Market Rollercoaster: Analysis Of Today's Dow, S&P 500, And Nasdaq Fluctuations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Rollercoaster: Decoding Today's Dow, S&P 500, and Nasdaq Fluctuations

Today's stock market saw significant volatility, leaving investors on edge. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced dramatic swings, prompting questions about the underlying causes and potential future implications. This analysis delves into the key factors driving these fluctuations and offers insights for navigating the current market climate.

Understanding the Day's Volatility:

The market opened with a sense of uncertainty, reflecting ongoing concerns about several key economic indicators. Inflation remains a persistent headwind, with recent data suggesting that price pressures may be more stubborn than initially anticipated. This fuels speculation about further interest rate hikes by the Federal Reserve, a move that could stifle economic growth and negatively impact corporate earnings.

Adding to the market's jitters were mixed signals from the corporate sector. While some companies reported better-than-expected earnings, others fell short of analyst projections, highlighting the uneven nature of the current economic recovery. This divergence in corporate performance contributed to the choppy trading conditions observed throughout the day.

Dow Jones Industrial Average: A Closer Look:

The Dow Jones Industrial Average experienced a significant intraday reversal, initially plunging before recovering some lost ground. This suggests a battle between bearish and bullish sentiment amongst investors. The index's sensitivity to macroeconomic factors, particularly interest rate changes, makes it particularly susceptible to volatility during periods of economic uncertainty. Key Dow components, including [mention specific companies and their performance – e.g., "Boeing and Caterpillar," ] showed mixed results, further contributing to the index's fluctuating performance.

S&P 500 and Nasdaq: Technology's Impact:

The S&P 500, a broader market index, mirrored the Dow's volatility, although its fluctuations were slightly less dramatic. The Nasdaq Composite, heavily weighted towards technology stocks, exhibited a similar pattern, reflecting investors' ongoing concerns about the tech sector's valuation in the face of rising interest rates. The performance of major tech giants like [mention specific companies and their performance – e.g., "Apple and Microsoft"] played a significant role in shaping the Nasdaq's trajectory.

Factors Driving Market Fluctuations:

- Inflation and Interest Rates: The persistent threat of inflation and the potential for further interest rate hikes by the Federal Reserve remain primary drivers of market uncertainty.

- Corporate Earnings Reports: Mixed corporate earnings reports highlight the uneven nature of the economic recovery and contribute to investor hesitancy.

- Geopolitical Uncertainty: Ongoing geopolitical tensions can also influence market sentiment, creating additional volatility.

- Investor Sentiment: Overall investor confidence, impacted by the aforementioned factors, plays a crucial role in driving market trends.

Navigating the Market Uncertainty:

The current market environment demands a cautious approach from investors. Diversification of investment portfolios, a long-term investment strategy, and careful risk assessment are crucial for weathering market storms. Staying informed about economic indicators and company performance is essential for making well-informed investment decisions. Consulting with a financial advisor can provide personalized guidance in navigating these challenging market conditions.

Conclusion:

Today's market rollercoaster highlights the challenges inherent in navigating periods of economic uncertainty. While short-term fluctuations are inevitable, a long-term perspective and a well-defined investment strategy are essential for navigating volatility and achieving long-term financial goals. Continuous monitoring of key economic indicators and company performance, along with careful risk management, remain crucial for success in today’s dynamic market landscape. The coming weeks will be critical in determining the direction of the market, as investors await further economic data and corporate earnings announcements.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Rollercoaster: Analysis Of Today's Dow, S&P 500, And Nasdaq Fluctuations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

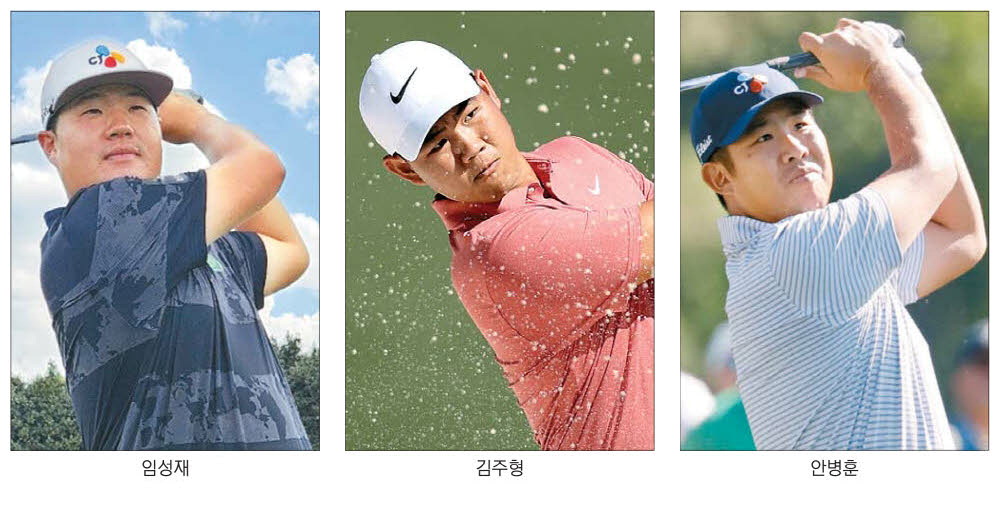

K Golfs Rising Stars Lim Sung Jae Kim Joo Hyung And Ahn Byung Hoons Upcoming Tournament

