META Stock Price Prediction: Opportunities After The US-China Trade Deal Conclusion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

META Stock Price Prediction: Opportunities After the US-China Trade Deal Conclusion

The recent tentative easing of US-China trade tensions has sent ripples through global markets, and tech giants like Meta (formerly Facebook) are poised to benefit. While a comprehensive trade deal remains elusive, the thawing relationship presents significant opportunities for META, potentially impacting its stock price in the coming months. This article explores potential scenarios and offers a considered prediction for META's stock price performance, focusing on the factors influencing its trajectory.

The Impact of Reduced Trade Friction on META

For years, escalating trade wars cast a long shadow over tech companies. Uncertainty surrounding tariffs, export restrictions, and supply chain disruptions hampered growth and investment. META, with its significant global operations and reliance on complex supply chains, was particularly vulnerable. A reduction in trade friction, however, could unlock several key benefits:

- Reduced Costs: Lower tariffs on components and reduced logistical complexities translate to lower production costs for META's hardware initiatives, including its Oculus VR headsets and future AR/VR projects. This boosts profitability and potentially attracts increased investment.

- Expanded Market Access: Easing trade tensions opens doors to a larger Chinese market, a crucial demographic for META's advertising and app revenue streams. Improved access could lead to substantial revenue growth.

- Increased Investor Confidence: A more stable geopolitical landscape reassures investors, leading to potentially higher stock valuations for tech companies like META. Reduced uncertainty makes META a more attractive investment proposition.

- Enhanced Supply Chain Resilience: A less volatile trade environment allows META to diversify its supply chains more effectively, mitigating risks associated with geopolitical instability. This long-term stability increases overall business resilience.

Factors Affecting META Stock Price Beyond the Trade Deal

While the US-China trade situation plays a significant role, other factors will also influence META's stock price:

- Competition: Intense rivalry with other tech giants, particularly in areas like the metaverse and advertising, remains a key challenge. META's ability to innovate and maintain market share will be crucial.

- Regulatory Scrutiny: Ongoing regulatory investigations and antitrust concerns in various jurisdictions continue to pose risks to META's growth and profitability. Navigating these regulatory hurdles effectively is essential.

- Advertising Revenue: The performance of META's advertising business, its primary revenue driver, will remain a crucial indicator of its financial health and stock price. Changes in advertising spending patterns can significantly impact its valuation.

- Metaverse Development: META's significant investments in the metaverse are high-risk, high-reward. Success in this space could propel significant stock price growth, while failure could have negative consequences.

META Stock Price Prediction: A Cautiously Optimistic Outlook

Considering the potential benefits from improved US-China relations alongside the existing challenges, we offer a cautiously optimistic prediction. While a dramatic surge is unlikely in the short term, a gradual upward trend in META's stock price is plausible in the next 12-18 months. Factors like successful navigation of regulatory hurdles and sustained growth in advertising revenue will be key drivers of this predicted growth. We anticipate a potential price range of $300-$350 per share within the next year, contingent upon these positive developments. However, this is a prediction, and inherent market volatility means that significant deviations are possible.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and it's crucial to conduct your own thorough research before making any investment decisions. Consult with a qualified financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on META Stock Price Prediction: Opportunities After The US-China Trade Deal Conclusion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Figmas Ceo Reveals His Approach To Integrating Artificial Intelligence

