Meta (META) Stock Surge: Reasons Behind The Price Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Meta (META) Stock Surge: Reasons Behind the Price Increase

Meta Platforms (META), formerly known as Facebook, has seen a significant surge in its stock price recently, leaving investors and analysts scrambling to understand the driving forces behind this unexpected rally. After a period of considerable downturn, what's fueling this renewed confidence in the social media giant? Let's delve into the key factors contributing to the META stock price increase.

The Resurgence of the Metaverse and AI Integration:

One of the most significant catalysts for the recent surge is Meta's renewed focus and impressive advancements in the metaverse and artificial intelligence (AI). While the initial metaverse investments faced skepticism, recent developments showcase tangible progress. Meta's increased emphasis on AI integration across its platforms, particularly in advertising and content creation tools, has also resonated positively with investors. This is a crucial aspect, as AI-powered tools are expected to boost efficiency and monetization strategies. The company's ongoing investment in developing cutting-edge AI technologies positions them strategically for future growth in this rapidly evolving sector.

Improved Financial Performance and Cost-Cutting Measures:

Meta's recent financial reports have shown signs of stabilization and even improvement. The company has implemented aggressive cost-cutting measures, streamlining operations and improving efficiency. This focus on profitability, coupled with a more disciplined approach to spending, has reassured investors concerned about previous financial performance. The reduction in operating expenses, while impacting certain aspects of the business, has ultimately bolstered Meta's bottom line and presented a more positive financial outlook.

Increased Advertising Revenue and User Engagement:

Despite concerns about competition and shifting user habits, Meta continues to generate substantial advertising revenue. Recent data indicates a stabilization and even a slight increase in user engagement across its platforms, including Facebook, Instagram, and WhatsApp. This positive trend in user engagement translates directly into increased advertising opportunities and higher revenue streams, which is a key factor driving investor confidence. The company's effective strategies to retain users and engage new audiences are contributing significantly to this positive performance.

Stronger-than-Expected Q2 Earnings and Future Outlook:

Meta's Q2 2024 earnings surpassed analyst expectations, exceeding predictions for revenue and earnings per share (EPS). This positive surprise significantly boosted investor sentiment. The company's positive outlook for the remainder of the year, based on projections of continued growth in advertising revenue and user engagement, further solidified the market’s belief in Meta's potential for long-term growth. This strong performance has signaled a potential turning point for the company, re-establishing confidence in its future trajectory.

Market Sentiment and Investor Confidence:

Beyond specific financial factors, the overall market sentiment has also played a role. A broader market upswing, coupled with growing optimism about the technology sector, has contributed to the positive performance of META stock. Investor confidence has been restored due to the combination of positive financial results, strategic advancements in AI and the metaverse, and a more efficient operational structure. This renewed confidence is a significant driver of the recent surge.

Conclusion:

The recent surge in Meta (META) stock price is a complex phenomenon driven by a confluence of factors. Improved financial performance, strategic advancements in AI and the metaverse, increased advertising revenue, and a positive market sentiment have all played crucial roles. While challenges remain, the recent developments paint a more optimistic picture for Meta's future, potentially signaling a significant turnaround for the tech giant. However, investors should always conduct thorough research and consider their risk tolerance before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Meta (META) Stock Surge: Reasons Behind The Price Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Edwards Late Surge Propels Timberwolves To Dominant Game 4 Win Over Warriors

