Market Volatility Increases Amidst India-Pakistan Border Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility Increases Amidst India-Pakistan Border Tensions

Geopolitical tensions between India and Pakistan are sending shockwaves through global financial markets, triggering increased volatility and investor uncertainty. The recent escalation along the border has reignited concerns about regional stability, impacting everything from stock markets to commodity prices. Experts warn that the situation could further destabilize an already fragile global economic landscape.

Escalating Tensions and Market Reactions:

The heightened military activity and rhetoric between the two nuclear-armed nations have created a climate of fear among investors. This uncertainty is manifesting itself in several ways:

-

Sharp Stock Market Swings: Indian and Pakistani stock markets have experienced significant fluctuations, with indices experiencing both sharp gains and losses in rapid succession. Investors are quickly reacting to news headlines and official statements, leading to erratic trading patterns. The volatility extends beyond the immediate region, impacting global indices as well.

-

Currency Fluctuations: The Indian Rupee and Pakistani Rupee have shown increased volatility against major currencies like the US dollar. This reflects investor apprehension and capital flight as investors seek safer havens for their assets. Currency traders are closely monitoring the situation, anticipating further shifts.

-

Commodity Price Impacts: The escalating tensions are also affecting commodity markets. Oil prices, already sensitive to geopolitical events, have seen a noticeable increase, reflecting concerns about potential disruptions to energy supplies in the region. Other commodities sensitive to global instability are also experiencing price swings.

Expert Analysis and Predictions:

Analysts warn that the situation remains fluid and unpredictable. The longer the tensions persist, the greater the potential for economic damage. Several factors are contributing to market anxiety:

-

Nuclear Threat: The presence of nuclear weapons on both sides adds an extra layer of complexity and risk, making the situation far more perilous than typical border skirmishes.

-

Regional Instability: The conflict has the potential to destabilize the entire South Asian region, impacting trade, tourism, and investment.

-

Global Economic Fallout: Given the interconnected nature of the global economy, any major escalation could have significant spillover effects, exacerbating existing economic challenges worldwide.

What to Watch For:

Investors and market watchers should closely monitor the following in the coming days and weeks:

- Official Statements: Statements from both governments will be crucial in gauging the trajectory of the conflict and its potential impact on markets.

- Military Activity: Any significant escalation in military activity along the border will likely trigger further market volatility.

- International Response: The response of the international community will also play a significant role in shaping the situation and its market consequences.

Investing During Times of Geopolitical Uncertainty:

Navigating market volatility during times of geopolitical uncertainty requires a cautious and strategic approach. Investors may consider diversifying their portfolios, reducing risk exposure, and seeking advice from financial professionals. Staying informed about the latest developments and reacting thoughtfully to market signals is crucial for minimizing potential losses.

Keywords: India-Pakistan border tensions, market volatility, stock market, currency fluctuations, commodity prices, geopolitical risk, investment strategy, South Asia, global economy, nuclear weapons, Rupee, oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility Increases Amidst India-Pakistan Border Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wolves Upset Warriors Top Plays From Last Nights Victory

May 10, 2025

Wolves Upset Warriors Top Plays From Last Nights Victory

May 10, 2025 -

Action Packed Trailer For The Old Guard 2 Showcases Theron And Thurmans Intense Battle

May 10, 2025

Action Packed Trailer For The Old Guard 2 Showcases Theron And Thurmans Intense Battle

