Mastercard Forecasts $15 Billion In Chargeback Fraud Losses For 2025: Preparing For The Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mastercard Forecasts $15 Billion in Chargeback Fraud Losses for 2025: Preparing for the Impact

The global payments landscape is bracing for a significant surge in chargeback fraud, with Mastercard predicting a staggering $15 billion in losses by 2025. This alarming forecast underscores the urgent need for businesses and financial institutions to bolster their fraud prevention strategies and adapt to the evolving tactics of cybercriminals. The projected increase represents a substantial jump from current levels, highlighting the growing sophistication and scale of chargeback fraud attacks.

This isn't just a problem for large corporations; small and medium-sized businesses (SMBs) are particularly vulnerable. The financial impact of even a single successful chargeback can be devastating for a small business, potentially leading to significant revenue losses and operational disruptions. Understanding the evolving threat landscape and implementing proactive measures is crucial for survival in this increasingly challenging environment.

Understanding the Rise in Chargeback Fraud

Several factors contribute to the predicted increase in chargeback fraud:

- Rise of E-commerce: The continued growth of online shopping provides fertile ground for fraudulent activities. The ease of creating fake accounts and exploiting vulnerabilities in online payment systems makes e-commerce a prime target.

- Sophisticated Fraud Techniques: Cybercriminals are constantly developing new and more sophisticated techniques to bypass security measures. This includes using stolen identities, synthetic identities, and exploiting vulnerabilities in merchant systems.

- Lack of Robust Fraud Prevention: Many businesses still lack adequate fraud prevention measures, relying on outdated technologies and processes that are easily circumvented.

- Increased Use of Mobile Payments: The increasing popularity of mobile payment methods presents new challenges, as these platforms can be more susceptible to certain types of fraud.

Strategies for Mitigating Chargeback Fraud Losses

Businesses need to adopt a multi-layered approach to effectively combat chargeback fraud. Key strategies include:

- Strengthening Authentication Processes: Implementing strong customer authentication methods, such as multi-factor authentication (MFA), can significantly reduce the risk of unauthorized transactions.

- Investing in Advanced Fraud Detection Systems: Utilizing AI-powered fraud detection systems that can analyze transaction data in real-time and identify suspicious patterns is critical. These systems can learn and adapt to evolving fraud techniques, providing a dynamic layer of protection.

- Improving Data Security: Protecting sensitive customer data through robust security measures is paramount. This includes encrypting data both in transit and at rest, as well as implementing regular security audits and vulnerability assessments.

- Thorough Vendor Due Diligence: Businesses should carefully vet their payment processors and other third-party vendors to ensure they have adequate security measures in place.

- Employee Training: Educating employees about common fraud schemes and best practices for handling sensitive information is crucial. Regular training can significantly reduce the risk of internal fraud.

- Proactive Monitoring and Response: Implementing robust monitoring systems that can detect suspicious activity in real-time and enable quick responses is essential.

The Impact on Businesses and the Future of Payments

The predicted $15 billion in chargeback fraud losses will have significant repercussions across the payments ecosystem. Businesses will need to allocate more resources to fraud prevention, potentially impacting profitability. Consumers may also face increased scrutiny during online transactions, potentially leading to friction in the shopping experience.

The future of payments security hinges on collaborative efforts between businesses, financial institutions, and regulatory bodies. By sharing information, developing industry best practices, and investing in innovative technologies, the industry can work together to mitigate the growing threat of chargeback fraud and protect consumers and businesses alike. Ignoring this challenge will only lead to greater financial losses and damage to consumer trust. The time for proactive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mastercard Forecasts $15 Billion In Chargeback Fraud Losses For 2025: Preparing For The Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

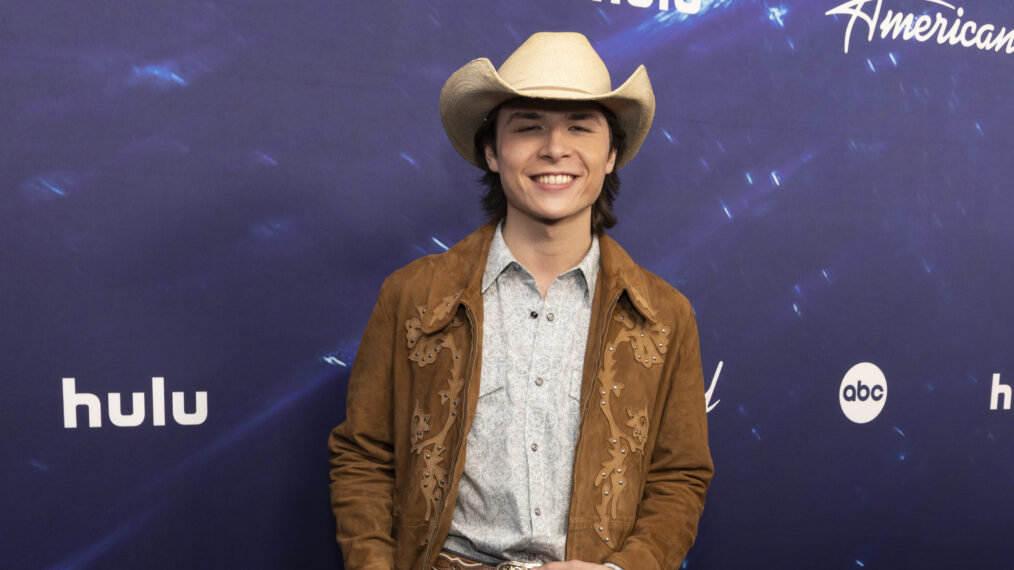

American Idols John Foster Addresses Online Rumors

May 05, 2025

American Idols John Foster Addresses Online Rumors

May 05, 2025 -

Update On Darius Garlands Toe Injury Details And Cavaliers Response

May 05, 2025

Update On Darius Garlands Toe Injury Details And Cavaliers Response

May 05, 2025 -

Labour Day Dining Find Open Restaurants Cafes And Bars

May 05, 2025

Labour Day Dining Find Open Restaurants Cafes And Bars

May 05, 2025 -

Nhl First Round Game 7 Best Prop Bets On Jake Neighbours Vs Winnipeg Jets

May 05, 2025

Nhl First Round Game 7 Best Prop Bets On Jake Neighbours Vs Winnipeg Jets

May 05, 2025 -

Mob Land Seraphinas Antwerp Crisis And The Escalating Home War

May 05, 2025

Mob Land Seraphinas Antwerp Crisis And The Escalating Home War

May 05, 2025