MicroStrategy's Bitcoin Gambit: The Role Of STRK Preferred Stock Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's Bitcoin Gambit: Unpacking the Role of STRK Preferred Stock

MicroStrategy, the business intelligence firm spearheaded by Michael Saylor, has become synonymous with its aggressive Bitcoin investment strategy. But beyond the headline-grabbing Bitcoin purchases, lies a more nuanced financial maneuver: the issuance of its STRK preferred stock. This article delves into the intricacies of MicroStrategy's Bitcoin gambit and explains the crucial role STRK preferred stock plays in fueling its cryptocurrency ambitions.

The Bitcoin Bull: MicroStrategy's audacious bet on Bitcoin has made it a prominent player in the cryptocurrency space. The company has accumulated a substantial Bitcoin hoard, becoming one of the largest corporate holders globally. This strategy, however, requires significant capital investment. This is where STRK comes into play.

Understanding STRK Preferred Stock: MicroStrategy's STRK preferred stock is not your average equity offering. It's a novel instrument designed to provide a pathway for investors to gain exposure to MicroStrategy's Bitcoin holdings without directly investing in Bitcoin itself. This is appealing to investors who are interested in Bitcoin's potential but might be hesitant about the volatility of the cryptocurrency market.

Key Features of STRK:

- Bitcoin Exposure: The primary benefit is exposure to Bitcoin's price movements. The value of STRK is intrinsically linked to the performance of MicroStrategy's Bitcoin holdings. As Bitcoin's price rises, so too should the value of STRK.

- Reduced Volatility (Potentially): While still subject to market fluctuations, STRK aims to offer a slightly smoother ride than directly investing in Bitcoin. This is due to the mitigating factors offered by MicroStrategy’s broader business operations.

- Dividend Potential: STRK offers the potential for dividend payments, further incentivizing investment. These dividends are typically tied to the performance of MicroStrategy’s Bitcoin holdings.

- Liquidity: The offering aims to improve the liquidity of MicroStrategy's Bitcoin holdings, allowing for greater flexibility in managing its Bitcoin portfolio.

STRK and MicroStrategy's Funding Strategy: The issuance of STRK serves as a clever financing mechanism for MicroStrategy. By selling STRK, the company raises capital without needing to sell its Bitcoin holdings directly, preserving its long-term Bitcoin investment strategy. This allows MicroStrategy to potentially capitalize on future Bitcoin price appreciation without diluting its Bitcoin position.

Risks Associated with STRK:

- Bitcoin Price Volatility: The most significant risk remains the inherent volatility of Bitcoin. A sharp decline in Bitcoin's price could negatively impact the value of STRK.

- MicroStrategy's Financial Performance: While STRK is linked to Bitcoin, the overall financial health of MicroStrategy also plays a role. Poor performance in its core business could negatively affect STRK's value.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain, and any changes could impact the value of both Bitcoin and STRK.

Conclusion: A Strategic Move or a Gamble?

MicroStrategy's issuance of STRK preferred stock represents a sophisticated strategy to manage its Bitcoin holdings and secure further funding for its cryptocurrency endeavors. It offers investors a unique way to gain Bitcoin exposure while potentially mitigating some of the risks associated with direct Bitcoin investment. However, investors should carefully consider the inherent risks before investing in STRK, understanding that its value is inextricably linked to the performance of Bitcoin and the overall financial health of MicroStrategy. The long-term success of this strategy remains to be seen, but it’s undoubtedly a fascinating development in the ever-evolving world of corporate cryptocurrency investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's Bitcoin Gambit: The Role Of STRK Preferred Stock Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Genoa Atalanta Match Preview Key Players And Predictions

