MicroStrategy (MSTR) Vs. Bitcoin (BTC): A February 2025 Stock Price Comparison

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy (MSTR) vs. Bitcoin (BTC): A February 2025 Stock Price Comparison

Introduction: February 2025. The crypto winter has (hopefully) thawed, and the tech world is buzzing. But how have two titans of the digital landscape – MicroStrategy (MSTR), the business intelligence company with a massive Bitcoin bet, and Bitcoin (BTC) itself – fared? This article dives into a comparative analysis of their potential February 2025 stock and price performance, exploring the factors that might influence their trajectories. It's crucial to remember that this is speculative analysis based on current trends and market predictions; investing involves inherent risk.

MicroStrategy (MSTR): The Bitcoin-Heavyweight

MicroStrategy's stock price is intrinsically linked to the performance of Bitcoin. Michael Saylor's bold strategy of accumulating BTC as a treasury reserve asset has made MSTR a proxy investment for Bitcoin for many investors. However, MSTR's success isn't solely dependent on BTC's price. Its core business of providing enterprise analytics software also plays a significant role.

Factors influencing MSTR's February 2025 price:

- Bitcoin's Price: The most dominant factor. A bullish Bitcoin market in 2025 would likely boost MSTR's stock price significantly. Conversely, a bearish market could severely impact it.

- Adoption of MicroStrategy's Analytics Software: Continued growth and market share gains in the business intelligence sector would provide a crucial buffer against Bitcoin's volatility.

- Regulatory Landscape: Changes in Bitcoin regulations, both globally and in the US, could significantly impact MSTR's valuation. Clearer regulatory frameworks could be positive, while overly restrictive measures could be detrimental.

- Overall Market Sentiment: A positive macroeconomic environment would generally favor tech stocks, including MSTR.

Bitcoin (BTC): The Digital Gold Standard?

Predicting Bitcoin's price is notoriously difficult. However, several factors could shape its value by February 2025:

Factors influencing BTC's February 2025 price:

- Increased Institutional Adoption: Further mainstream acceptance by large financial institutions and corporations could drive price appreciation.

- Technological Advancements: Developments like the Lightning Network and Taproot upgrades could enhance Bitcoin's scalability and usability, boosting demand.

- Global Macroeconomic Conditions: Economic uncertainty and inflation could drive investors towards Bitcoin as a hedge against traditional assets.

- Regulatory Clarity (or Lack Thereof): Clearer regulations could lead to greater institutional investment and increased price stability. Conversely, uncertainty could cause volatility.

- Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, is historically associated with price increases in the long term. The next halving will influence the price trajectory.

MSTR vs. BTC: A Speculative Comparison

By February 2025, a moderately bullish Bitcoin market scenario could see BTC trading between $100,000 and $200,000. This would likely propel MSTR's stock price to new highs, potentially exceeding its current value considerably, assuming its core business maintains stability. However, a significant downturn in the Bitcoin market could significantly drag down MSTR's value. The interplay between MSTR's core business performance and Bitcoin's price will determine its trajectory.

Disclaimer: This analysis is purely speculative and intended for informational purposes only. It is not financial advice. Investing in cryptocurrency and stocks involves significant risk, and past performance is not indicative of future results. Conduct thorough research and consult with a financial advisor before making any investment decisions. Remember to diversify your portfolio to mitigate risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy (MSTR) Vs. Bitcoin (BTC): A February 2025 Stock Price Comparison. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game Stops 6 Billion Balance Sheet And Bitcoin Investments Implications For Future Growth

May 25, 2025

Game Stops 6 Billion Balance Sheet And Bitcoin Investments Implications For Future Growth