May 10, 2025 -

Pacers Vs Celtics Nuggets Vs Suns Your Guide To Nba Playoffs Game 3 On Friday

May 10, 2025

Pacers Vs Celtics Nuggets Vs Suns Your Guide To Nba Playoffs Game 3 On Friday

May 10, 2025 -

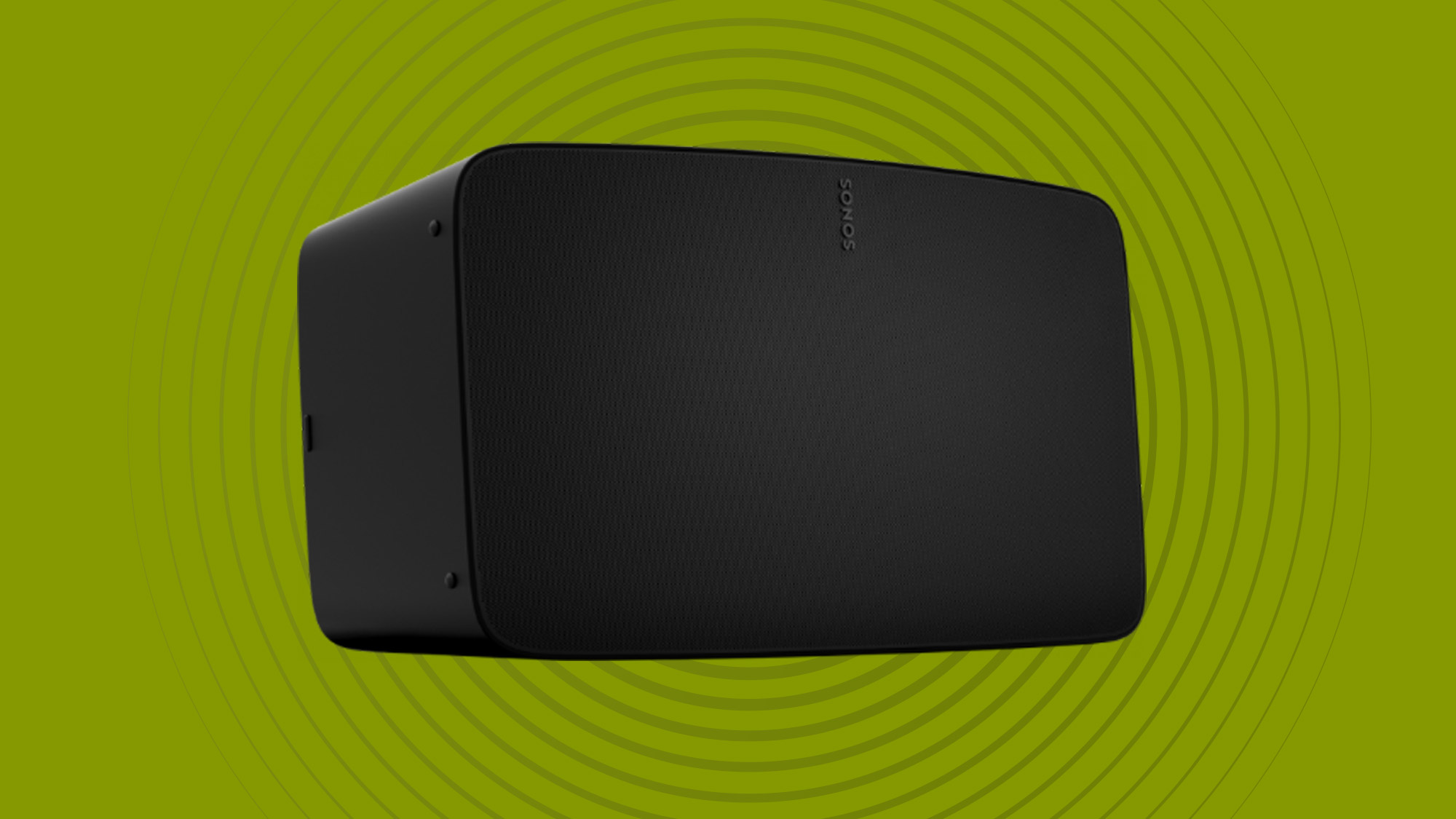

Top Sonos Deals And Sales For May 2025 Save Big Now

May 10, 2025

Top Sonos Deals And Sales For May 2025 Save Big Now

May 10, 2025 -

Wolves Stunning Series Win Top Moments Against The Warriors

May 10, 2025

Wolves Stunning Series Win Top Moments Against The Warriors

May 10, 2025

Latest Posts

-

Save Big On Mothers Day 2025 Restaurant Deals And Offers

May 10, 2025

Save Big On Mothers Day 2025 Restaurant Deals And Offers

May 10, 2025 -

Tensions Escalate Pakistans Response To India Live Updates From The Ground

May 10, 2025

Tensions Escalate Pakistans Response To India Live Updates From The Ground

May 10, 2025 -

Aluguel De Casas Na Praia E Campo Guia Completo Para Quem Nao Quer Comprar

May 10, 2025

Aluguel De Casas Na Praia E Campo Guia Completo Para Quem Nao Quer Comprar

May 10, 2025 -

Eu Cloud Strategy Decentralization Not Hyperscalers Drives Innovation

May 10, 2025

Eu Cloud Strategy Decentralization Not Hyperscalers Drives Innovation

May 10, 2025 -

Westbrook Injury Update Nuggets Guards Status For Game 3 Vs Thunder

May 10, 2025

Westbrook Injury Update Nuggets Guards Status For Game 3 Vs Thunder

May 10, 2025