Metaplanet's Bitcoin Stash Grows: $127 Million Investment Exceeds El Salvador's

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Metaplanet's Bitcoin Stash Grows: $127 Million Investment Dwarfs El Salvador's Holdings

Metaplanet, a lesser-known player in the cryptocurrency space, has made headlines with a staggering Bitcoin investment, surpassing even El Salvador's much-publicized national holdings. The company recently revealed a $127 million investment in Bitcoin, a move that significantly shifts the landscape of corporate Bitcoin adoption and sparks debate about the future of institutional cryptocurrency investment. This bold strategy positions Metaplanet as a major force to be reckoned with in the evolving crypto market.

A Giant Leap for Corporate Bitcoin Adoption

El Salvador's pioneering adoption of Bitcoin as legal tender garnered significant global attention. However, Metaplanet's recent investment eclipses El Salvador's holdings, showcasing a growing trend of large-scale Bitcoin adoption by corporations. This move signals a significant shift in how institutional investors are viewing Bitcoin, moving beyond the speculative realm and into a strategic asset allocation strategy.

This isn't just about holding Bitcoin; it's about recognizing its potential as a long-term store of value and a hedge against inflation. Many analysts believe that this strategy, while risky, could ultimately pay off handsomely for Metaplanet in the long run. The move highlights a growing confidence in Bitcoin's future, despite its inherent volatility.

Metaplanet's Strategic Move: More Than Just Speculation

Unlike some speculative investments, Metaplanet's decision appears to be part of a broader, long-term strategy. While the company hasn't explicitly revealed its full plan, industry experts speculate that this massive Bitcoin purchase could be linked to:

- Diversification of Assets: Protecting against potential market downturns in traditional financial markets.

- Long-Term Growth Potential: Capitalizing on Bitcoin's potential for significant appreciation over time.

- Hedging Against Inflation: Preserving the value of assets in an environment of rising inflation.

- Technological Innovation: Exploring opportunities within the Bitcoin ecosystem, such as Lightning Network integration.

The Implications for the Crypto Market

Metaplanet's substantial investment has significant implications for the wider cryptocurrency market:

- Increased Institutional Adoption: It encourages other corporations to consider similar large-scale Bitcoin investments.

- Price Volatility: While potentially impacting short-term price fluctuations, such large-scale purchases generally signal a positive outlook for Bitcoin's long-term growth.

- Regulatory Scrutiny: It may lead to increased regulatory scrutiny of large corporate Bitcoin holdings.

Beyond the Headlines: Understanding Metaplanet

While Metaplanet's Bitcoin investment dominates the headlines, understanding the company itself is crucial. Further investigation into Metaplanet's business model and future plans will provide a clearer picture of the rationale behind their bold move. The company's strategy warrants further analysis to understand the full impact of their significant Bitcoin holdings.

The Future of Bitcoin in Corporate Portfolios

Metaplanet's decision serves as a compelling case study for other businesses considering Bitcoin as a strategic asset. The significant investment showcases the growing confidence in Bitcoin's future value and its potential to become a cornerstone of diversified corporate portfolios. As more companies follow suit, the cryptocurrency market will undoubtedly undergo further transformation. The impact of Metaplanet’s $127 million investment will continue to unfold in the coming months and years, shaping the future landscape of Bitcoin adoption and corporate finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Metaplanet's Bitcoin Stash Grows: $127 Million Investment Exceeds El Salvador's. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