May 25, 2025 -

Scott Mc Tominay A Manchester United Departure And Napolis New Star

May 25, 2025

Scott Mc Tominay A Manchester United Departure And Napolis New Star

May 25, 2025 -

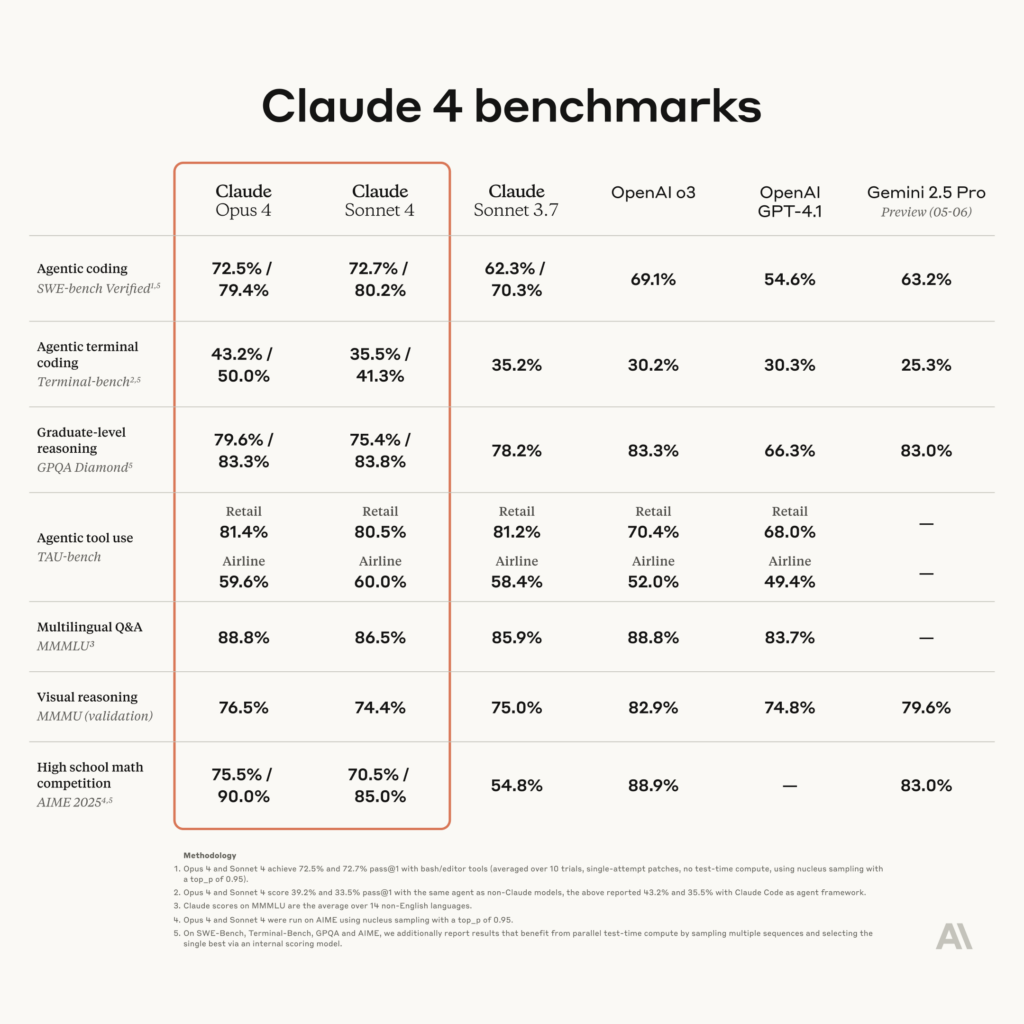

Claude 4 Sonnet And Opus Exploring Anthropics Advancements In Agentic Ai Coding

May 25, 2025

Claude 4 Sonnet And Opus Exploring Anthropics Advancements In Agentic Ai Coding

May 25, 2025 -

Moodeng Stock Explodes On Robinhood Is A New High On The Horizon

May 25, 2025

Moodeng Stock Explodes On Robinhood Is A New High On The Horizon

May 25, 2025 -

Mukul Dev From Cockpit To Screen The Actors Untold Aviation Story

May 25, 2025

Mukul Dev From Cockpit To Screen The Actors Untold Aviation Story

May 25, 2025

Latest Posts

-

Senna Agius Secures First Career Moto2 Victory At Silverstone

May 25, 2025

Senna Agius Secures First Career Moto2 Victory At Silverstone

May 25, 2025 -

Ine And Abadnet Institute Partner For Cybersecurity Training In Saudi Arabia

May 25, 2025

Ine And Abadnet Institute Partner For Cybersecurity Training In Saudi Arabia

May 25, 2025 -

Conheca Opcoes Para Ter Uma Casa Na Praia Ou Campo Sem Compra Integral

May 25, 2025

Conheca Opcoes Para Ter Uma Casa Na Praia Ou Campo Sem Compra Integral

May 25, 2025 -

From Hackman To Nicholson The Story Behind A Celebrated Oscar Winning Performance

May 25, 2025

From Hackman To Nicholson The Story Behind A Celebrated Oscar Winning Performance

May 25, 2025 -

Retour Sur Terre Battue Pour Nadal Decryptage Du Debut De Roland Garros

May 25, 2025

Retour Sur Terre Battue Pour Nadal Decryptage Du Debut De Roland Garros

May 25, 2025