MicroStrategy's Bitcoin Holdings Surge Past 555k BTC After 1895 Coin Purchase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's Bitcoin Bet Grows: Holdings Top 555,000 BTC After Massive Purchase

MicroStrategy, the business intelligence firm led by the outspoken Bitcoin bull Michael Saylor, has once again significantly increased its Bitcoin holdings. The company announced the purchase of an additional 1,895 bitcoins, pushing its total Bitcoin stash past a staggering 55,550 BTC. This latest acquisition underscores MicroStrategy's unwavering commitment to Bitcoin as a long-term investment strategy and highlights the growing institutional adoption of the cryptocurrency.

The purchase, made between August 29 and September 5, 2024, at an average price of approximately $34,558 per coin, represents a substantial investment. While the exact cost remains undisclosed, it's estimated to be in the tens of millions of dollars, further solidifying MicroStrategy's position as one of the largest corporate holders of Bitcoin globally. This bold move comes at a time of continued market volatility for Bitcoin, demonstrating MicroStrategy's confidence in the cryptocurrency's long-term potential.

MicroStrategy's Bitcoin Strategy: A Long-Term Vision

MicroStrategy's journey into the Bitcoin market began in August 2020, with its initial purchase of 21,454 BTC. Since then, the company has consistently added to its holdings, weathering market downturns and embracing the inherent volatility of the cryptocurrency market. This steadfast commitment to accumulating Bitcoin reflects a long-term strategic vision that positions Bitcoin as a significant asset in its treasury reserves.

This strategy, however, isn't without its critics. Some analysts argue that the significant portion of MicroStrategy's assets tied up in Bitcoin represents a substantial risk. However, Saylor and his team have repeatedly defended their strategy, highlighting Bitcoin's potential as a hedge against inflation and its potential for significant long-term appreciation.

The Impact on the Bitcoin Market

MicroStrategy's large-scale Bitcoin purchases have a noticeable impact on the overall market. These substantial investments contribute to increased demand and can influence Bitcoin's price. Institutional investors, particularly those with substantial assets like MicroStrategy, play a key role in shaping the cryptocurrency market narrative and driving adoption.

What's Next for MicroStrategy and Bitcoin?

The company’s continued investment in Bitcoin signals a sustained bullish outlook on the cryptocurrency's future. While predicting the future price of Bitcoin is inherently speculative, MicroStrategy's actions suggest a strong belief in its long-term value. The company's ongoing commitment to Bitcoin positions it as a key player in the evolving landscape of institutional cryptocurrency investment. Whether other companies follow suit remains to be seen, but MicroStrategy's actions undeniably set a precedent for corporate Bitcoin adoption.

Key takeaways:

- Record-Breaking Holdings: MicroStrategy now holds over 55,550 BTC, solidifying its position as a major Bitcoin holder.

- Continued Investment: The 1,895 BTC purchase demonstrates unwavering commitment to Bitcoin's long-term potential.

- Market Impact: MicroStrategy's actions significantly influence Bitcoin’s market dynamics and institutional adoption.

- Strategic Vision: The company’s strategy highlights Bitcoin as a valuable long-term asset and a hedge against inflation.

- Future Outlook: MicroStrategy’s continued investment sets a precedent for corporate Bitcoin adoption.

This latest acquisition from MicroStrategy underscores the growing acceptance of Bitcoin as a legitimate asset class among institutional investors. The company's unwavering commitment to Bitcoin, despite market volatility, is a powerful testament to its belief in the cryptocurrency's long-term potential. Only time will tell if this bold strategy will ultimately prove successful, but one thing is certain: MicroStrategy continues to make waves in the Bitcoin market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's Bitcoin Holdings Surge Past 555k BTC After 1895 Coin Purchase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Shai Gilgeous Alexander Lead The Thunder Past Jokics Nuggets

