Market Volatility: Dow, S&P 500, And Nasdaq Fluctuate Amidst Rising Bond Yields And Trade Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: Dow, S&P 500, and Nasdaq Fluctuate Amidst Rising Bond Yields and Trade Concerns

Wall Street experienced a rollercoaster ride this week, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite Index all exhibiting significant fluctuations. Investors are grappling with a confluence of factors, primarily rising bond yields and persistent anxieties surrounding global trade relations. This volatile market environment leaves many wondering what the future holds for their portfolios.

The recent surge in US Treasury bond yields has been a major catalyst for market uncertainty. Higher yields generally indicate increased investor confidence in the economy, but they also make bonds a more attractive alternative to stocks, drawing investment away from the equity market. This shift in investor sentiment has led to a sell-off in several sectors, particularly technology stocks, which are often more sensitive to interest rate changes.

<h3>Rising Bond Yields: A Double-Edged Sword</h3>

The rise in bond yields is a complex issue. While reflecting a healthy economy, it also presents challenges. Higher borrowing costs can stifle business investment and economic growth, potentially leading to a slowdown in corporate earnings. This is particularly relevant for growth-oriented companies heavily reliant on debt financing. The current situation necessitates a careful assessment of the balance between economic growth and the potential for inflation.

- Impact on Tech Stocks: The tech sector, known for its high valuations and growth expectations, has been disproportionately affected by rising bond yields. Investors are reassessing the risk-reward profile of these companies, leading to price corrections.

- Impact on Small-Cap Stocks: Small-cap companies, often with higher growth potential but also greater risk, are particularly vulnerable to market volatility. Their stock prices tend to be more sensitive to changes in interest rates and overall market sentiment.

<h3>Trade Tensions Continue to Cast a Shadow</h3>

Adding to the market's jitters are ongoing concerns about global trade. Uncertainty surrounding trade policies and potential tariffs continues to weigh on investor confidence. The impact of these tensions varies across sectors, with some industries more exposed to international trade than others. This uncertainty makes it difficult for businesses to plan for the future and can lead to decreased investment and hiring.

<h3>Navigating the Volatility: Strategies for Investors</h3>

For individual investors, this period of market volatility demands a thoughtful and strategic approach. Here are some key considerations:

- Diversification: A well-diversified portfolio is crucial to mitigate risk. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) can help cushion the impact of market fluctuations.

- Risk Tolerance: Investors should honestly assess their risk tolerance and adjust their portfolio accordingly. A higher risk tolerance may allow for greater exposure to equities, while a lower risk tolerance might favor a more conservative approach with a greater allocation to bonds.

- Long-Term Perspective: It’s vital to maintain a long-term perspective. Short-term market fluctuations are normal, and attempting to time the market is often unsuccessful. Focusing on long-term investment goals can help investors weather short-term volatility.

- Professional Advice: Considering consulting a financial advisor can provide valuable guidance during periods of market uncertainty. A financial advisor can help create a personalized investment strategy tailored to your specific needs and risk tolerance.

The current market volatility underscores the importance of informed decision-making and a long-term investment strategy. Staying informed about economic indicators, geopolitical events, and market trends is crucial for navigating these challenging times. While short-term fluctuations are inevitable, a well-planned approach can help investors protect their portfolios and achieve their financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: Dow, S&P 500, And Nasdaq Fluctuate Amidst Rising Bond Yields And Trade Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Smaller Faster Oppo Find X8 Ultra Packs A Punch

Apr 11, 2025

Smaller Faster Oppo Find X8 Ultra Packs A Punch

Apr 11, 2025 -

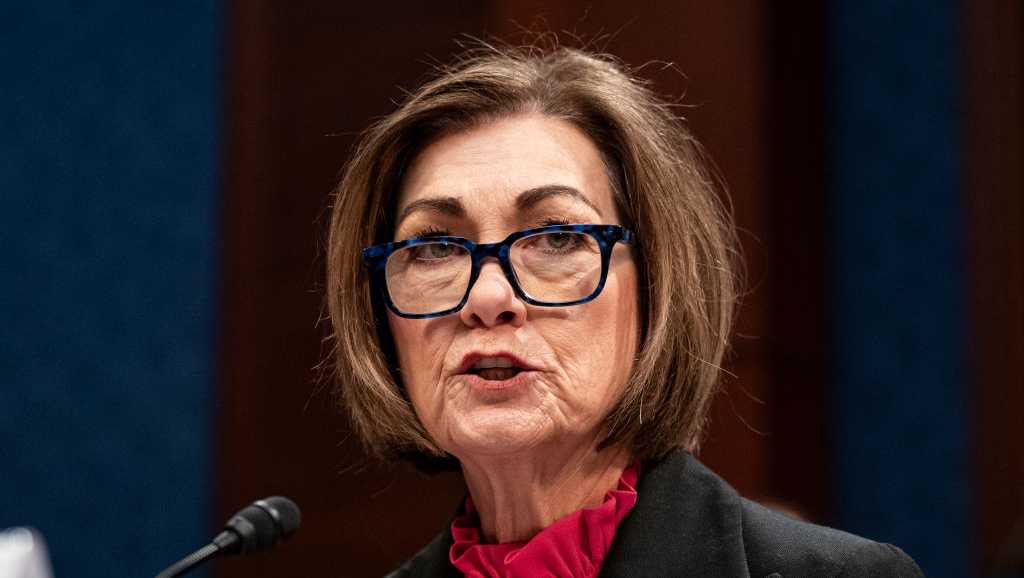

Iowa Governor Reynolds Announces She Will Not Seek Re Election

Apr 11, 2025

Iowa Governor Reynolds Announces She Will Not Seek Re Election

Apr 11, 2025 -

Watch Legia Warsaw Vs Chelsea Full Match Details Lineups And Broadcast Info

Apr 11, 2025

Watch Legia Warsaw Vs Chelsea Full Match Details Lineups And Broadcast Info

Apr 11, 2025 -

Kolkata Knight Riders Triumph Narines Spin Wrecks Csks Innings

Apr 11, 2025

Kolkata Knight Riders Triumph Narines Spin Wrecks Csks Innings

Apr 11, 2025 -

Roman Kemps Reaction To Father Martin Kemps Marriage Statement

Apr 11, 2025

Roman Kemps Reaction To Father Martin Kemps Marriage Statement

Apr 11, 2025