Market Volatility: US Stocks And Dollar Fall After Trump's Fed Chair Remarks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: US Stocks and Dollar Tumble After Trump's Fed Chair Remarks

The US stock market experienced a significant downturn, and the dollar weakened, following President Trump's latest comments regarding Federal Reserve Chairman Jerome Powell. This unexpected volatility sent shockwaves through global financial markets, leaving investors scrambling to understand the implications. The President's criticism of the Fed's monetary policy once again highlighted the delicate balance between political influence and central bank independence.

The market reacted swiftly and negatively to Trump's remarks, which were perceived as highly critical of Powell's handling of interest rates. This renewed uncertainty, coming at a time of already simmering trade tensions and global economic slowdown concerns, fueled a sell-off across major indices.

What Triggered the Market Drop?

Trump's comments, delivered [insert date and context of remarks here], focused on [summarize Trump's specific criticism of the Fed and Powell]. This marked a continuation of his previous criticisms, which have often been seen as attempts to pressure the Fed into lowering interest rates to boost economic growth. However, the Fed, by design, operates independently of political pressures to maintain its credibility and control inflation.

This direct attack on the Fed's independence raised concerns about potential political interference in monetary policy. Investors fear that such interference could lead to unpredictable and potentially harmful economic consequences. The perceived undermining of the Fed's authority is a major factor contributing to the market's negative response.

Impact on US Stocks and the Dollar:

The immediate impact was a sharp decline in major US stock market indices. The Dow Jones Industrial Average [insert percentage change], the S&P 500 [insert percentage change], and the Nasdaq Composite [insert percentage change] all experienced significant losses. This sell-off reflects investors' anxieties about future economic growth and the potential for further market volatility.

The US dollar also weakened against other major currencies following the news. This reflects a loss of investor confidence in the US economy and the potential for further political uncertainty. Currency traders often react negatively to political interference in economic policy, as it can create uncertainty and instability.

H2: Long-Term Implications and Expert Opinions:

The long-term implications of this market volatility remain uncertain. Many economists and financial analysts are expressing concern about the potential for further market instability if the President continues to publicly criticize the Fed. [Quote a relevant financial expert here, citing their source].

Some experts believe that Trump's actions could erode confidence in the US economy, potentially leading to lower investment and slower economic growth. Others argue that the market will eventually recover, provided the Fed maintains its independence and continues to manage monetary policy effectively.

H3: What Investors Should Do:

- Stay Informed: Keep abreast of economic news and developments to understand the evolving situation.

- Diversify Your Portfolio: Spread your investments across different asset classes to mitigate risk.

- Consult a Financial Advisor: Seek professional advice tailored to your individual circumstances.

- Avoid Panic Selling: Emotional decision-making often leads to poor investment outcomes.

Conclusion:

The recent market volatility underscores the crucial role of central bank independence and the significant impact of political rhetoric on investor sentiment. The ongoing tensions between the President and the Federal Reserve highlight the complex interplay between politics and economics, and the potential for unpredictable market consequences. Investors must remain vigilant and adapt their strategies to navigate this period of uncertainty. The situation warrants close monitoring and careful consideration of the evolving geopolitical and economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: US Stocks And Dollar Fall After Trump's Fed Chair Remarks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

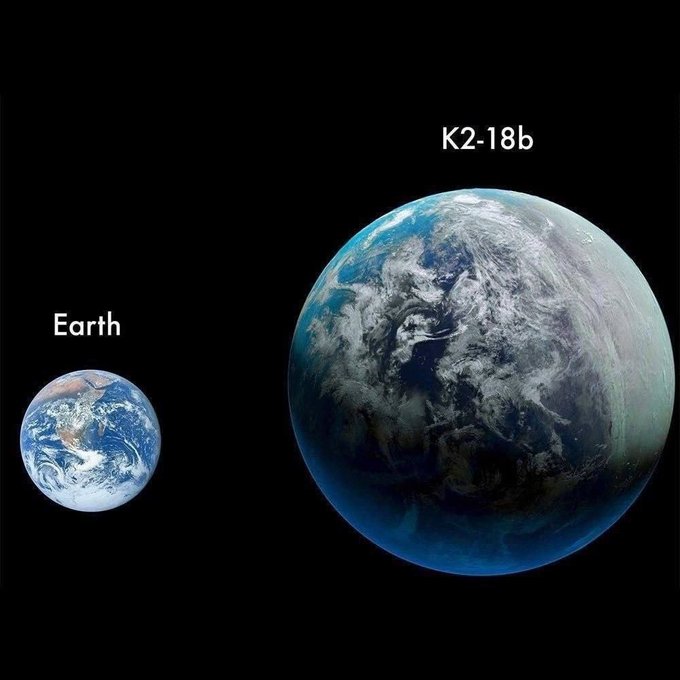

K2 18b Evidence Mounts For Ocean Planet Supporting Life

Apr 22, 2025

K2 18b Evidence Mounts For Ocean Planet Supporting Life

Apr 22, 2025 -

John Mc Ginn On Kieran Tierney A Celtic Reunion On The Cards

Apr 22, 2025

John Mc Ginn On Kieran Tierney A Celtic Reunion On The Cards

Apr 22, 2025 -

Limited Time Return Taco Bell Brings Back A Fan Favorite

Apr 22, 2025

Limited Time Return Taco Bell Brings Back A Fan Favorite

Apr 22, 2025 -

Up To The Minute Gold Coast Weather Updates

Apr 22, 2025

Up To The Minute Gold Coast Weather Updates

Apr 22, 2025 -

Crypto Mining And Data Centers In Texas The Impact Of Cheap Power And Emerging Regulations

Apr 22, 2025

Crypto Mining And Data Centers In Texas The Impact Of Cheap Power And Emerging Regulations

Apr 22, 2025