May 07, 2025

Can Shai Gilgeous Alexander Lead The Thunder Past Jokics Nuggets

May 07, 2025 -

Xrp Price Decline In May 2025 Five Potential Contributing Factors

May 07, 2025

Xrp Price Decline In May 2025 Five Potential Contributing Factors

May 07, 2025 -

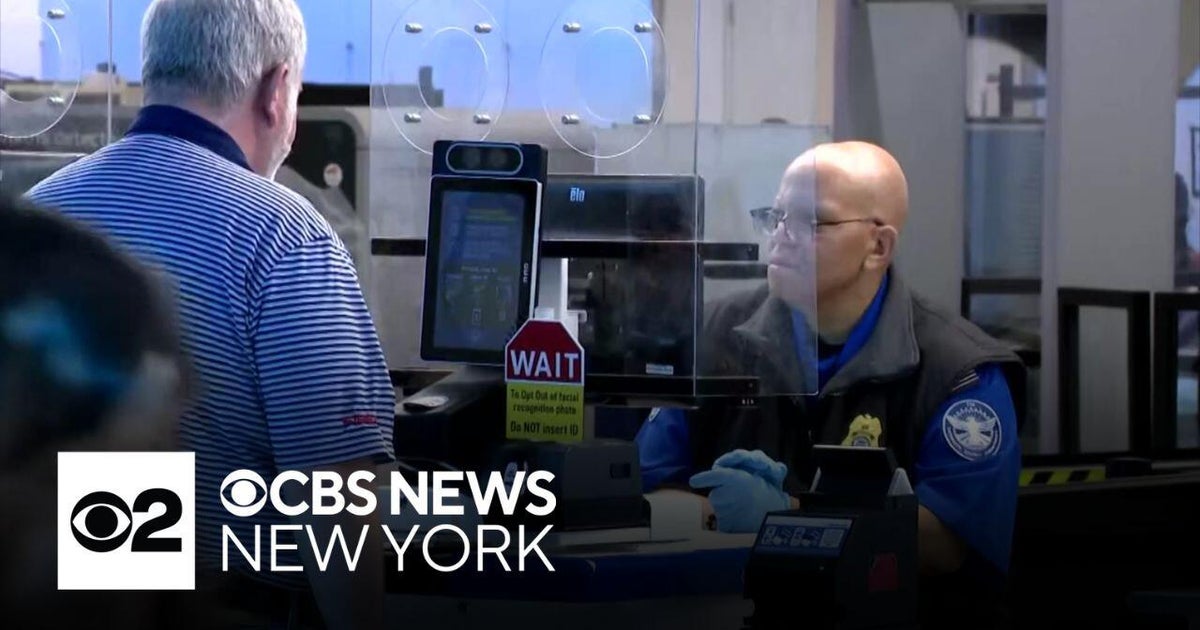

Real Id Enforcement Delayed How To Fly Domestically Without A Real Id

May 07, 2025

Real Id Enforcement Delayed How To Fly Domestically Without A Real Id

May 07, 2025 -

Arsenal Vs Psg Artetas Pre Match Presser Full Transcript

May 07, 2025

Arsenal Vs Psg Artetas Pre Match Presser Full Transcript

May 07, 2025 -

Nuggets Top Thunder In Game 1 Thriller Gordons Game Winner Seals Victory

May 07, 2025

Nuggets Top Thunder In Game 1 Thriller Gordons Game Winner Seals Victory

May 07, 2025

Latest Posts

-

Houthi Group Ceases Fire In Yemen Trumps Announcement

May 08, 2025

Houthi Group Ceases Fire In Yemen Trumps Announcement

May 08, 2025 -

May 7 2025 Knicks Celtics Game Box Score Playoff Showdown

May 08, 2025

May 7 2025 Knicks Celtics Game Box Score Playoff Showdown

May 08, 2025 -

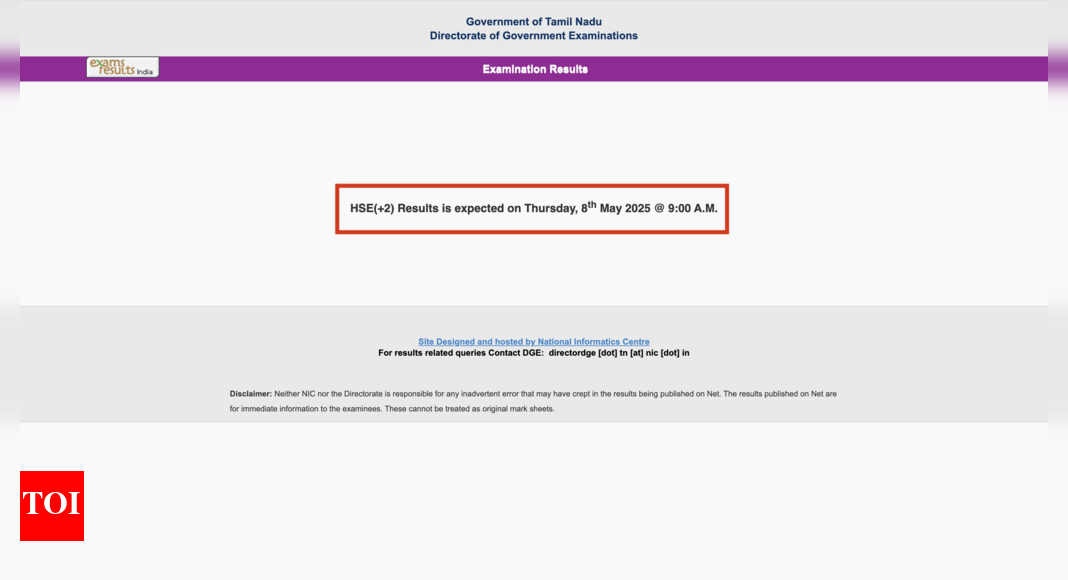

Tamil Nadu 12th Hsc Public Exam Result 2024 Live Updates Direct Download Link

May 08, 2025

Tamil Nadu 12th Hsc Public Exam Result 2024 Live Updates Direct Download Link

May 08, 2025 -

Kamino Kmno 30 Day Performance A 100 Increase Following Binance Listing

May 08, 2025

Kamino Kmno 30 Day Performance A 100 Increase Following Binance Listing

May 08, 2025 -

Is The Yemen War Over Trump Announces Houthi Ceasefire Agreement

May 08, 2025

Is The Yemen War Over Trump Announces Houthi Ceasefire Agreement

May 08, 2025