May Consumer Sentiment Index Shows Decline; Inflation Expectations Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

May Consumer Sentiment Index Plunges as Inflation Fears Soar

Consumer confidence took a significant dive in May, according to the latest data released today, fueling concerns about the ongoing impact of inflation on the US economy. The University of Michigan's Consumer Sentiment Index plummeted to its lowest level in 11 months, signaling a growing pessimism among American consumers regarding the current economic climate. This sharp decline underscores the increasing pressure inflation is placing on household budgets and future spending plans.

Inflationary Pressures Squeeze Consumer Spending

The May Consumer Sentiment Index reading of 57.7 represents a substantial drop from April's 63.9 and marks a significant downturn from the 71.0 recorded just a year ago. This dramatic fall is primarily attributed to the persistent rise in inflation, which continues to erode purchasing power and significantly impact consumer spending habits. The survey revealed that consumers are increasingly worried about rising prices for essential goods and services, leading to a decrease in overall spending and a growing sense of economic uncertainty.

Soaring Inflation Expectations Cast a Long Shadow

Perhaps even more alarming than the decline in overall sentiment is the surge in inflation expectations. Consumers now anticipate inflation to remain stubbornly high over the next year and even further into the future. This reflects a growing lack of faith in the Federal Reserve's ability to effectively curb inflation without triggering a recession. The one-year inflation expectation jumped to 4.6%, the highest level since last fall, while the five-year inflation expectation climbed to 3.1%. These elevated expectations suggest that consumers are bracing for a prolonged period of high prices, further dampening their spending intentions.

What this Means for the Economy

This significant drop in consumer sentiment carries potentially serious implications for the US economy. Consumer spending accounts for a significant portion of GDP, and a decline in confidence often translates to reduced spending, impacting economic growth. Businesses may respond to weakened demand by slowing investment and hiring, potentially contributing to a broader economic slowdown. The Federal Reserve will undoubtedly be closely monitoring this data as it weighs its future monetary policy decisions. The central bank faces a difficult challenge: combating inflation without triggering a sharp economic downturn.

Key Factors Contributing to the Decline:

- High Inflation: Persistently high inflation erodes purchasing power, forcing consumers to cut back on spending.

- Rising Interest Rates: Increased interest rates aimed at curbing inflation can increase borrowing costs, further impacting consumer spending.

- Geopolitical Uncertainty: Ongoing global events, such as the war in Ukraine, contribute to economic uncertainty and consumer anxiety.

- Supply Chain Disruptions: While easing, lingering supply chain issues continue to fuel price increases.

Looking Ahead:

The decline in the May Consumer Sentiment Index serves as a stark reminder of the challenges facing the US economy. The ongoing battle against inflation and its impact on consumer confidence will be a key factor shaping economic prospects in the coming months. Economists will be closely watching future data releases for signs of either a sustained decline or a potential rebound in consumer sentiment. The coming months will be crucial in determining the trajectory of the US economy. Stay tuned for further updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on May Consumer Sentiment Index Shows Decline; Inflation Expectations Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Recall 16 000 Gallons Of Ice Cream And Frozen Yogurt Recalled

