Mega-Unlocks: Which Asset Class Will Deliver The Biggest Returns?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mega-Unlocks: Which Asset Class Will Deliver the Biggest Returns?

The global economy is poised for a period of significant change, presenting investors with a unique opportunity – and a daunting challenge. Massive shifts in technology, demographics, and geopolitics are creating what some are calling "mega-unlocks," potential for explosive growth across various asset classes. But the question on every investor's mind is: where will the biggest returns be found? Navigating this complex landscape requires careful analysis and a clear understanding of the potential and risks involved.

The Contenders: A Look at Leading Asset Classes

Several asset classes are primed for significant growth, each presenting unique opportunities and challenges:

1. Technology Stocks: The tech sector remains a dominant force, driven by ongoing innovation in artificial intelligence (AI), cloud computing, and cybersecurity. While valuations have fluctuated, the long-term growth potential remains substantial. However, increased regulatory scrutiny and potential economic slowdowns pose significant risks. Investing in this sector requires a keen eye for identifying companies with strong fundamentals and a sustainable competitive advantage. Key terms: AI stocks, cloud computing stocks, cybersecurity stocks, tech valuations.

2. Renewable Energy: The global push towards decarbonization is fueling massive investment in renewable energy sources like solar, wind, and geothermal. Government policies supporting the transition to green energy further bolster this sector's growth prospects. However, the intermittent nature of some renewable energy sources and the need for significant infrastructure investment represent challenges. Key terms: renewable energy stocks, solar energy investments, wind energy investment, green energy transition.

3. Emerging Market Equities: Developing economies, particularly in Asia and Africa, offer compelling growth opportunities driven by rising populations, increasing urbanization, and expanding middle classes. These markets present higher risk-reward profiles compared to developed markets, but the potential for significant returns is substantial. However, geopolitical instability and economic volatility pose significant challenges. Key terms: emerging markets investment, Asian equities, African equities, developing market risk.

4. Real Estate: While interest rate hikes have impacted the real estate market in some regions, long-term demand for housing and commercial properties remains robust, particularly in areas experiencing population growth. However, inflation and potential economic slowdowns represent significant headwinds. Diversification within the real estate sector – considering both residential and commercial properties – is crucial for mitigating risk. Key terms: real estate investment, commercial real estate, residential real estate, inflation impact on real estate.

5. Infrastructure: The global need for modernizing infrastructure – from transportation networks to energy grids – presents significant investment opportunities. Government spending on infrastructure projects, coupled with the growing adoption of sustainable infrastructure solutions, makes this sector particularly attractive. However, long-term project timelines and regulatory complexities need careful consideration. Key terms: infrastructure investment, sustainable infrastructure, transportation infrastructure, energy grid modernization.

Assessing the Risks and Rewards

While the potential for substantial returns exists across these asset classes, investors must carefully assess the inherent risks. Diversification remains a critical strategy for mitigating risk and maximizing returns. A well-diversified portfolio that balances growth potential with risk tolerance is key to navigating the complexities of the current market environment.

Conclusion: No Easy Answers, but Strategic Opportunities Abound

Predicting the "biggest" winner is inherently challenging. The optimal asset allocation strategy will depend on individual risk tolerance, investment horizon, and market outlook. However, the mega-unlocks currently unfolding present compelling opportunities for savvy investors willing to conduct thorough research and adapt to changing market conditions. Thorough due diligence and expert advice are essential to capitalizing on this period of significant market transformation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mega-Unlocks: Which Asset Class Will Deliver The Biggest Returns?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Donna Vekic Vs Madison Keys Analyzing The Indian Wells 2025 Clash

Mar 13, 2025

Donna Vekic Vs Madison Keys Analyzing The Indian Wells 2025 Clash

Mar 13, 2025 -

From Celtic Obscurity To Champions League Contention Gustaf Lagerbielkes Transfer Saga

Mar 13, 2025

From Celtic Obscurity To Champions League Contention Gustaf Lagerbielkes Transfer Saga

Mar 13, 2025 -

Lebih Dari Tampan Daya Tarik Seo Kang Joon Yang Membuat Wanita Klepek Klepek

Mar 13, 2025

Lebih Dari Tampan Daya Tarik Seo Kang Joon Yang Membuat Wanita Klepek Klepek

Mar 13, 2025 -

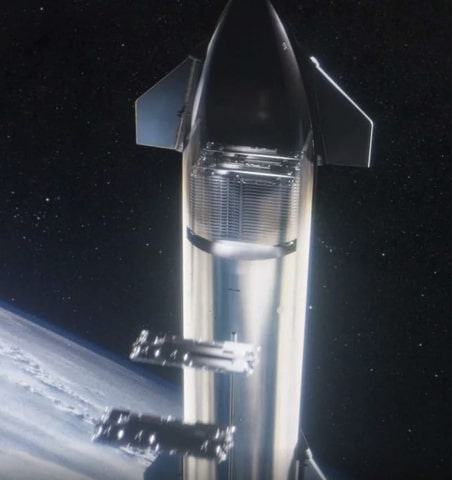

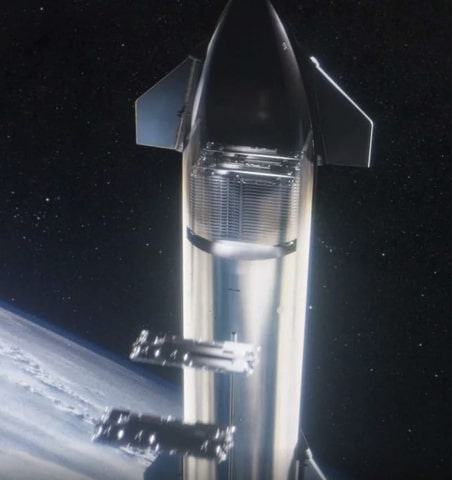

Eric Schmidt Leads Relativity Space Revolutionizing Space Travel

Mar 13, 2025

Eric Schmidt Leads Relativity Space Revolutionizing Space Travel

Mar 13, 2025 -

The Great Tech Talent Paradox Layoffs Soar Qualified Workers Remain Scarce

Mar 13, 2025

The Great Tech Talent Paradox Layoffs Soar Qualified Workers Remain Scarce

Mar 13, 2025