Market Volatility Got You Down? A Timeless Tip From Warren Buffett

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility Got You Down? A Timeless Tip from Warren Buffett

Market swings giving you anxiety? Feeling the pressure of recent volatility? You're not alone. Even seasoned investors experience unease during turbulent market periods. But what's the secret to navigating these choppy waters? Legendary investor Warren Buffett offers a timeless piece of advice that remains remarkably relevant today: focus on the long term.

This isn't just a platitude; it's a core tenet of Buffett's remarkably successful investment strategy. While short-term fluctuations can be dramatic, they often pale in comparison to the long-term growth potential of sound investments. Buffett's enduring success is a testament to the power of this simple yet profound strategy.

Understanding Buffett's Long-Term Approach

Buffett famously advises investors to think of the stock market as a business, not a casino. Short-term gains and losses are essentially noise in the context of a long-term investment horizon. He doesn't chase fleeting trends or react to daily market fluctuations. Instead, he focuses on identifying fundamentally strong companies with a proven track record and a sustainable competitive advantage.

This long-term perspective allows him to weather market storms without panic selling. He understands that market corrections, even significant ones, are a normal part of the investment cycle. These dips, while unsettling, often present opportunities to buy undervalued assets.

Practical Applications of Buffett's Wisdom

How can you apply this wisdom to your own portfolio? Here are some key takeaways:

- Develop a long-term investment plan: Don't invest based on fleeting market trends. Create a diversified portfolio aligned with your financial goals and risk tolerance. This plan should be revisited periodically, but not in response to daily market fluctuations.

- Focus on fundamental analysis: Instead of relying on technical indicators or market sentiment, concentrate on evaluating the underlying value of companies. Look at factors such as revenue growth, profitability, debt levels, and competitive landscape.

- Ignore the noise: Turn off the constant stream of market news and social media chatter. These sources often amplify fear and uncertainty, leading to impulsive decisions.

- Invest in quality companies: Choose companies with strong management teams, a history of consistent performance, and a clear path to future growth.

- Stay disciplined: Stick to your investment plan, even during periods of market volatility. Avoid emotional decision-making, which often leads to poor investment outcomes.

The Power of Patience

Buffett’s success isn't just about picking the right stocks; it's about having the patience to let those investments grow over time. He understands that compounding returns are a powerful force that can significantly enhance wealth over the long term.

Market volatility is inevitable. The key is to remain calm, focused, and disciplined. By adopting a long-term perspective, as advocated by Warren Buffett, you can navigate market uncertainty and significantly improve your chances of achieving your financial goals. Remember, investing is a marathon, not a sprint.

Keywords: Warren Buffett, long-term investing, market volatility, investment strategy, stock market, investment advice, financial planning, portfolio diversification, fundamental analysis, long-term growth, patience in investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility Got You Down? A Timeless Tip From Warren Buffett. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