May 17, 2025

Urgent Recall 16 000 Gallons Of Ice Cream And Frozen Yogurt Recalled

May 17, 2025 -

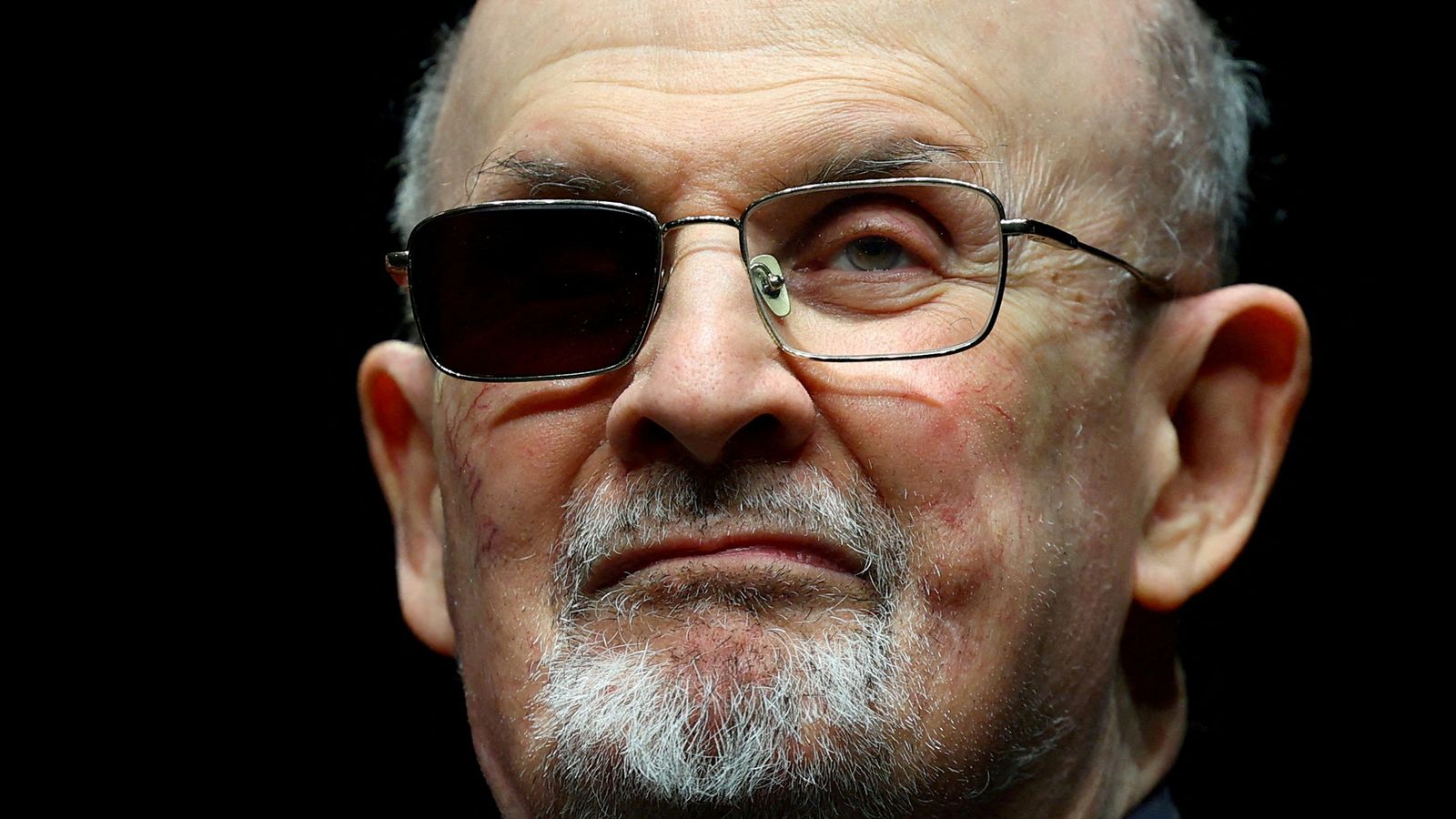

Rushdie Stabbing Hadi Matar Receives Prison Sentence Authors Vision Impaired

May 17, 2025

Rushdie Stabbing Hadi Matar Receives Prison Sentence Authors Vision Impaired

May 17, 2025 -

Large Fire Engulfs Nottoway Plantation Officials Respond

May 17, 2025

Large Fire Engulfs Nottoway Plantation Officials Respond

May 17, 2025 -

Alcaraz Defeats Draper Advances To Italian Open Semifinals

May 17, 2025

Alcaraz Defeats Draper Advances To Italian Open Semifinals

May 17, 2025 -

Andor Family Connections The Kleya Cassian Relationship Debunked

May 17, 2025

Andor Family Connections The Kleya Cassian Relationship Debunked

May 17, 2025