MicroStrategy (MSTR) Stock: Can It Beat Bitcoin's Returns In The Long Term?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy (MSTR) Stock: Can it Beat Bitcoin's Returns in the Long Term?

MicroStrategy (MSTR), the business intelligence company, has become synonymous with Bitcoin. Its aggressive Bitcoin acquisition strategy, spearheaded by CEO Michael Saylor, has captivated investors and sparked a fierce debate: can holding MSTR stock outperform a direct investment in Bitcoin itself over the long term? The answer, as we'll explore, is complex and hinges on several crucial factors.

The Bitcoin Bet: A High-Stakes Gamble

MicroStrategy's decision to amass a substantial Bitcoin hoard, now exceeding 150,000 BTC, has undeniably shaped its stock price. The company's fortunes are increasingly tied to the volatile cryptocurrency market. While this strategy has yielded impressive short-term gains for some investors, the inherent risks associated with Bitcoin's price fluctuations remain significant. A major Bitcoin downturn could severely impact MSTR's stock price, regardless of its underlying business performance.

MSTR Stock Performance vs. Bitcoin: A Comparative Analysis

Comparing MSTR's stock performance against Bitcoin's price requires careful consideration. While Bitcoin's price has shown remarkable growth since MicroStrategy's initial investments, MSTR's stock price isn't solely a reflection of Bitcoin's value. The company's core business operations, software solutions, and overall market standing also influence its share price. Analyzing both assets separately, then comparing their returns, paints a clearer picture than simply looking at one in relation to the other. Historical data reveals periods where Bitcoin significantly outperformed MSTR, and vice versa, highlighting the unpredictable nature of both investments.

Factors Influencing MSTR's Long-Term Potential:

Several key factors will determine whether MSTR can surpass Bitcoin's long-term returns:

- Bitcoin's Market Trajectory: The future of Bitcoin is inherently uncertain. Factors like regulatory changes, widespread adoption, and technological advancements will significantly influence its price.

- MicroStrategy's Business Performance: MSTR's core business must remain healthy and profitable. Strong financial results can help mitigate the volatility linked to its Bitcoin holdings.

- Market Sentiment: Investor confidence in both Bitcoin and MicroStrategy plays a crucial role. Negative sentiment can lead to substantial price drops for both assets.

- Competition: The business intelligence market is competitive. MSTR's ability to innovate and maintain its market share is vital for long-term success.

- Bitcoin's Institutional Adoption: Increased institutional investment in Bitcoin could positively impact both Bitcoin's price and MSTR's stock value.

The Verdict: A Risky but Potentially Rewarding Proposition

Investing in MicroStrategy stock carries significant risk. Its fortunes are heavily intertwined with Bitcoin's volatile price movements. While the potential for substantial returns exists, especially if Bitcoin continues its upward trajectory, investors must carefully weigh the risks involved. A diversified investment portfolio is crucial to mitigate the volatility associated with both MSTR and Bitcoin.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The cryptocurrency market is highly volatile, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy (MSTR) Stock: Can It Beat Bitcoin's Returns In The Long Term?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Master Plan 4 How Tesla Aims To Dominate With Its Terawatt Energy Vision

May 23, 2025

Master Plan 4 How Tesla Aims To Dominate With Its Terawatt Energy Vision

May 23, 2025 -

Significant Increase Hanover Board Grants Members 7 000 Stipend

May 23, 2025

Significant Increase Hanover Board Grants Members 7 000 Stipend

May 23, 2025 -

Football Whispers The Inside Track On Rodrygo Wirtz Diaz De Bruyne Mc Atee And Fernandez

May 23, 2025

Football Whispers The Inside Track On Rodrygo Wirtz Diaz De Bruyne Mc Atee And Fernandez

May 23, 2025 -

Tottenham Hotspur Defeat Manchester United In Europa League Final

May 23, 2025

Tottenham Hotspur Defeat Manchester United In Europa League Final

May 23, 2025 -

Luminar Ceo Exit The Robert Tesla Video And Its Potential Role

May 23, 2025

Luminar Ceo Exit The Robert Tesla Video And Its Potential Role

May 23, 2025

Latest Posts

-

Australian Regulator Issues Warning Over Starlinks Satellite Internet Service

May 23, 2025

Australian Regulator Issues Warning Over Starlinks Satellite Internet Service

May 23, 2025 -

Cryptocurrency Regulation How New Hampshire Arizona And Texas Are Shaping The Future Of Bitcoin

May 23, 2025

Cryptocurrency Regulation How New Hampshire Arizona And Texas Are Shaping The Future Of Bitcoin