Apr 12, 2025

K Golfs Rising Stars Lim Sung Jae Kim Joo Hyung And Ahn Byung Hoons Upcoming Tournament

Apr 12, 2025 -

Arsenal Stars Career Questioned Former Teammates Call Him Overrated

Apr 12, 2025

Arsenal Stars Career Questioned Former Teammates Call Him Overrated

Apr 12, 2025 -

Cricket News South African Player Faces Psl Ban For Joining Ipl

Apr 12, 2025

Cricket News South African Player Faces Psl Ban For Joining Ipl

Apr 12, 2025 -

Google Cloud Next 2025 Day Two Highlights And What They Mean For You

Apr 12, 2025

Google Cloud Next 2025 Day Two Highlights And What They Mean For You

Apr 12, 2025 -

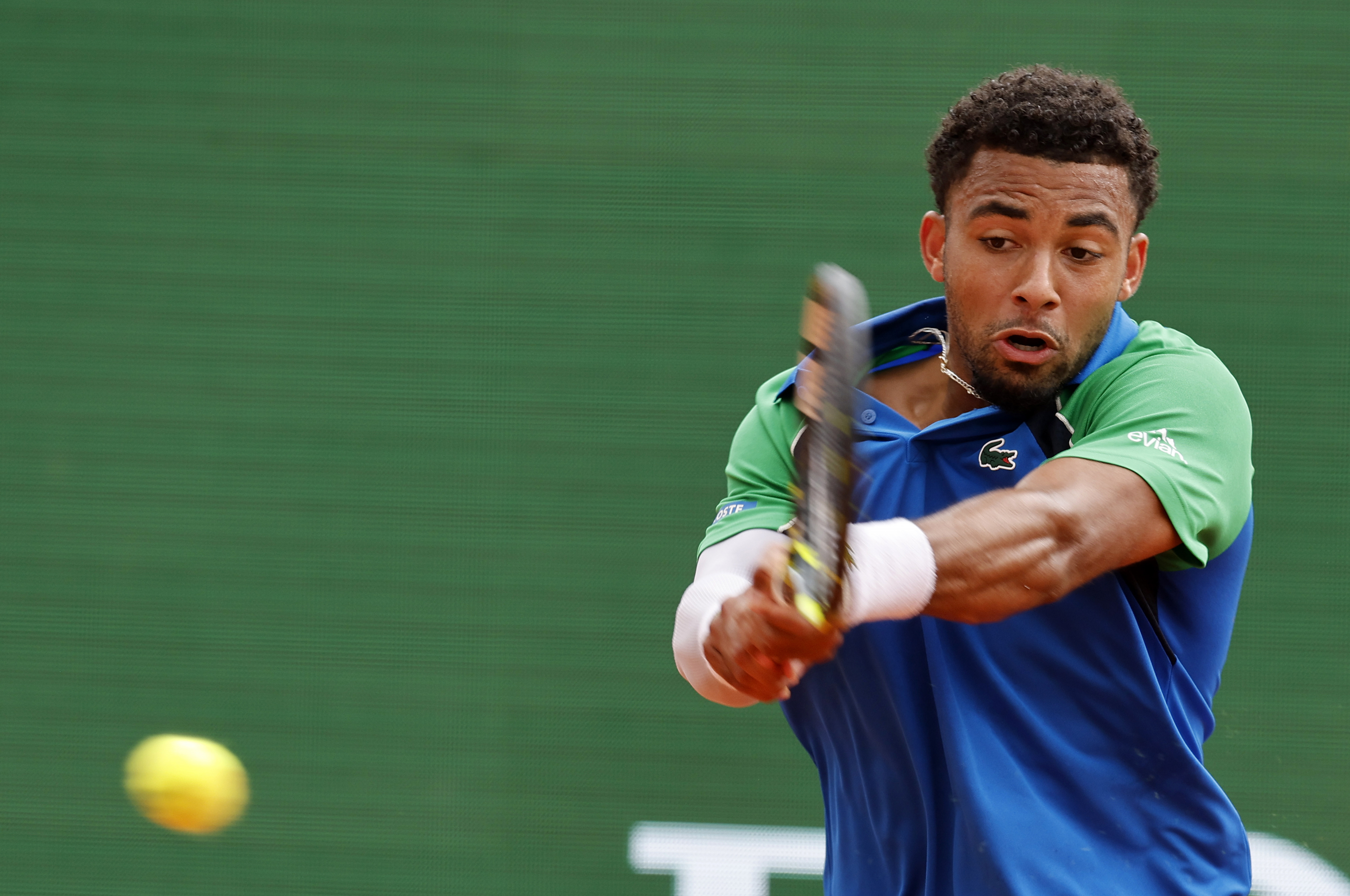

Finalista Espanol En Montecarlo Alcaraz Supera A Fils Tras Remontada

Apr 12, 2025

Finalista Espanol En Montecarlo Alcaraz Supera A Fils Tras Remontada

Apr 12, 2025