MicroStrategy (MSTR) Stock: Analyst Predicts Q1 Earnings Boost

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy (MSTR) Stock: Analyst Predicts Q1 Earnings Boost, Bitcoin Betting Pays Off?

MicroStrategy (MSTR) stock is buzzing after a prominent analyst predicted a significant earnings boost for the first quarter of 2024. This bullish forecast hinges largely on the company's substantial Bitcoin holdings and the recent price appreciation of the cryptocurrency. Could this be the signal investors have been waiting for?

The tech firm, known for its business intelligence software, has aggressively pursued a Bitcoin acquisition strategy, making it one of the largest corporate holders of the digital asset. This bold move, initially met with skepticism by some, is now potentially paying dividends, fueling speculation about a strong Q1 earnings report.

Analyst Predictions and Market Reaction:

Equity Research analyst [Analyst Name, and firm if available], has projected a significant increase in MicroStrategy's Q1 earnings, attributing the positive outlook primarily to the unrealized gains from its Bitcoin investments. The analyst's report highlights the recent surge in Bitcoin's price as a key driver for this anticipated increase. While the specific figures remain undisclosed pending the official earnings release, the prediction has already sent ripples through the market, with MSTR stock experiencing a notable price increase.

Bitcoin's Role in MicroStrategy's Financial Performance:

MicroStrategy's significant Bitcoin holdings have become a defining characteristic of the company, transforming its investment strategy and, potentially, its future financial performance. The company's bet on Bitcoin's long-term growth has been a risky yet potentially lucrative endeavor. The recent price appreciation of Bitcoin is directly impacting the company's bottom line, and analysts are increasingly recognizing the potential for substantial gains.

- Increased Market Volatility: It's crucial to remember that the cryptocurrency market is inherently volatile. While the recent price increase is positive, future price fluctuations could significantly impact MicroStrategy's financial performance. Investors should understand and accept this inherent risk.

- Long-Term Strategy: MicroStrategy's CEO, Michael Saylor, has repeatedly emphasized the company's long-term commitment to Bitcoin, suggesting that short-term price fluctuations are less of a concern than the overall growth potential of the cryptocurrency.

What to Expect from the Q1 Earnings Report:

All eyes are now on MicroStrategy's upcoming Q1 earnings report. Investors will be closely scrutinizing the details to assess the accuracy of the analyst's prediction and gauge the long-term implications of the company's Bitcoin strategy. The report is expected to provide a clearer picture of the impact of Bitcoin's price movements on MicroStrategy's financial health and its future prospects.

- Detailed Breakdown of Bitcoin Holdings: The report is expected to provide a detailed breakdown of the company’s Bitcoin holdings, including the average purchase price and the current market value.

- Impact on Revenue and Profitability: Investors will be keen to see how Bitcoin's price appreciation has impacted MicroStrategy's revenue and overall profitability, beyond the unrealized gains.

- Future Guidance: The company's guidance for the remainder of the year will be another critical aspect of the report, offering insights into their future plans and strategies.

Investing in MSTR Stock: A Risky but Potentially Rewarding Venture?

Investing in MicroStrategy stock presents both significant risks and potential rewards. The company's heavy reliance on Bitcoin's performance introduces substantial volatility. However, for investors with a high-risk tolerance and a bullish outlook on Bitcoin's long-term growth, MSTR could represent a compelling investment opportunity. Thorough due diligence and a clear understanding of the risks involved are crucial before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy (MSTR) Stock: Analyst Predicts Q1 Earnings Boost. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Meg Ryan Lists Montecito Mansion For 19 5 Million A Look Inside

