MicroStrategy's STRK Preferred Stock: A Deep Dive Into Bitcoin Funding

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's STRK Preferred Stock: A Deep Dive into Bitcoin Funding

MicroStrategy, the business intelligence company known for its significant Bitcoin holdings, recently made headlines with the launch of its Series A Convertible Preferred Stock, ticker symbol STRK. This move isn't just another corporate financing strategy; it represents a novel approach to funding further Bitcoin acquisitions, sparking considerable interest among investors and crypto enthusiasts alike. This article delves into the intricacies of STRK, its implications for MicroStrategy's Bitcoin strategy, and the potential impact on the broader cryptocurrency market.

Understanding MicroStrategy's STRK Preferred Stock

MicroStrategy's STRK is a convertible preferred stock offering, allowing investors to convert their shares into common stock at a predetermined price. The key differentiator, however, lies in its primary purpose: to raise capital for acquiring more Bitcoin. This direct link between the investment and Bitcoin acquisition sets STRK apart from traditional corporate financing methods.

Key Features of STRK:

- Convertible into Common Stock: Investors can convert their preferred shares into common stock at a specified conversion ratio, offering potential for upside if MicroStrategy's stock price appreciates.

- Bitcoin-Focused Investment: The proceeds from the sale of STRK are explicitly earmarked for purchasing more Bitcoin, providing a transparent and focused investment strategy.

- Attractive Yield: The preferred stock offers a dividend yield, potentially attracting income-seeking investors while simultaneously contributing to MicroStrategy's Bitcoin accumulation.

- Reduced Dilution: Compared to issuing additional common stock, preferred stock can potentially minimize dilution for existing shareholders.

Implications for MicroStrategy's Bitcoin Strategy:

MicroStrategy's CEO, Michael Saylor, has been a vocal advocate for Bitcoin as a long-term investment and store of value. The launch of STRK solidifies this commitment, providing a dedicated funding mechanism for their continued accumulation of Bitcoin. This strategy significantly reduces reliance on traditional debt financing or equity dilution, potentially maintaining a stronger balance sheet while expanding their Bitcoin holdings.

The Broader Impact on the Cryptocurrency Market:

MicroStrategy's actions carry weight in the cryptocurrency market. The company's significant Bitcoin holdings and its innovative financing strategy could encourage other corporations to consider similar approaches. This could lead to increased institutional adoption of Bitcoin and potentially drive further price appreciation. However, it's crucial to remember that the success of this strategy is inherently tied to the future price performance of Bitcoin.

Risks and Considerations:

While the STRK offering presents exciting possibilities, investors should be aware of potential risks:

- Bitcoin Price Volatility: The value of Bitcoin is inherently volatile. If the price falls significantly, MicroStrategy's investment and the value of STRK could be negatively impacted.

- Interest Rate Risk: The attractiveness of the dividend yield is influenced by prevailing interest rates. Rising interest rates could reduce the appeal of STRK compared to other fixed-income investments.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain, and any adverse regulatory changes could affect MicroStrategy's Bitcoin holdings and the value of STRK.

Conclusion:

MicroStrategy's STRK preferred stock represents a bold and innovative approach to financing Bitcoin acquisitions. It demonstrates a strong commitment to Bitcoin's long-term potential and could influence other corporations to adopt similar strategies. However, potential investors should carefully weigh the risks associated with Bitcoin's volatility and the broader regulatory environment before investing in STRK. The success of this strategy will largely depend on the future performance of Bitcoin and the overall stability of the cryptocurrency market. Continued monitoring of MicroStrategy's financial statements and industry news will be crucial for understanding the ongoing impact of this strategic move.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's STRK Preferred Stock: A Deep Dive Into Bitcoin Funding. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

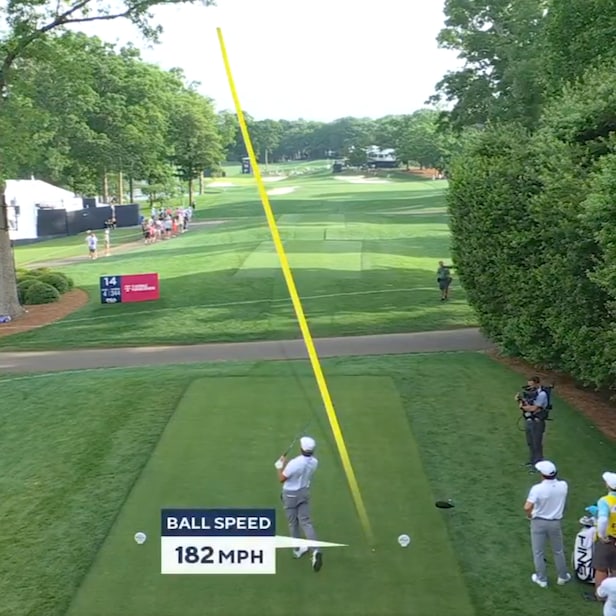

Homas Close Call A Par 4 Hole In One Attempt At The 2025 Pga

May 17, 2025

Homas Close Call A Par 4 Hole In One Attempt At The 2025 Pga

May 17, 2025 -

Ge 2025 Overseas Voters Echo Domestic Trends 92 83 Turnout

May 17, 2025

Ge 2025 Overseas Voters Echo Domestic Trends 92 83 Turnout

May 17, 2025 -

Apple Blocks Fortnite I Os Users Globally Lose Access To Popular Game

May 17, 2025

Apple Blocks Fortnite I Os Users Globally Lose Access To Popular Game

May 17, 2025 -

Rare Earth Minerals The Next Battlefield In The Global Power Game

May 17, 2025

Rare Earth Minerals The Next Battlefield In The Global Power Game

May 17, 2025 -

At The Pga A Compelling Narrative Overshadows The Competition

May 17, 2025

At The Pga A Compelling Narrative Overshadows The Competition

May 17, 2025