MicroStrategy (MSTR) Stock Performance Analysis: Outperforming Bitcoin In 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy (MSTR) Stock Performance Analysis: Outperforming Bitcoin in 2025?

MicroStrategy (MSTR), the business intelligence company that's become synonymous with Bitcoin, has captivated investors with its bold strategy. But will this high-risk, high-reward approach pay off? Could MSTR stock actually outperform Bitcoin itself by 2025? Let's dive into a performance analysis and explore the possibilities.

The MSTR-Bitcoin Gamble: A Risky Proposition?

Michael Saylor's decision to heavily invest MicroStrategy's treasury in Bitcoin was a daring move, transforming the company into a de facto Bitcoin investment vehicle. While this strategy has attracted significant attention and, at times, fueled MSTR stock price increases, it also exposes the company to the extreme volatility inherent in the cryptocurrency market. This makes predicting future performance incredibly challenging.

MSTR Stock Performance: A Rollercoaster Ride

MSTR stock has experienced dramatic price swings, mirroring Bitcoin's own volatile nature. While periods of Bitcoin's price appreciation have boosted MSTR's stock price, periods of decline have resulted in significant losses for investors. Analyzing past performance doesn't guarantee future success, but it provides valuable insight into the correlation between Bitcoin's price and MSTR's stock valuation.

Factors Influencing MSTR Stock in 2025:

Several factors could impact MSTR's stock performance in the coming years:

- Bitcoin's Price: The price of Bitcoin remains the single most significant factor influencing MSTR's valuation. A sustained bull market for Bitcoin would likely boost MSTR's stock price considerably. Conversely, a prolonged bear market could severely depress it.

- Regulatory Landscape: The evolving regulatory environment surrounding cryptocurrencies globally is a key uncertainty. Stringent regulations could negatively impact Bitcoin's price and, by extension, MSTR's stock.

- MicroStrategy's Business Operations: While Bitcoin investment dominates the narrative, MicroStrategy's core business intelligence operations also play a role. The success of its software products and services could provide a degree of insulation from Bitcoin price volatility.

- Market Sentiment: Investor sentiment toward both Bitcoin and MSTR itself significantly impacts stock price. Positive news and increased institutional adoption could drive prices up, while negative news or decreased confidence could lead to declines.

- Adoption of Bitcoin as a Reserve Asset: Increased adoption of Bitcoin by corporations and institutions as a store of value could positively impact Bitcoin's price and MSTR's stock.

Outperforming Bitcoin: A Realistic Goal?

The question of whether MSTR will outperform Bitcoin by 2025 is highly speculative. While a strong Bitcoin bull market could benefit both, MSTR's stock price is subject to additional factors, including its operational performance and investor sentiment specific to the company. Therefore, while a positive correlation exists, directly outperforming Bitcoin is not a guaranteed outcome.

Conclusion: High Risk, High Reward (or Loss)

Investing in MSTR is a high-risk, high-reward strategy intrinsically tied to the fortunes of Bitcoin. While the potential for significant gains exists, investors must be prepared for substantial losses if the Bitcoin market experiences a prolonged downturn. Thorough due diligence, a long-term investment horizon, and an understanding of the inherent volatility are crucial for anyone considering investing in MicroStrategy. Always consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy (MSTR) Stock Performance Analysis: Outperforming Bitcoin In 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Revolutionizing Communication Domain Names Replace Phone Numbers In New Messaging Service

May 26, 2025

Revolutionizing Communication Domain Names Replace Phone Numbers In New Messaging Service

May 26, 2025 -

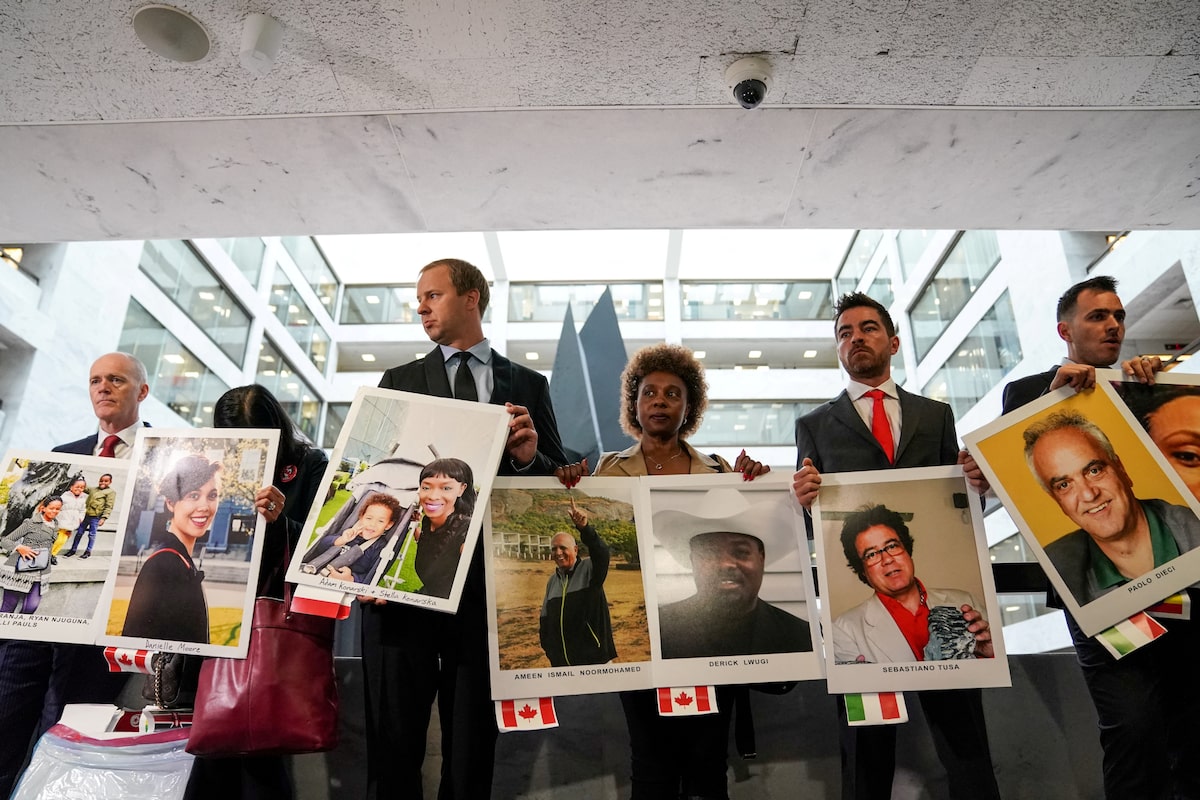

737 Max Crisis Boeing Avoids Prosecution With Doj Deal

May 26, 2025

737 Max Crisis Boeing Avoids Prosecution With Doj Deal

May 26, 2025 -

Unexpected Google Pixel 10 Leak Surfaces Online

May 26, 2025

Unexpected Google Pixel 10 Leak Surfaces Online

May 26, 2025 -

New Charles Bronson Boulevard Celebrating A Hollywood Legacy In Four Mile

May 26, 2025

New Charles Bronson Boulevard Celebrating A Hollywood Legacy In Four Mile

May 26, 2025 -

Conquer Crosswords Daily With Usa Today Play

May 26, 2025

Conquer Crosswords Daily With Usa Today Play

May 26, 2025