Maximize Your $1,000: Selecting The Right Tech Stocks Now

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Maximize Your $1,000: Selecting the Right Tech Stocks Now

The tech sector is a rollercoaster, offering massive potential returns but also significant risk. With $1,000 to invest, smart stock selection is crucial. This guide helps you navigate the market and choose tech stocks that could maximize your returns in today's dynamic environment.

Understanding the Current Tech Landscape:

The tech market is currently experiencing a period of both consolidation and innovation. While some giants are facing regulatory scrutiny and slowing growth, other smaller, disruptive companies are emerging. This presents both challenges and opportunities for investors. Before diving in, consider these factors:

- Interest Rates: Rising interest rates impact growth stocks more significantly than others. Companies relying on future growth prospects might see their valuations decline in a higher-rate environment.

- Inflation: Inflation erodes purchasing power and can affect consumer spending on tech products, influencing the performance of related companies.

- Geopolitical Factors: Global events can significantly impact the tech sector, influencing supply chains and market sentiment.

Identifying Potential Tech Stock Winners:

Picking winning stocks requires research and a degree of risk tolerance. Here are some areas to focus on:

-

Artificial Intelligence (AI): AI is revolutionizing multiple industries. Investing in companies leading AI development or applying AI to solve real-world problems could yield substantial returns. Look for companies with strong AI patents and a clear path to monetization. Consider established players alongside promising startups.

-

Cloud Computing: The cloud continues to grow exponentially. Companies offering cloud infrastructure, software, and services remain strong contenders. Focus on companies with robust infrastructure, strong customer acquisition, and a diversified customer base.

-

Cybersecurity: With increasing cyber threats, cybersecurity remains a crucial and growing market. Invest in companies offering robust security solutions for individuals and businesses. Look for companies with innovative technology and a strong track record of protecting against emerging threats.

-

Renewable Energy Tech: The shift towards renewable energy is accelerating. Companies developing and deploying solar, wind, and other renewable energy technologies are poised for growth. Consider companies with a proven track record, innovative technology, and strong government support.

Diversification is Key:

Don't put all your eggs in one basket. With $1,000, you can diversify across a few promising tech stocks to mitigate risk. Consider investing in a mix of established players and high-growth startups, balancing risk and potential reward. Research each company thoroughly before making any investment decisions.

Strategies for $1,000 Investment:

- Fractional Shares: Many brokerage platforms allow you to buy fractional shares of high-priced stocks, allowing you to diversify even with a small investment.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly (e.g., $50 per week) to reduce the impact of market volatility. This strategy helps to mitigate the risk of investing a lump sum at a market peak.

- Long-Term Perspective: The tech sector is known for its volatility. Have a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations.

Disclaimer: Investing in the stock market involves inherent risks. The information provided here is for educational purposes only and not financial advice. Always conduct your own thorough research before making any investment decisions and consult with a qualified financial advisor. Past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Maximize Your $1,000: Selecting The Right Tech Stocks Now. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tasmanian Devils Face New Stadium Challenge Mlc Vote Looms

Apr 08, 2025

Tasmanian Devils Face New Stadium Challenge Mlc Vote Looms

Apr 08, 2025 -

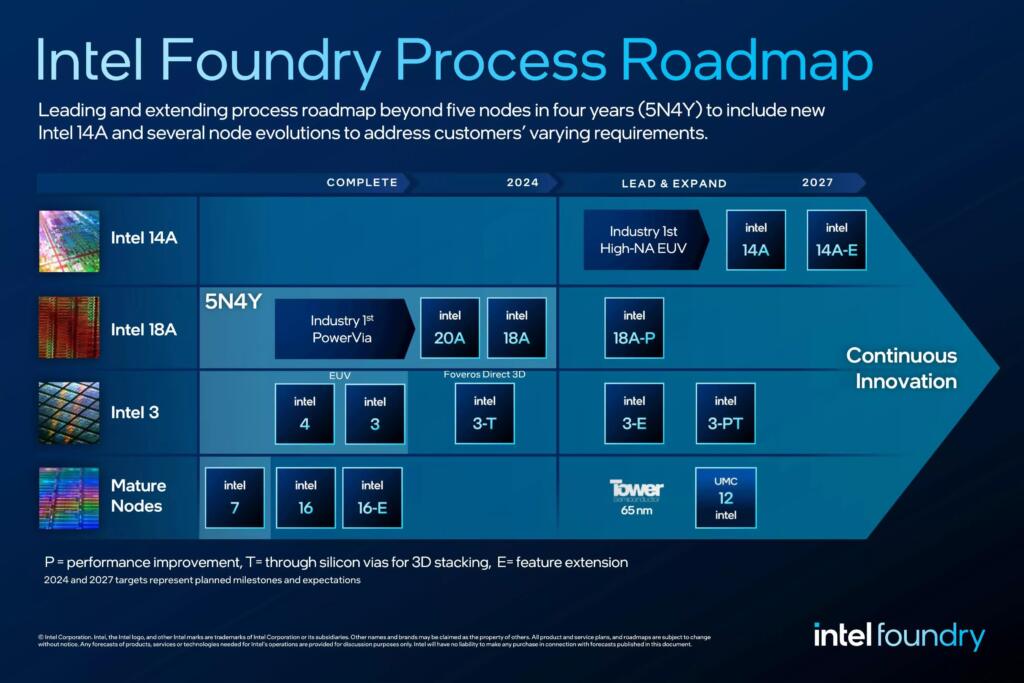

Intels 18 Angstrom Chips Second Half Of 2025 Marks Mass Production Start

Apr 08, 2025

Intels 18 Angstrom Chips Second Half Of 2025 Marks Mass Production Start

Apr 08, 2025 -

Us Stocks Plummet Total Market Index Suffers Significant Losses

Apr 08, 2025

Us Stocks Plummet Total Market Index Suffers Significant Losses

Apr 08, 2025 -

Wales And Lions Star Dan Biggar Hangs Up Boots After 18 Seasons

Apr 08, 2025

Wales And Lions Star Dan Biggar Hangs Up Boots After 18 Seasons

Apr 08, 2025 -

Qodrat 2 Dan Jumbo Pertempuran Sengit Di Bioskop Usai Raih 1 Juta Penonton

Apr 08, 2025

Qodrat 2 Dan Jumbo Pertempuran Sengit Di Bioskop Usai Raih 1 Juta Penonton

Apr 08, 2025