May 14, 2025

Edwards Late Surge Propels Timberwolves To Dominant Game 4 Win Over Warriors

May 14, 2025 -

Upcoming I Os 18 5 Release Previewing I Os 19s Wi Fi Improvements

May 14, 2025

Upcoming I Os 18 5 Release Previewing I Os 19s Wi Fi Improvements

May 14, 2025 -

Hollywood Icons Fall Guilty Verdict In On Set Sexual Assault Trial

May 14, 2025

Hollywood Icons Fall Guilty Verdict In On Set Sexual Assault Trial

May 14, 2025 -

Match Lnh Caroline Inflige Une Claque 5 2 Aux Capitals De Washington

May 14, 2025

Match Lnh Caroline Inflige Une Claque 5 2 Aux Capitals De Washington

May 14, 2025 -

Game 4 Recap Knicks Victory Over Celtics Marked By Tatum Injury

May 14, 2025

Game 4 Recap Knicks Victory Over Celtics Marked By Tatum Injury

May 14, 2025

Latest Posts

-

Global Health Crisis The Return Of Highly Contagious Measles

May 14, 2025

Global Health Crisis The Return Of Highly Contagious Measles

May 14, 2025 -

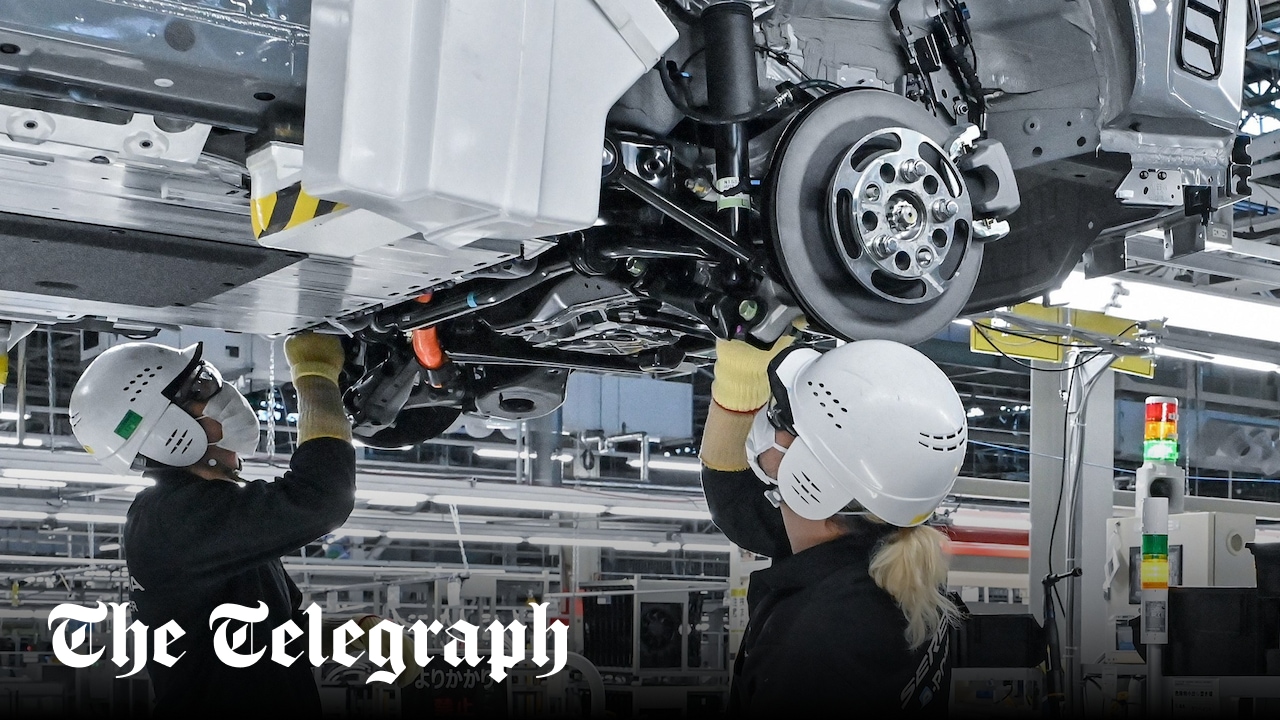

Major Job Cuts At Nissan 20 000 Positions Eliminated

May 14, 2025

Major Job Cuts At Nissan 20 000 Positions Eliminated

May 14, 2025 -

New Asus Desktop Pc Features Nvidias Fastest Superchip Dvd Drive And Unexplained Slot

May 14, 2025

New Asus Desktop Pc Features Nvidias Fastest Superchip Dvd Drive And Unexplained Slot

May 14, 2025 -

Fwaws Farmer Thomas A Difficult Decision Following Clarettes Ultimatum

May 14, 2025

Fwaws Farmer Thomas A Difficult Decision Following Clarettes Ultimatum

May 14, 2025 -

Positieve Reactie Werkgroep Waarheidsvinding Op Icaos Mh 17 Conclusie

May 14, 2025

Positieve Reactie Werkgroep Waarheidsvinding Op Icaos Mh 17 Conclusie

May 14, 2025