MicroStrategy's Bitcoin Gamble: How STRK Preferred Stock Fuels Its Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's Bitcoin Gamble: How STRK Preferred Stock Fuels its Holdings

MicroStrategy, the business intelligence company, has become synonymous with Bitcoin. Its aggressive, and at times controversial, Bitcoin acquisition strategy has captivated the crypto and financial worlds. But how does this publicly traded company consistently fund its massive Bitcoin holdings? A significant part of the answer lies in its innovative use of preferred stock, specifically its STRK preferred stock.

The Bitcoin Bull: MicroStrategy's CEO, Michael Saylor, is a fervent Bitcoin advocate. He believes Bitcoin is the future of finance and has consistently poured company resources into accumulating the cryptocurrency. This strategy, while rewarding during Bitcoin's bull runs, has also exposed the company to significant volatility. To mitigate risk and secure funding, MicroStrategy has cleverly leveraged its STRK preferred stock offering.

Understanding STRK Preferred Stock: MicroStrategy's STRK preferred stock isn't your typical preferred stock. It's a novel instrument designed to specifically support the company's Bitcoin strategy. Instead of paying traditional dividends, holders of STRK receive dividends in Bitcoin. This ingenious approach allows MicroStrategy to acquire more Bitcoin without directly impacting its cash reserves. Investors, in turn, gain exposure to Bitcoin's price movements without the complexities of directly holding the cryptocurrency.

The Mechanics of Funding: The issuance of STRK preferred stock provides MicroStrategy with a steady stream of capital. This capital is then used to purchase more Bitcoin, thus fueling the company's ambitious Bitcoin acquisition strategy. This indirect method avoids the potentially dilutive effects of issuing common stock and allows MicroStrategy to maintain a relatively stable equity structure.

The Risks and Rewards: While the STRK strategy offers a unique way to finance Bitcoin acquisitions, it's not without its risks. The value of the Bitcoin dividends is directly tied to Bitcoin's price volatility. If Bitcoin’s price plummets, the value of the STRK dividends decreases, potentially impacting investor confidence. However, the strategy also presents significant upside potential. If Bitcoin's price appreciates, STRK holders benefit directly from the increased Bitcoin dividend payments.

STRK and Long-Term Strategy: MicroStrategy's use of STRK highlights a long-term, bullish bet on Bitcoin. The company isn't simply speculating; it's building a strategic position in the cryptocurrency market, utilizing innovative financial tools to achieve its goals. This strategy underscores the growing integration of cryptocurrencies into mainstream financial markets and the innovative ways companies are adapting to navigate this evolving landscape.

The Future of STRK and MicroStrategy: The success of MicroStrategy's Bitcoin strategy, and consequently the performance of STRK preferred stock, will heavily depend on the future price of Bitcoin. Industry analysts are closely watching this unique financial experiment, as it sets a precedent for other companies seeking to incorporate cryptocurrencies into their business models. Whether this innovative approach proves sustainable long-term remains to be seen, but it undeniably represents a significant development in the intersection of traditional finance and the cryptocurrency revolution.

Keywords: MicroStrategy, Bitcoin, STRK, preferred stock, cryptocurrency, Michael Saylor, Bitcoin investment, financial innovation, crypto strategy, Bitcoin price, volatility, investment strategy, stock market, financial markets

Related Terms: cryptocurrency investment, alternative investments, digital assets, blockchain technology, Bitcoin mining, crypto regulation, institutional investors, hedge funds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's Bitcoin Gamble: How STRK Preferred Stock Fuels Its Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Palaces Party Nketiah And Eze Secure Impressive Win

May 21, 2025

Palaces Party Nketiah And Eze Secure Impressive Win

May 21, 2025 -

Unbelievable Wheel Of Fortunes Million Dollar Moment

May 21, 2025

Unbelievable Wheel Of Fortunes Million Dollar Moment

May 21, 2025 -

Next Weeks East Enders Zack Hudson Kidnapped Lake Crash Disaster

May 21, 2025

Next Weeks East Enders Zack Hudson Kidnapped Lake Crash Disaster

May 21, 2025 -

Analyzing Micro Strategy Mstr And Bitcoin Btc February 2025 Market Outlook And Investment Strategies

May 21, 2025

Analyzing Micro Strategy Mstr And Bitcoin Btc February 2025 Market Outlook And Investment Strategies

May 21, 2025 -

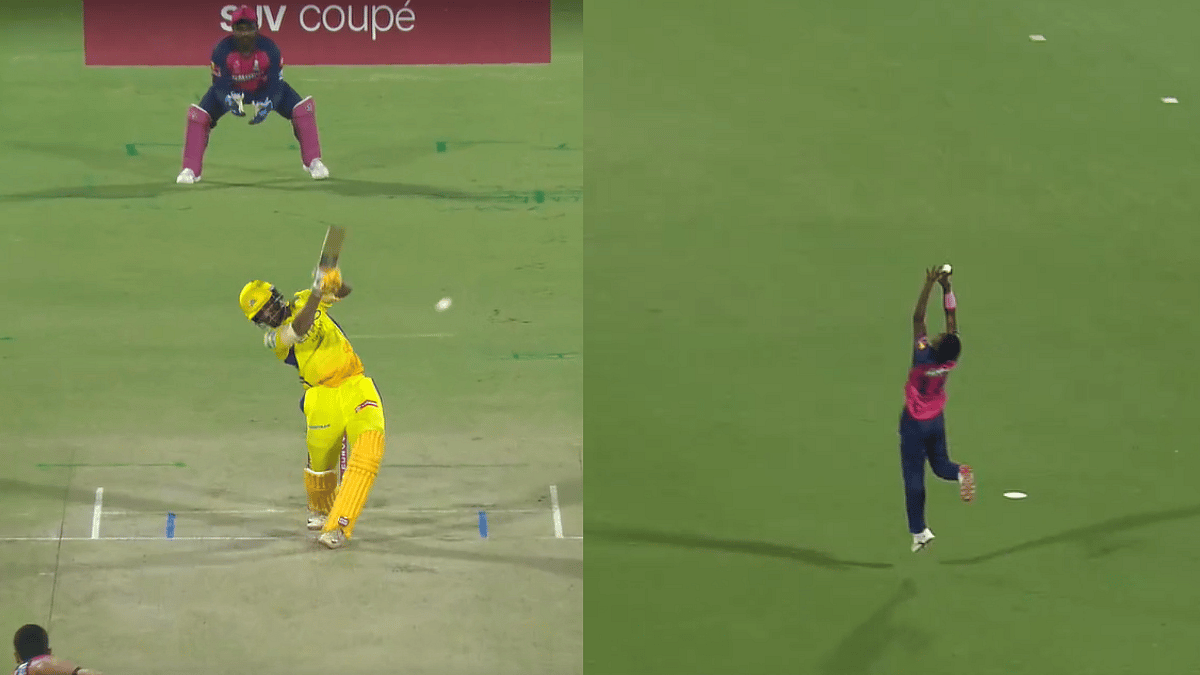

Ipl 2025 Kwena Maphakas Unbelievable Catch Removes Urvil Patel In Csk Vs Rr Thriller

May 21, 2025

Ipl 2025 Kwena Maphakas Unbelievable Catch Removes Urvil Patel In Csk Vs Rr Thriller

May 21, 2025