MicroStrategy's Bitcoin Bet: Can MSTR Stock Outpace BTC In The Long Run? (February 2025 Analysis)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's Bitcoin Bet: Can MSTR Stock Outpace BTC in the Long Run? (February 2025 Analysis)

MicroStrategy's aggressive Bitcoin (BTC) acquisition strategy, spearheaded by CEO Michael Saylor, has been a captivating saga since 2020. This bold move, turning the business intelligence company into one of the world's largest corporate Bitcoin holders, has sent ripples throughout the financial world. But the question remains: will investing in MSTR stock outperform simply holding Bitcoin itself over the long term? This February 2025 analysis delves into the complexities of this high-stakes gamble.

MSTR's Bitcoin Holdings: A Mountain of Cryptocurrency

As of February 2025, MicroStrategy holds a substantial Bitcoin hoard, valued at (insert realistic estimated value based on February 2025 BTC price prediction). This massive investment represents a significant portion of the company's overall assets, effectively making Bitcoin a core component of its business model. This strategy, while audacious, exposes MSTR to the considerable volatility inherent in the cryptocurrency market.

The Bull Case for MSTR Stock:

- Bitcoin's Continued Adoption: Proponents of MSTR argue that Bitcoin's increasing acceptance as a store of value and a potential hedge against inflation will drive its price upwards. This, in turn, would inflate the value of MicroStrategy's holdings, boosting MSTR's stock price.

- Brand Recognition and Investor Confidence: MicroStrategy's early and unwavering commitment to Bitcoin has solidified its position as a leader in the corporate adoption of crypto. This brand association could attract investors seeking exposure to the cryptocurrency market through a more established, publicly traded entity.

- Potential for Diversification Beyond Bitcoin: While Bitcoin forms a significant part of MSTR's strategy, the company continues its core business operations. Successful performance in its traditional business segments could provide a buffer against Bitcoin price fluctuations, offering a more diversified investment.

The Bear Case Against MSTR Stock:

- Bitcoin's Volatility: Bitcoin's price is notoriously volatile. Sharp price drops could significantly impact MSTR's valuation, potentially wiping out significant shareholder value even if the underlying Bitcoin holdings recover.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain globally. Changes in regulations could negatively impact the value of Bitcoin and subsequently, MSTR's stock.

- Dependence on Bitcoin's Success: MSTR's success is heavily tied to the performance of Bitcoin. If Bitcoin fails to meet expectations, MSTR's stock price could underperform compared to other tech stocks or even simply holding BTC.

MSTR vs. BTC: The Long-Term Outlook

Predicting the future of either MSTR stock or Bitcoin is inherently speculative. However, a crucial consideration is the potential for outperformance. While MSTR’s stock price is influenced by Bitcoin's value, it also incorporates the performance of its core business and broader market sentiment towards the company itself. This added layer of complexity means that MSTR could theoretically outperform Bitcoin in the long run – but this is not a guaranteed outcome.

Conclusion:

MicroStrategy's Bitcoin bet is a high-risk, high-reward strategy. While the company's commitment to Bitcoin has earned it considerable attention and could potentially lead to outsized returns, investors must carefully consider the inherent volatility associated with cryptocurrency investments. Whether MSTR stock will outpace BTC in the long run remains uncertain and depends on a confluence of factors, including Bitcoin's price trajectory, regulatory developments, and MicroStrategy's success in its core business. Thorough due diligence and a high risk tolerance are crucial before considering an investment in MSTR stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's Bitcoin Bet: Can MSTR Stock Outpace BTC In The Long Run? (February 2025 Analysis). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dragons Star Tom Eisenhuths Career Cut Short By Injuries

May 23, 2025

Dragons Star Tom Eisenhuths Career Cut Short By Injuries

May 23, 2025 -

Circle Bitkub And Blockchain Com Which Crypto Company Will Ipo Next

May 23, 2025

Circle Bitkub And Blockchain Com Which Crypto Company Will Ipo Next

May 23, 2025 -

Bbc Releases Audio Of Oceangate Titan Sub Implosion Chilling Ship Footage

May 23, 2025

Bbc Releases Audio Of Oceangate Titan Sub Implosion Chilling Ship Footage

May 23, 2025 -

Shai Gilgeous Alexanders Mvp Triumph Messages From Vinicius Junior And Ronaldinho

May 23, 2025

Shai Gilgeous Alexanders Mvp Triumph Messages From Vinicius Junior And Ronaldinho

