MicroStrategy (MSTR) Q1 Earnings Preview: Is This A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy (MSTR) Q1 Earnings Preview: Is This a Buying Opportunity?

MicroStrategy (MSTR), the business intelligence company that's become synonymous with Bitcoin, is set to release its Q1 2024 earnings report soon. This announcement has investors buzzing, prompting the crucial question: is now the time to buy MSTR stock? The upcoming report will offer valuable insights into the company's performance, particularly its Bitcoin holdings and their impact on the bottom line. This article will delve into the key factors to watch, analyzing potential market reactions and evaluating the investment opportunity.

What to Expect from MicroStrategy's Q1 2024 Earnings:

MicroStrategy's earnings reports are always highly anticipated, not just for traditional business metrics, but also for the performance of its substantial Bitcoin holdings. While the company's core business remains important, the value of its Bitcoin reserves significantly influences its overall financial picture. Here's what analysts and investors will be closely scrutinizing:

-

Bitcoin Holdings and Valuation: The fluctuating price of Bitcoin is the wild card. Investors will be keen to see the impact of Bitcoin's price movements on MicroStrategy's balance sheet and overall valuation during Q1. Any significant changes in the company's Bitcoin holdings will also draw considerable attention.

-

Software Revenue and Performance: While Bitcoin dominates the narrative, the health of MicroStrategy's core software business is crucial for long-term sustainability. Analysts will assess revenue growth, customer acquisition, and overall software performance indicators.

-

Debt and Liquidity: MicroStrategy's significant Bitcoin investments have been funded partly through debt. Investors will carefully examine the company's debt levels, liquidity position, and its ability to manage financial risk.

-

Management Commentary: The tone and outlook provided by MicroStrategy's management regarding future Bitcoin strategy, software investments, and overall market expectations will be crucial in shaping investor sentiment.

Is MSTR Stock a Buy? Analyzing the Risks and Rewards:

The decision to buy MSTR stock is complex and depends on individual risk tolerance and investment strategies.

Potential Upsides:

- Bitcoin's Long-Term Potential: Many believe Bitcoin's price will appreciate significantly over the long term. This would boost MicroStrategy's balance sheet considerably.

- Software Business Growth: The company’s software business provides a degree of diversification and could deliver consistent growth.

- First-Mover Advantage: MicroStrategy's early and aggressive adoption of Bitcoin positions it as a leader in this evolving asset class.

Potential Downsides:

- Bitcoin Volatility: Bitcoin's price is incredibly volatile, exposing MSTR to substantial risk. A significant price drop could severely impact the company's valuation.

- Debt Burden: MicroStrategy's high debt levels add financial risk.

- Competition in the Software Market: MicroStrategy faces competition from established players in the business intelligence software sector.

Conclusion: A High-Risk, High-Reward Proposition?

MicroStrategy's Q1 earnings report will provide crucial insights into the company's performance and outlook. The investment opportunity presents a high-risk, high-reward scenario. Investors should carefully assess their risk tolerance, conduct thorough due diligence, and consider diversifying their portfolio before making any investment decisions in MSTR stock. This is not financial advice; consult with a qualified financial advisor before making any investment decisions. Stay tuned for the release of the Q1 results to gain a clearer understanding of the current market sentiment and potential future trajectory of MSTR stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy (MSTR) Q1 Earnings Preview: Is This A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

