May Consumer Sentiment Report: Inflation Concerns Surge After New Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

May Consumer Sentiment Report: Inflation Concerns Surge After New Tariffs

Inflation anxieties are skyrocketing, according to the latest May Consumer Sentiment Report, fueled by recently implemented tariffs and persistent price increases. The report paints a concerning picture for the US economy, revealing a significant downturn in consumer confidence as households grapple with the rising cost of living. This follows a steady climb in inflation throughout the first few months of the year, leaving many Americans feeling the pinch.

The University of Michigan's preliminary May Consumer Sentiment Index plummeted to its lowest level in a year, highlighting the growing unease among consumers. This dramatic drop is primarily attributed to two key factors: the impact of newly implemented tariffs and persistent inflationary pressures across various sectors.

Tariffs Exacerbate Inflationary Pressures

The recent wave of tariffs, designed to protect domestic industries, has instead inadvertently fueled inflation. These tariffs increase the cost of imported goods, leading to higher prices for consumers and businesses alike. This effect is particularly pronounced in sectors heavily reliant on imported materials, such as manufacturing and retail. The report specifically cites increased prices for household goods, automobiles, and energy as key contributors to the decline in consumer sentiment.

- Increased Costs of Goods: Tariffs on imported goods directly translate to higher prices on shelves, impacting household budgets significantly.

- Supply Chain Disruptions: The tariffs also contribute to supply chain disruptions, further limiting availability and driving up prices.

- Impact on Businesses: Businesses face increased input costs, potentially leading to job losses and reduced economic activity.

Persistent Inflation Erodes Purchasing Power

Beyond the impact of tariffs, the ongoing inflation continues to erode consumer purchasing power. While wages have seen some increases, they haven't kept pace with the rapid rise in prices for essential goods and services. This wage-inflation gap is a significant concern, as it limits consumer spending and overall economic growth.

- Wage Stagnation: Wage growth has not kept pace with inflation, squeezing household budgets.

- Reduced Consumer Spending: With less disposable income, consumers are cutting back on discretionary spending, impacting businesses.

- Uncertainty about the Future: The persistent inflation creates uncertainty about the future, leading to reduced consumer confidence.

What Does This Mean for the Economy?

The gloomy May Consumer Sentiment Report suggests a potential slowdown in economic growth. Decreased consumer confidence translates to reduced spending, potentially impacting business investment and employment. The Federal Reserve may need to reconsider its monetary policy in light of these findings, potentially adjusting interest rates to manage inflation and bolster consumer confidence.

The coming months will be crucial in determining the long-term economic implications of this decline in consumer sentiment. Close monitoring of inflation rates, consumer spending patterns, and government policy responses will be vital in understanding the trajectory of the US economy. Experts are closely watching for any signs of a recession, as the combination of high inflation and low consumer confidence creates a risky economic environment. Further analysis of the report and upcoming economic indicators will provide a clearer picture of the situation in the weeks and months ahead. The impact of these new tariffs and sustained inflation will undeniably shape the economic landscape for the foreseeable future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on May Consumer Sentiment Report: Inflation Concerns Surge After New Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Upset In Rome Errani And Paolini Defeat Andreeva And Shnaider To Reach Final