David Beckham Under Fire Can Mascherano Survive After Messis Historic Loss

May 13, 2025

David Beckham Under Fire Can Mascherano Survive After Messis Historic Loss

May 13, 2025 -

Solve Nyt Wordle May 12 Game 1423 Clues And Answer

May 13, 2025

Solve Nyt Wordle May 12 Game 1423 Clues And Answer

May 13, 2025 -

Hang Seng Weekly Recap Stimulus Hopes And Trade Winds Boost Hong Kong Stocks

May 13, 2025

Hang Seng Weekly Recap Stimulus Hopes And Trade Winds Boost Hong Kong Stocks

May 13, 2025 -

Diddy And Cassie Accused Exotic Dancers Shocking Claims Of Sexual Assault

May 13, 2025

Diddy And Cassie Accused Exotic Dancers Shocking Claims Of Sexual Assault

May 13, 2025 -

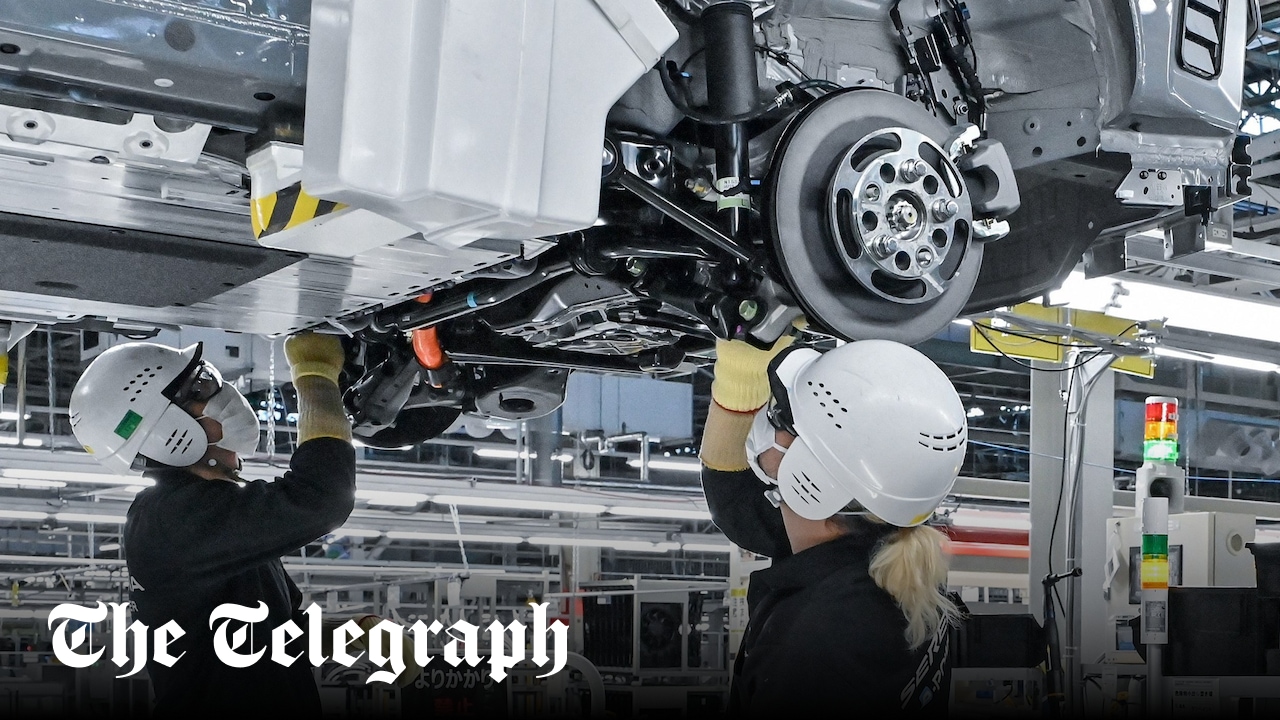

Nissan Announces 20 000 Job Cuts Globally Restructuring Impacts Worldwide Operations

May 13, 2025

Nissan Announces 20 000 Job Cuts Globally Restructuring Impacts Worldwide Operations

May 13, 2025

Latest Posts

-

The Rise Of Decentralized Cloud A New Era For Eu Data Storage

May 14, 2025

The Rise Of Decentralized Cloud A New Era For Eu Data Storage

May 14, 2025 -

Can Skinner Step Up Analyzing The Post Pickard Era

May 14, 2025

Can Skinner Step Up Analyzing The Post Pickard Era

May 14, 2025 -

Evergreens Triumphs And Tragedies Finding Strength In Adversity

May 14, 2025

Evergreens Triumphs And Tragedies Finding Strength In Adversity

May 14, 2025 -

Mardi 13 Mai 2025 Votre Horoscope Avec Bruno Sur Fun Radio

May 14, 2025

Mardi 13 Mai 2025 Votre Horoscope Avec Bruno Sur Fun Radio

May 14, 2025 -

Nfl Free Agency Raiders Add Experienced Linebacker Smith

May 14, 2025

Nfl Free Agency Raiders Add Experienced Linebacker Smith

May 14, 2025