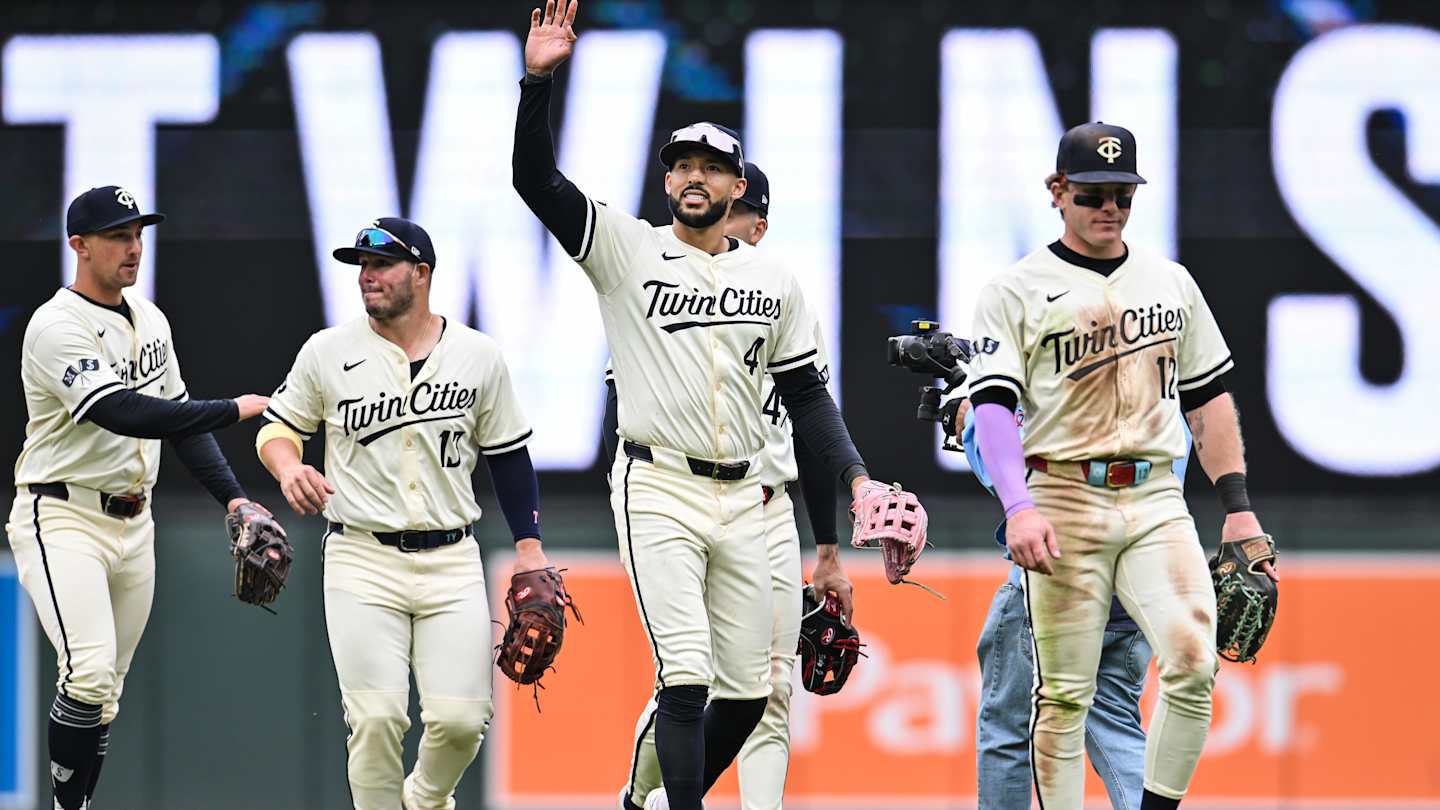

Crucial Cleveland Series A Test For The Minnesota Twins

May 02, 2025

Crucial Cleveland Series A Test For The Minnesota Twins

May 02, 2025 -

Europa League Peut On S Attendre A Une Surprise De Bilbao Contre Manchester United

May 02, 2025

Europa League Peut On S Attendre A Une Surprise De Bilbao Contre Manchester United

May 02, 2025 -

Crypto Tax Laws Still Stuck In The Past

May 02, 2025

Crypto Tax Laws Still Stuck In The Past

May 02, 2025 -

Magnificent Seven And Beyond A Dynasty Super Flex Rookie Mock Draft Analysis

May 02, 2025

Magnificent Seven And Beyond A Dynasty Super Flex Rookie Mock Draft Analysis

May 02, 2025 -

Apple Announces Q2 Earnings What Investors Need To Know

May 02, 2025

Apple Announces Q2 Earnings What Investors Need To Know

May 02, 2025