Market Rollercoaster: Bond Yields Surge, Impacting Dow, S&P 500, And Nasdaq Amidst US-China Trade War Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Rollercoaster: Bond Yields Surge, Impacting Dow, S&P 500, and Nasdaq Amidst US-China Trade War Concerns

The US stock market experienced a significant downturn today, with major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experiencing sharp declines. This market volatility is largely attributed to a surge in bond yields and escalating concerns surrounding the ongoing US-China trade war. The interconnectedness of these factors paints a complex picture for investors and highlights the fragility of the current economic climate.

Bond Yields Soar, Signaling Economic Uncertainty:

The yield on the benchmark 10-year Treasury note jumped significantly today, reaching its highest level in [Insert current yield and date]. This increase reflects investor anxieties about several key factors. Firstly, persistent inflation remains a concern, prompting the Federal Reserve to consider further interest rate hikes. Higher interest rates make bonds more attractive, driving up their yields and simultaneously impacting the stock market. Secondly, the escalating trade tensions between the US and China are contributing to a broader sense of economic uncertainty. Investors are moving towards safer assets like government bonds, increasing demand and pushing yields higher.

Trade War Intensifies, Adding Fuel to the Fire:

The US-China trade war continues to cast a long shadow over global markets. Recent developments, including [mention specific recent news, e.g., new tariffs, stalled negotiations], have fueled investor apprehension. The uncertainty surrounding future trade relations between the world's two largest economies is creating a climate of fear, leading to risk-aversion and a sell-off in equities. This uncertainty is particularly impactful on technology companies listed on the Nasdaq, many of which rely heavily on the Chinese market.

Impact on Major Indices:

The impact on major market indices is undeniable:

- Dow Jones Industrial Average: Experienced a drop of [Insert percentage and points] today.

- S&P 500: Suffered a decline of [Insert percentage and points], indicating widespread market weakness.

- Nasdaq Composite: Felt the brunt of the sell-off, with a decrease of [Insert percentage and points], largely attributed to the tech sector's sensitivity to trade tensions.

What This Means for Investors:

The current market volatility underscores the need for careful investment strategies. Investors should:

- Diversify their portfolios: Spreading investments across different asset classes can mitigate risk.

- Monitor economic indicators closely: Staying informed about inflation, interest rates, and trade developments is crucial.

- Consider risk tolerance: Investors with a lower risk tolerance may want to adjust their portfolios accordingly.

- Consult with a financial advisor: Seeking professional advice can help investors navigate the complexities of the current market.

Looking Ahead:

The coming weeks will be critical in determining the trajectory of the market. The outcome of ongoing trade negotiations between the US and China will play a significant role, along with any further announcements from the Federal Reserve regarding interest rates. The current market uncertainty highlights the importance of remaining informed and adaptable in the face of evolving economic conditions. Investors should prepare for continued volatility and maintain a long-term perspective. The interplay between bond yields and trade tensions will undoubtedly continue to shape market performance in the near future. This situation demands careful observation and strategic adjustments from both individual and institutional investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Rollercoaster: Bond Yields Surge, Impacting Dow, S&P 500, And Nasdaq Amidst US-China Trade War Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Smoakloader Ecosystem Targeted Operation Endgame Yields Multiple Arrests

Apr 12, 2025

Smoakloader Ecosystem Targeted Operation Endgame Yields Multiple Arrests

Apr 12, 2025 -

Di Mana Tayang Pertandingan Bayern Munchen Vs Dortmund Panduan Lengkap

Apr 12, 2025

Di Mana Tayang Pertandingan Bayern Munchen Vs Dortmund Panduan Lengkap

Apr 12, 2025 -

Elton Johns Latest Album Hits Number One A Chart Topping Legacy

Apr 12, 2025

Elton Johns Latest Album Hits Number One A Chart Topping Legacy

Apr 12, 2025 -

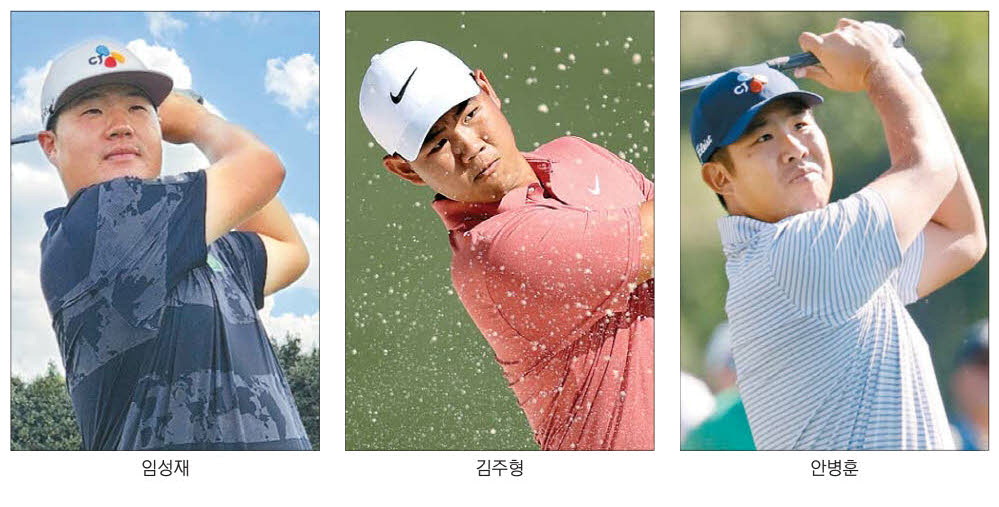

Koreas K Golf Trio Lim Sung Jae Kim Joo Hyung And Ahn Byung Hoon Begin New Season

Apr 12, 2025

Koreas K Golf Trio Lim Sung Jae Kim Joo Hyung And Ahn Byung Hoon Begin New Season

Apr 12, 2025 -

Masters Cut Who Made It From Liv Golf De Chambeau In Johnson Out

Apr 12, 2025

Masters Cut Who Made It From Liv Golf De Chambeau In Johnson Out

Apr 12, 2025