MicroStrategy (MSTR) Investment: Is It Better Than Holding Bitcoin (BTC)? (February 2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy (MSTR) Investment: Is it Better Than Holding Bitcoin (BTC)? (February 2025)

MicroStrategy's bold Bitcoin bet has made headlines for years. But with the cryptocurrency market's volatility, is investing in MSTR a smarter move than simply holding Bitcoin (BTC)? This February 2025 analysis dives deep into the complexities of this investment dilemma.

The business intelligence company MicroStrategy, led by its CEO Michael Saylor, has become synonymous with Bitcoin. Their massive Bitcoin holdings have made them a key player in the crypto space, influencing market sentiment and attracting both fervent supporters and skeptical critics. But for potential investors in 2025, the question remains: is buying MicroStrategy stock a superior strategy to directly owning Bitcoin?

Understanding the MicroStrategy (MSTR) Investment

MicroStrategy's stock price is intrinsically linked to the performance of Bitcoin. As the company's Bitcoin holdings appreciate, so too does its stock price (generally). However, this correlation isn't perfect. Several factors beyond Bitcoin's price influence MSTR's valuation:

- Company Performance: MicroStrategy's core business operations contribute to its overall financial health and stock price. Strong earnings reports and successful product launches can boost the stock even if Bitcoin's price stagnates.

- Debt Levels: MicroStrategy has taken on significant debt to fund its Bitcoin acquisitions. High debt levels can increase risk and negatively impact the stock price, regardless of Bitcoin's performance.

- Market Sentiment: Investor confidence in both MicroStrategy and Bitcoin influences the stock price. Negative news or regulatory uncertainty can lead to significant price drops.

Comparing MSTR to Direct Bitcoin (BTC) Ownership

Directly holding Bitcoin offers certain advantages and disadvantages compared to investing in MSTR:

Advantages of Holding BTC:

- Direct Exposure: You directly benefit from Bitcoin's price appreciation without the intermediary of MSTR's stock price fluctuations.

- Lower Fees: Buying and holding BTC generally involves lower fees than trading MSTR stock repeatedly.

- Greater Liquidity: Bitcoin is generally more liquid than MSTR stock, making it easier to buy and sell.

Disadvantages of Holding BTC:

- Higher Volatility: Bitcoin's price is notoriously volatile, leading to potentially significant losses.

- Security Risks: Securing your Bitcoin requires careful attention to security best practices to prevent theft or loss.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving and presents inherent risks.

Advantages of Investing in MSTR:

- Diversification (to a degree): While heavily correlated, MSTR's stock offers some diversification from pure Bitcoin exposure due to its operational business.

- Easier Access for Some Investors: Some investors may find it easier to buy MSTR stock through traditional brokerage accounts than to navigate cryptocurrency exchanges.

- Potential for Dividend Payments (future possibility): Although unlikely in the near term, future changes in MicroStrategy's strategy might include dividend payments.

Disadvantages of Investing in MSTR:

- Indirect Exposure: Your returns are filtered through MSTR's performance, potentially dampening gains or exacerbating losses compared to direct BTC ownership.

- Higher Management Fees: Investing in MSTR stock typically incurs brokerage fees and other associated costs.

- Dependence on Saylor's Strategy: MSTR's success is heavily reliant on the continued success of CEO Michael Saylor's Bitcoin strategy.

February 2025 Conclusion: Which is Better?

The "better" investment – MSTR or BTC – depends entirely on individual risk tolerance, investment goals, and market outlook.

- High-Risk, High-Reward: Direct Bitcoin ownership offers higher potential returns but significantly greater volatility.

- Lower-Risk, Lower-Reward: Investing in MSTR provides a less volatile but potentially less rewarding investment, offering a degree of diversification.

This analysis is for informational purposes only and not financial advice. Before making any investment decisions, conduct thorough research and consider consulting with a qualified financial advisor. The cryptocurrency market remains highly speculative, and past performance is not indicative of future results. Always prioritize risk management and only invest what you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy (MSTR) Investment: Is It Better Than Holding Bitcoin (BTC)? (February 2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roma Vs Milan Live Score 19 May 2025 Match Updates And Highlights

May 19, 2025

Roma Vs Milan Live Score 19 May 2025 Match Updates And Highlights

May 19, 2025 -

1 5 Mile Autonomous Drive Tesla Model Y Successfully Tests In Texas

May 19, 2025

1 5 Mile Autonomous Drive Tesla Model Y Successfully Tests In Texas

May 19, 2025 -

El Camp Nou Ve Caer Al Barca Impacto De La Derrota En La Liga

May 19, 2025

El Camp Nou Ve Caer Al Barca Impacto De La Derrota En La Liga

May 19, 2025 -

Aaron Gordons Game 7 Status Nuggets Star Plays Despite Hamstring Injury

May 19, 2025

Aaron Gordons Game 7 Status Nuggets Star Plays Despite Hamstring Injury

May 19, 2025 -

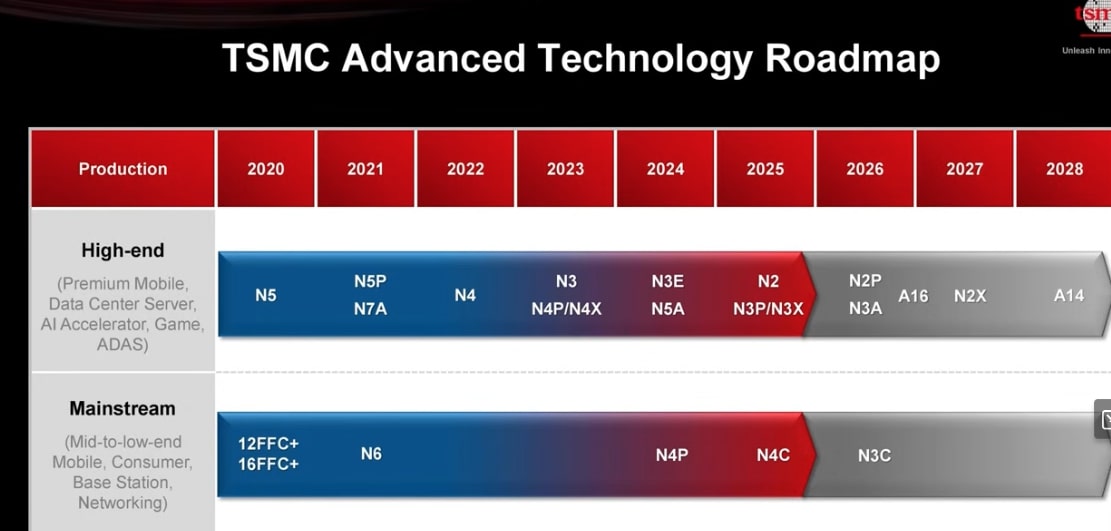

Tsmcs 2025 Technical Symposium A Deep Dive Into The 1 4nm Node And Future Plans

May 19, 2025

Tsmcs 2025 Technical Symposium A Deep Dive Into The 1 4nm Node And Future Plans

May 19, 2025