May 17, 2025

Upset In Rome Errani And Paolini Defeat Andreeva And Shnaider To Reach Final

May 17, 2025 -

Crystal Palaces Fa Cup Quest Can They Win Their First Ever Trophy

May 17, 2025

Crystal Palaces Fa Cup Quest Can They Win Their First Ever Trophy

May 17, 2025 -

Thunder Bay Council Debates Free Parking Proposal In October

May 17, 2025

Thunder Bay Council Debates Free Parking Proposal In October

May 17, 2025 -

Inside The Ropes Max Homas Exclusive Interview On Champ Connections

May 17, 2025

Inside The Ropes Max Homas Exclusive Interview On Champ Connections

May 17, 2025 -

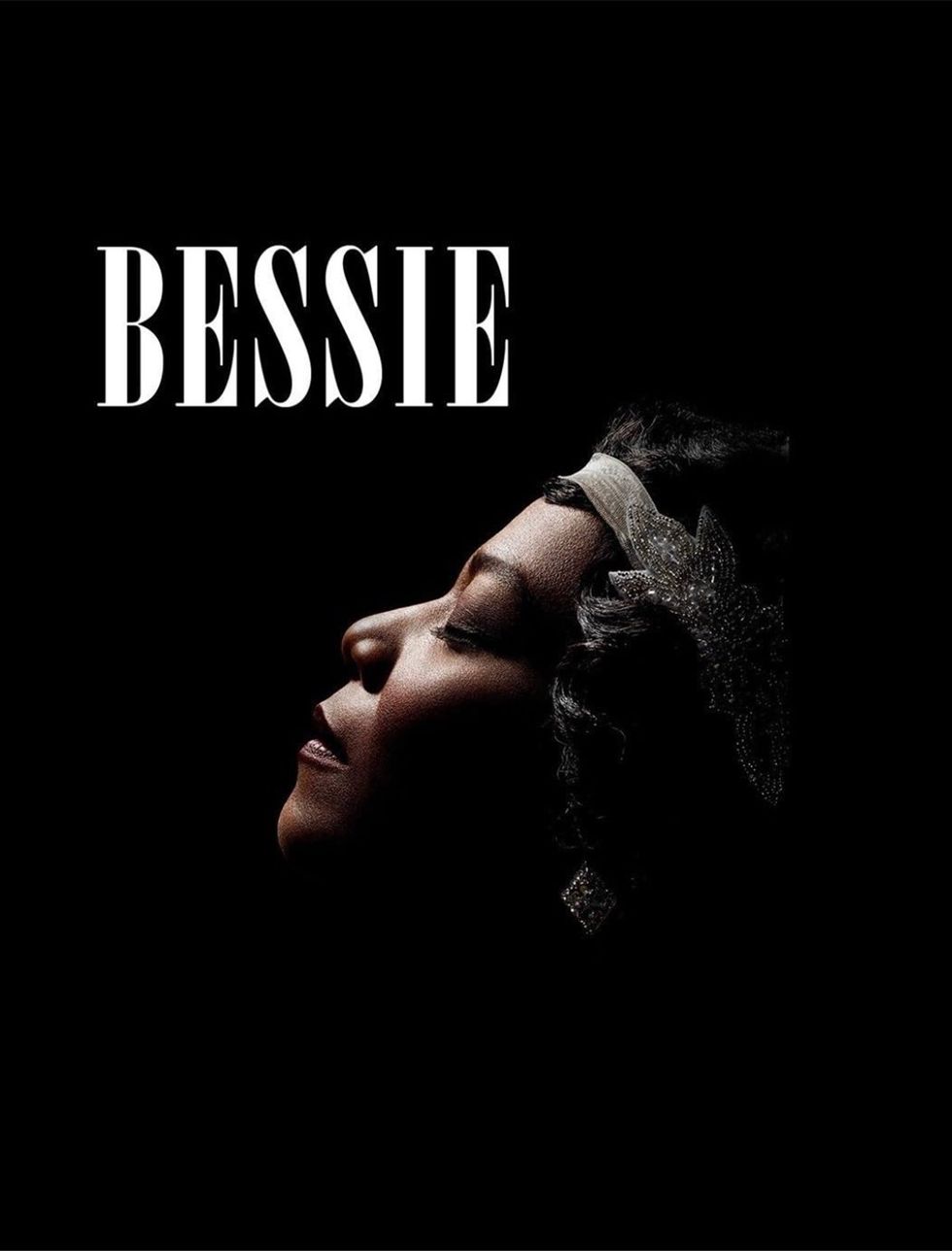

Five Ways Hbos Bessie Redefines Queer Cinema

May 17, 2025

Five Ways Hbos Bessie Redefines Queer Cinema

May 17, 2025