Market Volatility Increases As Traders Await Fed Rate Hike

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility Increases as Traders Await Fed Rate Hike

Investors brace for potential turbulence as the Federal Reserve's interest rate decision looms.

Global markets are experiencing heightened volatility as investors anxiously await the Federal Reserve's (Fed) announcement on its next interest rate hike. The anticipation surrounding the Fed's move has sent ripples through equity markets, bond yields, and currency exchange rates, leaving traders on edge. Uncertainty about the magnitude of the hike and its potential impact on the broader economy is fueling this market instability.

The Fed's Tightrope Walk: Inflation vs. Recession

The Fed is caught in a delicate balancing act. Inflation remains stubbornly high, pushing for aggressive interest rate increases to cool down the economy. However, excessive rate hikes risk triggering a recession, a scenario that would severely impact economic growth and corporate profits. This dilemma has created significant market uncertainty, leading to increased volatility in recent weeks.

<h3>What are traders watching for?</h3>

Traders are keenly focused on several key factors:

- The size of the rate hike: Will it be another 0.75 percentage point increase, a smaller 0.5 percentage point hike, or even a pause? The market is currently pricing in a range of possibilities, creating significant uncertainty.

- Forward guidance: The Fed's communication regarding future rate hikes is crucial. Will they signal further aggressive tightening or hint at a potential slowdown in the pace of increases?

- Economic data: Recent economic indicators, including inflation figures, employment reports, and consumer spending data, will heavily influence the Fed's decision. Any unexpected shifts in these figures could dramatically impact market sentiment.

<h3>Impact on Different Asset Classes</h3>

The impending Fed decision is affecting various asset classes differently:

- Equities: Stock markets have experienced significant swings, with technology stocks particularly vulnerable to rising interest rates. Higher rates increase borrowing costs for companies, potentially impacting their profitability and valuations.

- Bonds: Bond yields have been rising in anticipation of further rate hikes. Rising yields generally indicate a decline in bond prices, creating headwinds for fixed-income investors.

- Currencies: The US dollar has generally strengthened against other major currencies as investors seek safe-haven assets amidst the uncertainty.

<h3>Navigating the Volatility: Strategies for Investors</h3>

The current market volatility presents both challenges and opportunities for investors. Some strategies to consider include:

- Diversification: A well-diversified portfolio can help mitigate risk across different asset classes.

- Risk management: Implementing robust risk management strategies, such as stop-loss orders, is crucial to protect against potential losses.

- Long-term perspective: Maintaining a long-term investment horizon can help weather short-term market fluctuations.

- Professional advice: Seeking advice from a qualified financial advisor can provide personalized guidance based on individual circumstances and risk tolerance.

Conclusion:

The upcoming Fed rate hike decision is undoubtedly a pivotal moment for global markets. While uncertainty remains high, careful planning, diversification, and a long-term perspective can help investors navigate the volatile landscape. Staying informed about economic indicators and the Fed's communications is crucial for making informed investment decisions during this period of heightened market uncertainty. The coming days will be critical in determining the direction of markets in the near term. Keep an eye on the news for further updates and expert analysis as the Fed's decision draws closer.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility Increases As Traders Await Fed Rate Hike. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Mini Crossword Answers Wednesday May 7th Clues Solved

May 07, 2025

Nyt Mini Crossword Answers Wednesday May 7th Clues Solved

May 07, 2025 -

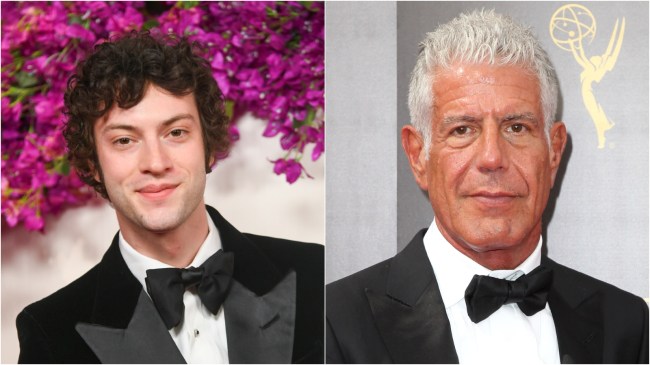

Tony A24s Method Acting Biopic On The Life Of Anthony Bourdain

May 07, 2025

Tony A24s Method Acting Biopic On The Life Of Anthony Bourdain

May 07, 2025 -

Analyzing The Golden State Warriors Minnesota Timberwolves Game May 6 2025 Charts

May 07, 2025

Analyzing The Golden State Warriors Minnesota Timberwolves Game May 6 2025 Charts

May 07, 2025 -

Warriors Game 7 Jitters Coach Kerrs Biggest Pre Match Headache

May 07, 2025

Warriors Game 7 Jitters Coach Kerrs Biggest Pre Match Headache

May 07, 2025 -

Against All Odds How Pat Spencer Transitioned From Lacrosse Star To Golden State Warriors Player

May 07, 2025

Against All Odds How Pat Spencer Transitioned From Lacrosse Star To Golden State Warriors Player

May 07, 2025

Latest Posts

-

Bonne Nouvelle Regardez La Finale De Ligue Des Champions Psg Inter Sur M6 Gratuitement

May 08, 2025

Bonne Nouvelle Regardez La Finale De Ligue Des Champions Psg Inter Sur M6 Gratuitement

May 08, 2025 -

Gilgeous Alexanders Positive Outlook After Thunders Game 1 Loss

May 08, 2025

Gilgeous Alexanders Positive Outlook After Thunders Game 1 Loss

May 08, 2025 -

The Power Of The Pen Writing As Therapy For Neurological Conditions

May 08, 2025

The Power Of The Pen Writing As Therapy For Neurological Conditions

May 08, 2025 -

Can The Thunder Upset The Nuggets Game 1 Showdown In Oklahoma City

May 08, 2025

Can The Thunder Upset The Nuggets Game 1 Showdown In Oklahoma City

May 08, 2025 -

Perth Nrl Franchise A Look At Its Business Model And Player Recruitment

May 08, 2025

Perth Nrl Franchise A Look At Its Business Model And Player Recruitment

May 08, 2025