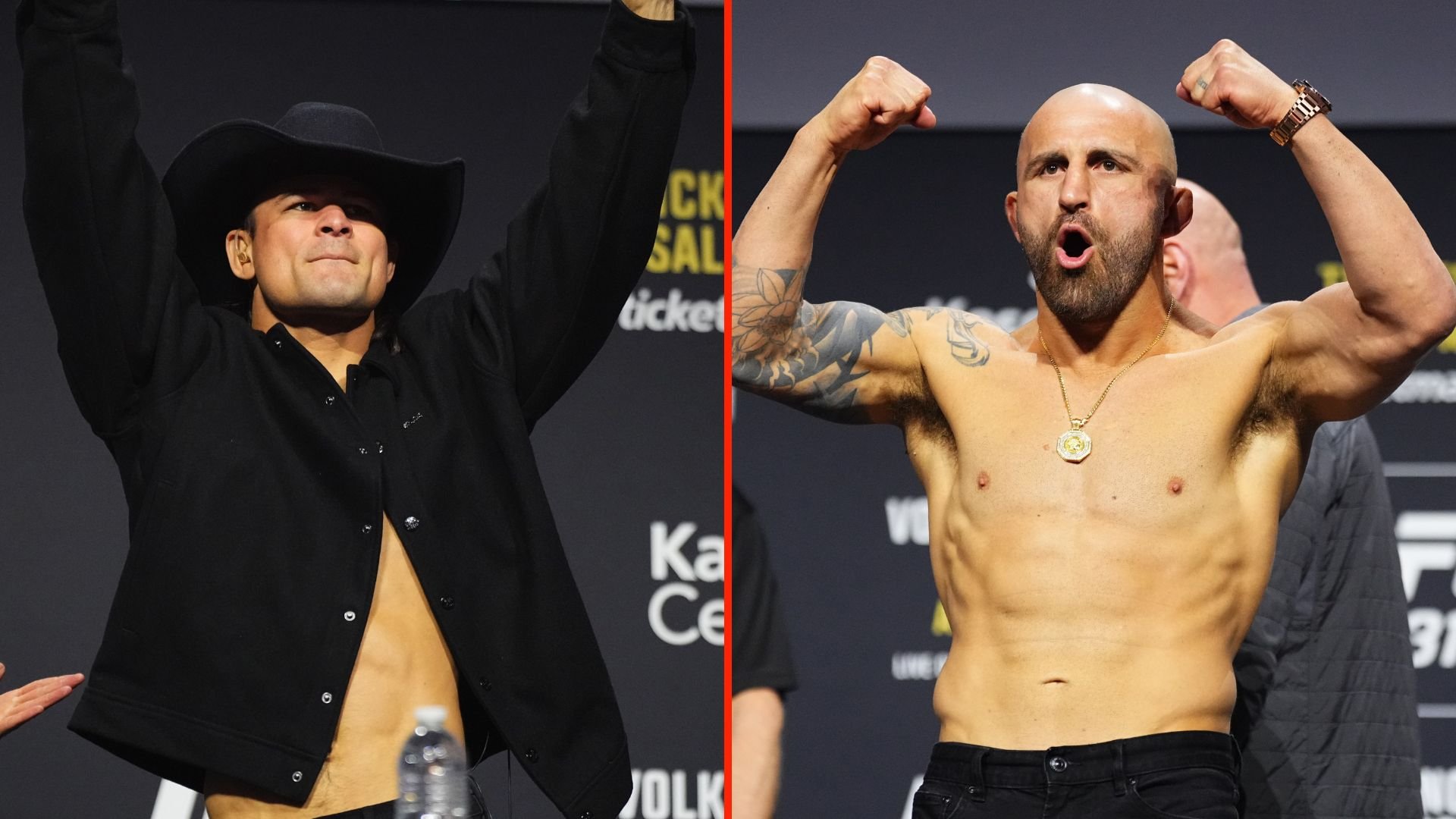

Volkanovski And Lopes Identical Plans For First Featherweight Defense Post Ufc 314

Apr 07, 2025

Volkanovski And Lopes Identical Plans For First Featherweight Defense Post Ufc 314

Apr 07, 2025 -

Breaking Irs Announces Significant Changes Affecting Tax Day Filers

Apr 07, 2025

Breaking Irs Announces Significant Changes Affecting Tax Day Filers

Apr 07, 2025 -

Nyt Connections Sports Edition April 6th 2024 Hints And Answers 195

Apr 07, 2025

Nyt Connections Sports Edition April 6th 2024 Hints And Answers 195

Apr 07, 2025 -

South Indian Ram Navami Recipes 8 Dishes For A Blessed And Prosperous Celebration

Apr 07, 2025

South Indian Ram Navami Recipes 8 Dishes For A Blessed And Prosperous Celebration

Apr 07, 2025 -

Google And Roblox Team Up For Immersive Advertising Experiences

Apr 07, 2025

Google And Roblox Team Up For Immersive Advertising Experiences

Apr 07, 2025