May 18, 2025

Genoa Atalanta Match Preview Key Players And Predictions

May 18, 2025 -

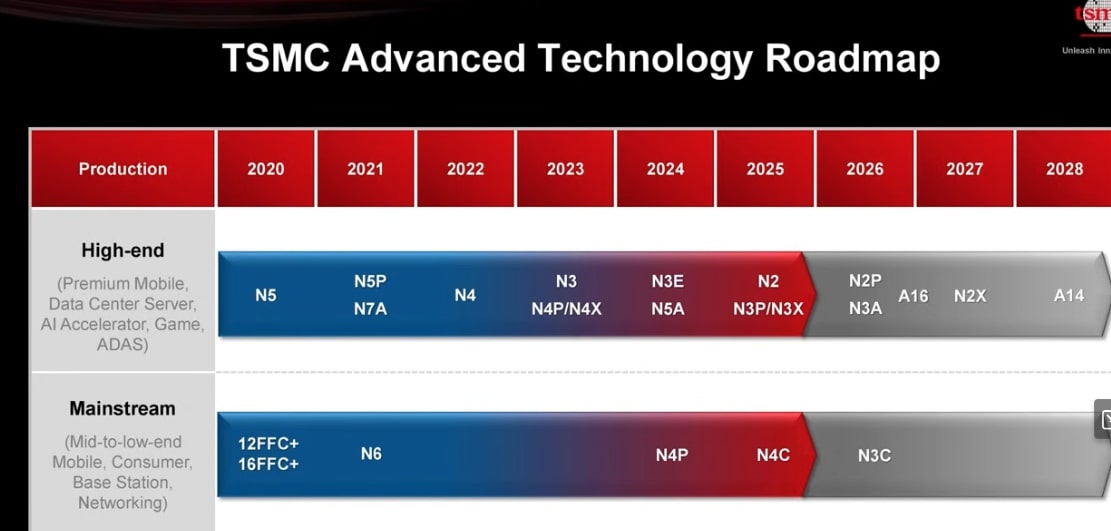

Tsmcs 2028 Technology Roadmap Insights From The 2025 Technical Symposium

May 18, 2025

Tsmcs 2028 Technology Roadmap Insights From The 2025 Technical Symposium

May 18, 2025 -

Geheimer Plan Fuer Mainz Europacup Feierlichkeiten Enthuellt

May 18, 2025

Geheimer Plan Fuer Mainz Europacup Feierlichkeiten Enthuellt

May 18, 2025 -

Doom The Dark Ages Review Love It Or Hate It

May 18, 2025

Doom The Dark Ages Review Love It Or Hate It

May 18, 2025 -

Mystery Message Ivanka Trump Leaves Note For Eli Ricks

May 18, 2025

Mystery Message Ivanka Trump Leaves Note For Eli Ricks

May 18, 2025

Latest Posts

-

Live Blog Darren Till Vs Darren Stewart At Misfits Boxing 21

May 18, 2025

Live Blog Darren Till Vs Darren Stewart At Misfits Boxing 21

May 18, 2025 -

Hoffenheim Vs Bayern Noten Und Kritik Nach Dem Auswaertssieg

May 18, 2025

Hoffenheim Vs Bayern Noten Und Kritik Nach Dem Auswaertssieg

May 18, 2025 -

Security Upgrade At Ottawa City Hall What To Expect On May 26th

May 18, 2025

Security Upgrade At Ottawa City Hall What To Expect On May 26th

May 18, 2025 -

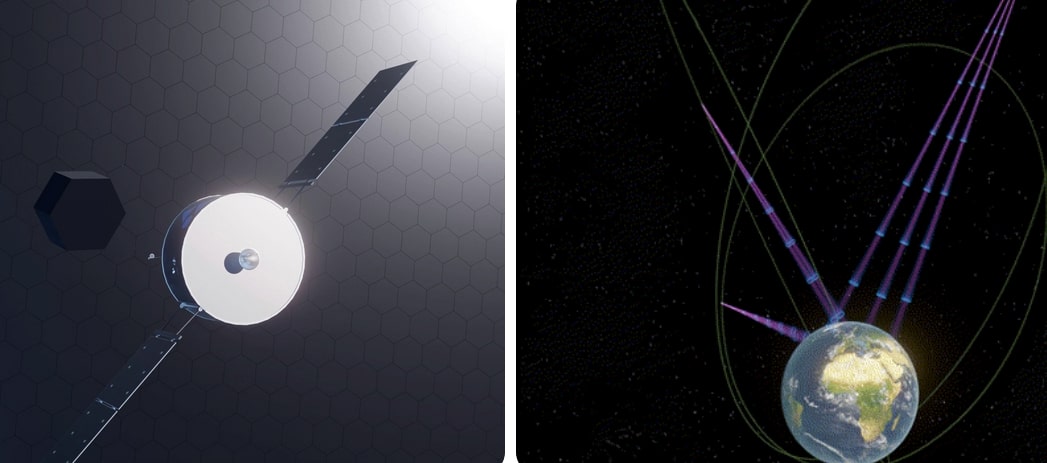

Space X Starship And The Future Of Space Solar Power A Megawatt To Gigawatt Transition

May 18, 2025

Space X Starship And The Future Of Space Solar Power A Megawatt To Gigawatt Transition

May 18, 2025 -

All Time Canadian Classique Xi Toronto Fc Vs Cf Montreal Combined

May 18, 2025

All Time Canadian Classique Xi Toronto Fc Vs Cf Montreal Combined

May 18, 2025