Market Volatility? Jim Cramer's Guide To Managing Investment Fears

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility? Jim Cramer's Guide to Managing Investment Fears

Market volatility. The words alone can send shivers down the spine of even the most seasoned investor. But amidst the rollercoaster rides and unpredictable swings, legendary investor Jim Cramer offers a lifeline, guiding us through the turbulent waters of market uncertainty. His advice? Don't panic, and focus on a strategic, long-term approach.

This article delves into Jim Cramer's key strategies for navigating market volatility, offering actionable insights to help you manage your investment fears and protect your portfolio.

Understanding the Fear Factor:

Market downturns trigger primal fears – fear of loss, fear of missing out (FOMO), and even fear of the unknown. Cramer emphasizes that these fears are natural but shouldn't dictate your investment decisions. He often stresses the importance of understanding why you're invested in the first place. Is it for retirement? For your children's education? Remembering your long-term goals can provide the anchor you need during stormy market conditions.

Cramer's Core Strategies for Managing Volatility:

Cramer's approach isn't about timing the market perfectly (a notoriously difficult feat), but about building a resilient portfolio capable of weathering the storms. Here are some key takeaways from his advice:

-

Diversification is Key: Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. This reduces the impact of any single investment performing poorly.

-

Long-Term Perspective: Market fluctuations are normal. Focus on the long-term growth potential of your investments rather than reacting to short-term noise. Cramer often advises investors to "buy and hold" quality companies with strong fundamentals.

-

Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps to average out the cost of your investments over time, reducing the impact of buying high and selling low.

-

Focus on Fundamentals: Don't let emotions drive your investment decisions. Instead, concentrate on the underlying strength of the companies you invest in. Look at their earnings, revenue growth, and debt levels. Solid fundamentals can help you weather market downturns.

-

Don't Panic Sell: Panic selling is often the worst thing an investor can do during a market downturn. Selling low locks in losses and prevents you from benefiting from any potential recovery.

Beyond the Basics: Cramer's Additional Tips:

Cramer frequently emphasizes the importance of:

-

Staying Informed: Keep abreast of market news and trends, but avoid getting overwhelmed by constant updates. Focus on reliable sources and filter out the noise.

-

Having a Plan: Before investing, develop a clear investment plan outlining your goals, risk tolerance, and investment strategy. This plan will serve as your roadmap during volatile times.

-

Seeking Professional Advice: Consider consulting a financial advisor for personalized guidance tailored to your specific circumstances.

Conclusion:

While market volatility is inevitable, it doesn't have to be paralyzing. By incorporating Jim Cramer's strategies—diversification, a long-term focus, dollar-cost averaging, and a focus on fundamentals—investors can navigate market uncertainty with greater confidence and reduce their investment fears. Remember, a well-structured plan and a calm approach are your best allies in the face of market volatility. Investing wisely is a marathon, not a sprint.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility? Jim Cramer's Guide To Managing Investment Fears. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Josh Bartelstein Phoenix Suns Ceo Named In Scandalous Affair Lawsuit

May 20, 2025

Josh Bartelstein Phoenix Suns Ceo Named In Scandalous Affair Lawsuit

May 20, 2025 -

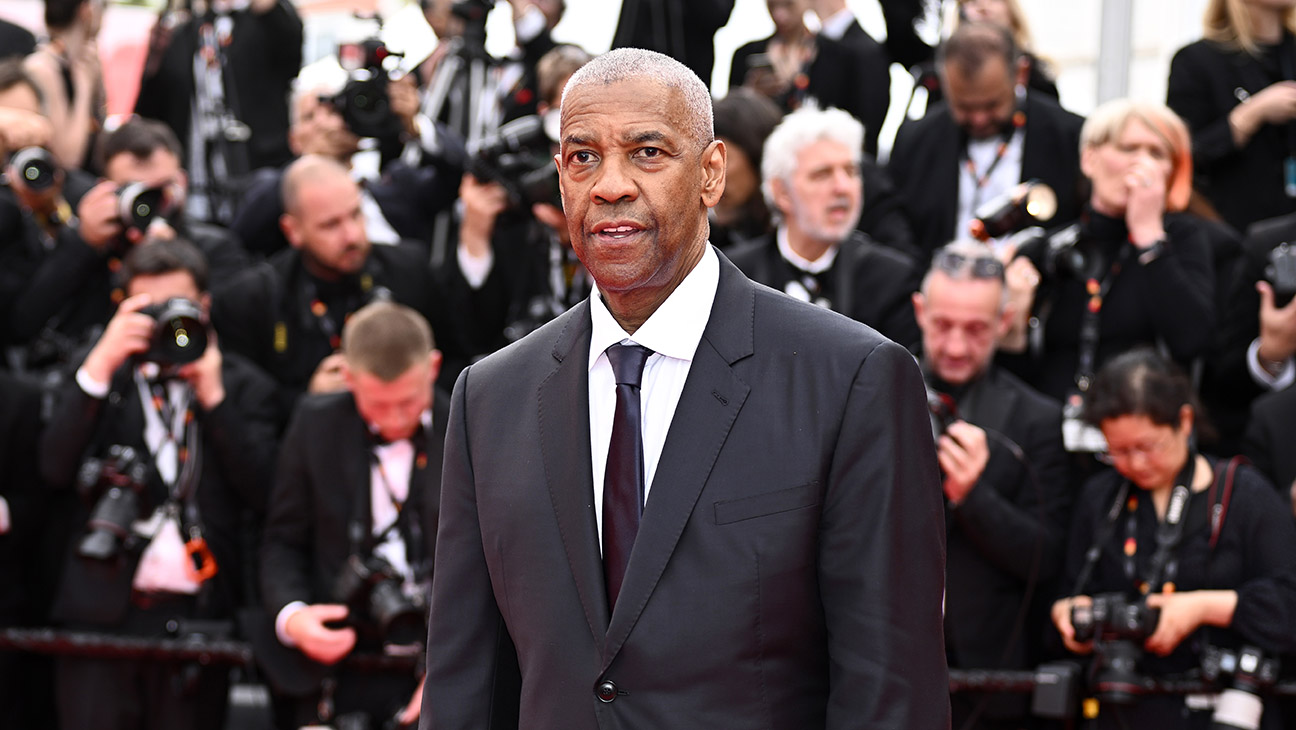

Surprise Denzel Washington Awarded Honorary Palme D Or At Cannes Film Festival

May 20, 2025

Surprise Denzel Washington Awarded Honorary Palme D Or At Cannes Film Festival

May 20, 2025 -

Canada Uk France Condemn Gaza Violence Joint Statement Released

May 20, 2025

Canada Uk France Condemn Gaza Violence Joint Statement Released

May 20, 2025 -

Film Review Denzel Washington And Spike Lees Interpretation Of Kurosawas Classic

May 20, 2025

Film Review Denzel Washington And Spike Lees Interpretation Of Kurosawas Classic

May 20, 2025 -

Review Tom Hardy Elevates Mob Land Season 1 Episode 8 Yet Season Remains Weak

May 20, 2025

Review Tom Hardy Elevates Mob Land Season 1 Episode 8 Yet Season Remains Weak

May 20, 2025