May 13, 2025

Figmas Ceo Reveals His Approach To Integrating Artificial Intelligence

May 13, 2025 -

Trump Greets Mbs Handshake Signals Start Of Middle East Trip

May 13, 2025

Trump Greets Mbs Handshake Signals Start Of Middle East Trip

May 13, 2025 -

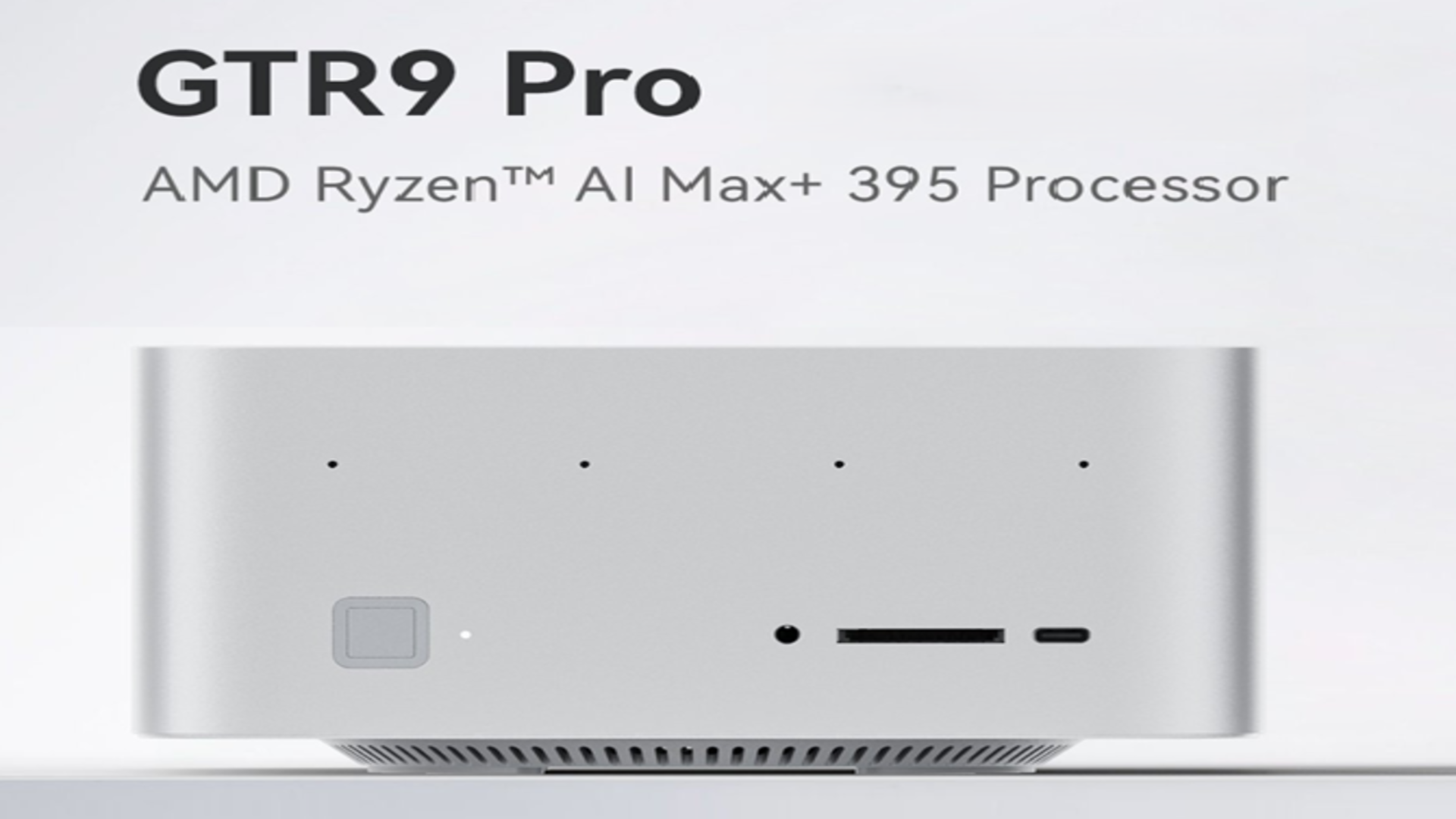

Amd Based Ai Workstation From Obscure Chinese Firm Rivals Nvidias Dgx Spark

May 13, 2025

Amd Based Ai Workstation From Obscure Chinese Firm Rivals Nvidias Dgx Spark

May 13, 2025 -

Xrp Explodes 27 Gain On News Of Potential Ripple Sec Settlement

May 13, 2025

Xrp Explodes 27 Gain On News Of Potential Ripple Sec Settlement

May 13, 2025 -

Public Outpouring Of Grief After Elephant Calf Dies On Malaysian Road

May 13, 2025

Public Outpouring Of Grief After Elephant Calf Dies On Malaysian Road

May 13, 2025

Latest Posts

-

September Premiere Confirmed Peacock Unveils The Paper New Office Spin Off

May 14, 2025

September Premiere Confirmed Peacock Unveils The Paper New Office Spin Off

May 14, 2025 -

One Controller To Rule Your Gaming Consoles Almost

May 14, 2025

One Controller To Rule Your Gaming Consoles Almost

May 14, 2025 -

Receba Dividendos As Principais Empresas Pagando Esta Semana

May 14, 2025

Receba Dividendos As Principais Empresas Pagando Esta Semana

May 14, 2025 -

Helldivers 2 Ceos Inappropriate Joke Sparks Backlash We Better Deliver On Updates

May 14, 2025

Helldivers 2 Ceos Inappropriate Joke Sparks Backlash We Better Deliver On Updates

May 14, 2025 -

Helldivers 2 Super Earth Threat Prepare For The Illuminates Assault

May 14, 2025

Helldivers 2 Super Earth Threat Prepare For The Illuminates Assault

May 14, 2025