May 23, 2025 -

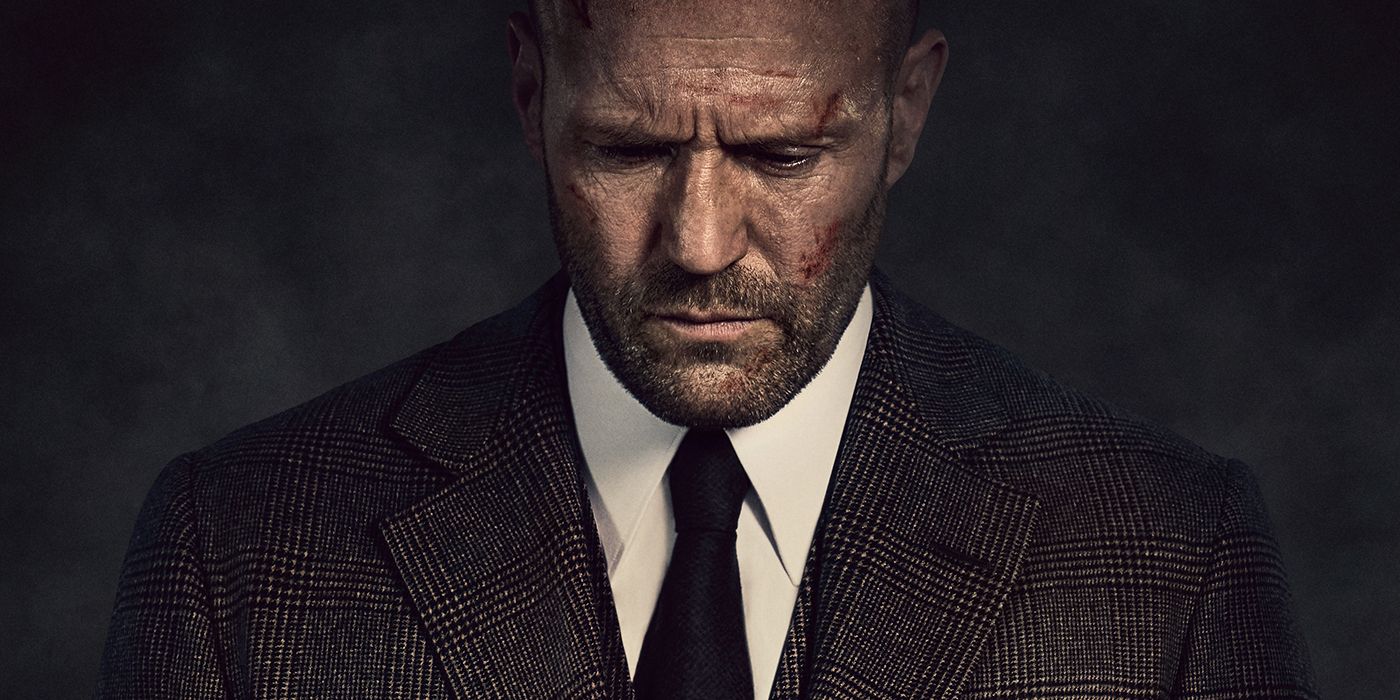

Streaming Top 10 Conquered Jason Stathams Film Achieves 90 Audience Score On Rotten Tomatoes

May 23, 2025

Streaming Top 10 Conquered Jason Stathams Film Achieves 90 Audience Score On Rotten Tomatoes

May 23, 2025

Latest Posts

-

Oceangate Titan Sub Implosion New Ship Footage Shared With Bbc

May 23, 2025

Oceangate Titan Sub Implosion New Ship Footage Shared With Bbc

May 23, 2025 -

The Promise Of Space Grown Crystals For Next Generation Pharmaceuticals

May 23, 2025

The Promise Of Space Grown Crystals For Next Generation Pharmaceuticals

May 23, 2025 -

Revolution In Electronics Room Temperature Petahertz Phototransistor Developed

May 23, 2025

Revolution In Electronics Room Temperature Petahertz Phototransistor Developed

May 23, 2025 -

What Was That Bang Video Captures Titan Missile Implosion

May 23, 2025

What Was That Bang Video Captures Titan Missile Implosion

May 23, 2025 -

Unexpected 12 Surge In Trump Linked Assets Analysis And Outlook

May 23, 2025

Unexpected 12 Surge In Trump Linked Assets Analysis And Outlook

May 23, 2025