May 01, 2025

Meg Ryan Lists Montecito Mansion For 19 5 Million A Look Inside

May 01, 2025 -

Europa League Semi Finals Tottenhams Lightning Fast Goal Stuns Opponents

May 01, 2025

Europa League Semi Finals Tottenhams Lightning Fast Goal Stuns Opponents

May 01, 2025 -

Ganara Pedri El Balon De Oro Evaluacion De Su Trayectoria Y Competencia

May 01, 2025

Ganara Pedri El Balon De Oro Evaluacion De Su Trayectoria Y Competencia

May 01, 2025 -

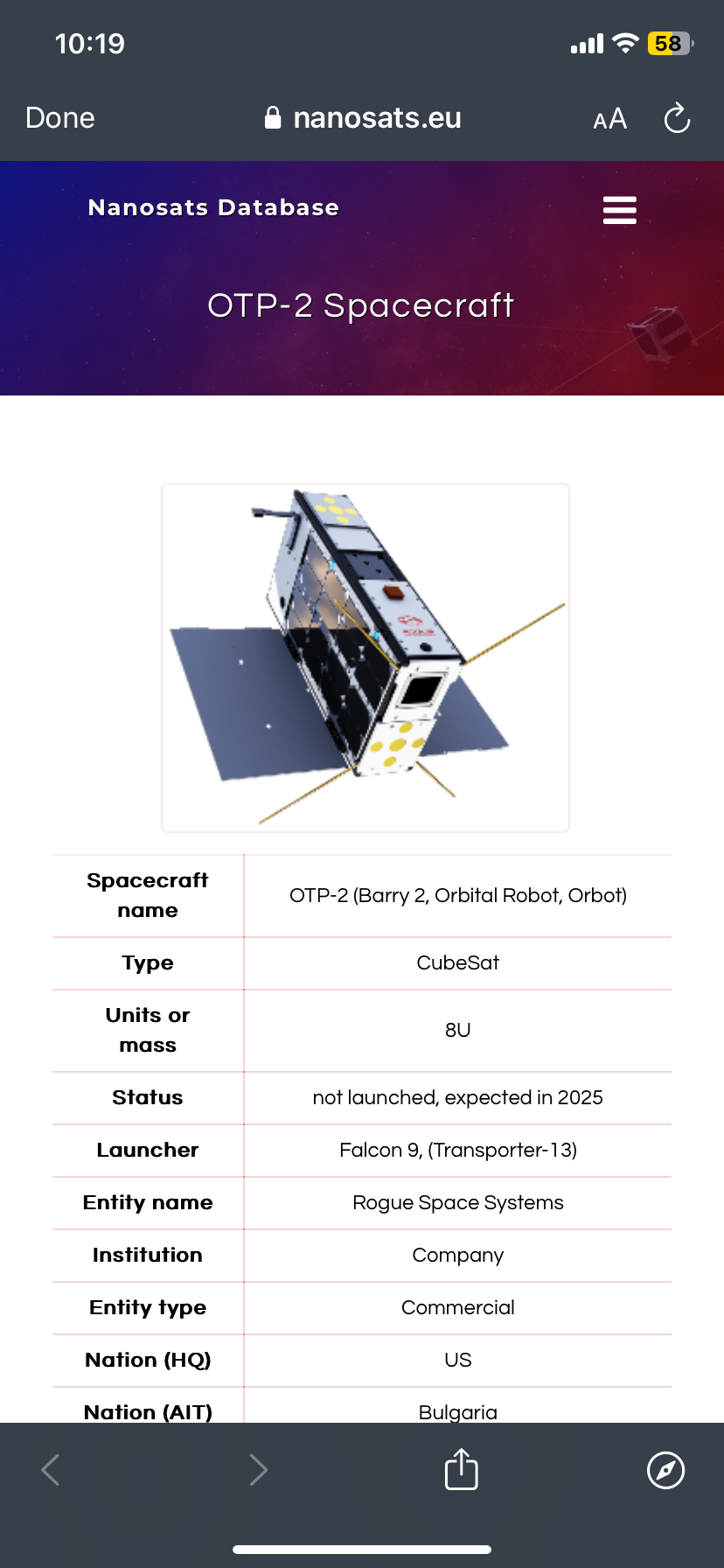

Otp 2 A Report On Two Crucial Propulsion Experiments

May 01, 2025

Otp 2 A Report On Two Crucial Propulsion Experiments

May 01, 2025 -

Post Match Analysis As Roma 1 0 Inter Milan April 27th 2025

May 01, 2025

Post Match Analysis As Roma 1 0 Inter Milan April 27th 2025

May 01, 2025