025