May 23, 2025 -

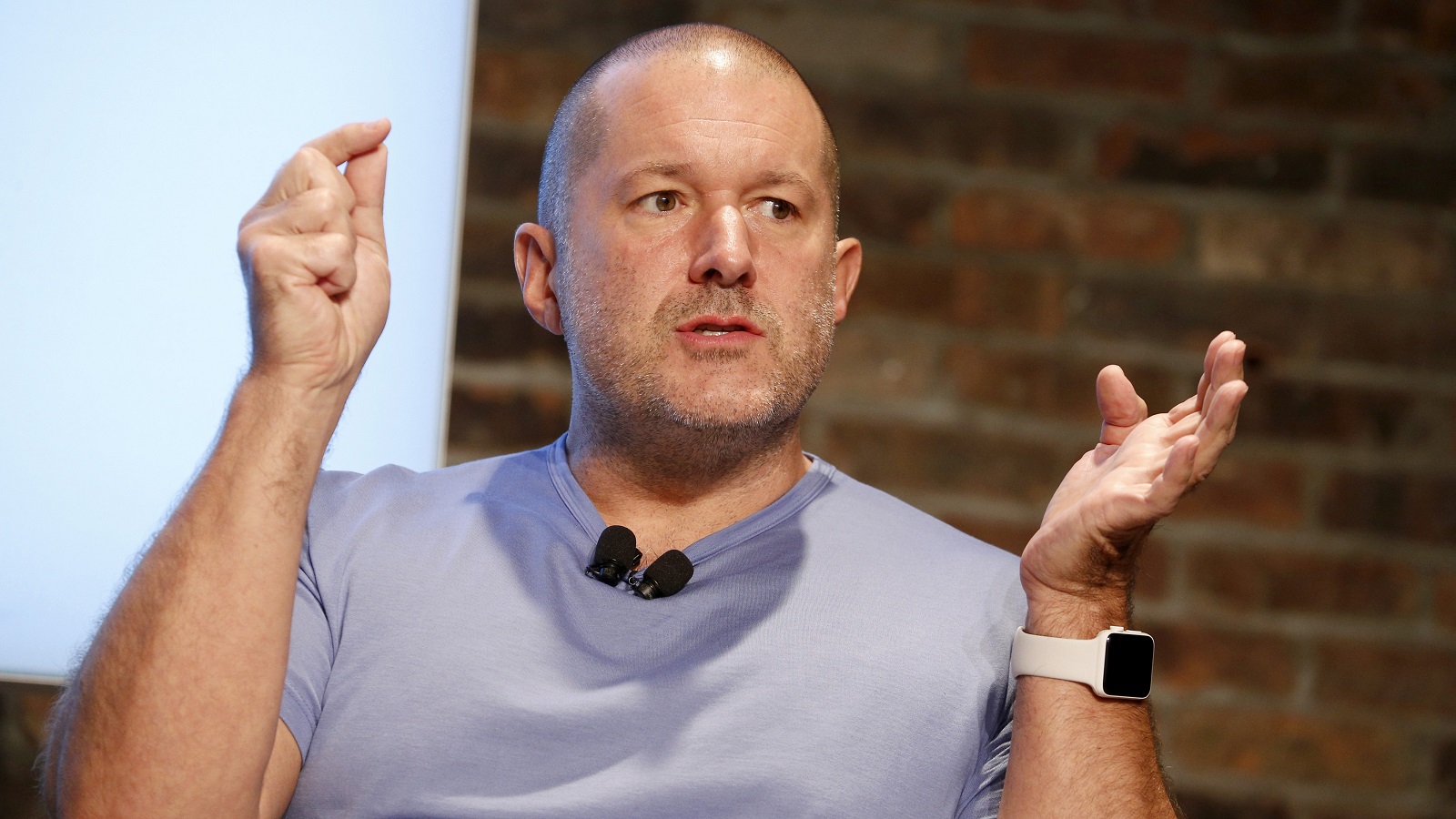

Jony Ive And Open Ai A New Chapter In Design And Artificial Intelligence

May 23, 2025

Jony Ive And Open Ai A New Chapter In Design And Artificial Intelligence

May 23, 2025 -

Acma Investigation Starlink Faces Backlash Over Customer Complaints

May 23, 2025

Acma Investigation Starlink Faces Backlash Over Customer Complaints

May 23, 2025 -

From Scratch Off To 150 000 A Kentucky Couples Winning Story

May 23, 2025

From Scratch Off To 150 000 A Kentucky Couples Winning Story

May 23, 2025