MicroStrategy's STRK: Preferred Stock Financing For Bitcoin Accumulation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's STRK: Fueling Bitcoin Accumulation Through Preferred Stock Financing

MicroStrategy, the business intelligence firm known for its aggressive Bitcoin accumulation strategy, has once again made headlines, this time with the launch of its Series A Convertible Preferred Stock, ticker symbol STRK. This innovative financing method represents a significant shift in how publicly traded companies can fund their cryptocurrency holdings, potentially paving the way for similar strategies from other major players. But what exactly is STRK, and how does it benefit MicroStrategy's ongoing Bitcoin purchasing spree?

Understanding MicroStrategy's STRK Offering:

MicroStrategy's STRK offering allows investors to purchase preferred stock, which offers several advantages over traditional common stock. These advantages include a potentially higher dividend yield and a conversion feature into common stock under specific circumstances. This cleverly designed instrument allows the company to raise significant capital without diluting existing shareholders' ownership to the same extent as a common stock offering. This is crucial for a company like MicroStrategy, which is committed to maintaining its substantial Bitcoin reserves.

The Bitcoin Connection:

The proceeds from the STRK offering are explicitly earmarked for further Bitcoin acquisitions. This direct link between the financing and MicroStrategy's core Bitcoin strategy underscores the company's unwavering belief in Bitcoin as a long-term investment. By using this method, MicroStrategy avoids the potential market volatility associated with directly selling more common stock to raise funds, allowing for a more controlled and strategic approach to Bitcoin accumulation.

Why is this a game-changer?

This strategy offers several key advantages:

- Reduced Dilution: Compared to issuing common stock, preferred stock offerings minimize the dilution of existing shareholder ownership. This is a significant advantage for long-term investors who value their stake in the company.

- Targeted Funding: The dedicated allocation of funds ensures transparency and reinforces the commitment to Bitcoin. This strengthens investor confidence in MicroStrategy's strategy.

- Potential for Higher Returns: The preferred stock structure may offer investors attractive dividend yields, potentially exceeding returns from traditional equity investments.

- Innovation in Corporate Finance: MicroStrategy's move sets a precedent for other publicly traded companies seeking to integrate cryptocurrency strategies into their core business models.

Risks and Considerations:

While the STRK offering presents several compelling advantages, investors should carefully consider the inherent risks. These include:

- Bitcoin Volatility: The value of Bitcoin is notoriously volatile, impacting the overall value of MicroStrategy's holdings and, consequently, the value of STRK.

- Market Conditions: The success of the offering depends on investor appetite for both preferred stock and Bitcoin.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains fluid, introducing potential future risks.

Conclusion:

MicroStrategy's launch of STRK represents a bold and innovative approach to financing cryptocurrency acquisitions. By leveraging preferred stock, the company is strategically accumulating Bitcoin while minimizing the impact on existing shareholders. This development is closely watched by other publicly-traded companies considering similar strategies, potentially reshaping the corporate landscape’s relationship with digital assets. The long-term success of this strategy, however, hinges on the continued performance of Bitcoin and the overall regulatory environment. Investors should conduct thorough due diligence before investing in STRK or any other cryptocurrency-related investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's STRK: Preferred Stock Financing For Bitcoin Accumulation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Profits And The Chip Challenge Teslas Innovation And Competitive Advantage

May 18, 2025

Ai Profits And The Chip Challenge Teslas Innovation And Competitive Advantage

May 18, 2025 -

Misfits Boxing 21 Till Vs Stewart Live Blog Highlights And Post Fight Reaction

May 18, 2025

Misfits Boxing 21 Till Vs Stewart Live Blog Highlights And Post Fight Reaction

May 18, 2025 -

Can Buffetts Investing Principles Guide Crypto Investments

May 18, 2025

Can Buffetts Investing Principles Guide Crypto Investments

May 18, 2025 -

Official Marc Guehi Leaves Crystal Palace In Permanent Transfer

May 18, 2025

Official Marc Guehi Leaves Crystal Palace In Permanent Transfer

May 18, 2025 -

2024 Election How Trump And Biden Are Using Facebook To Reach Senior Women

May 18, 2025

2024 Election How Trump And Biden Are Using Facebook To Reach Senior Women

May 18, 2025

Latest Posts

-

Micro Strategys Bitcoin Gamble How Strk Preferred Stock Plays A Role

May 18, 2025

Micro Strategys Bitcoin Gamble How Strk Preferred Stock Plays A Role

May 18, 2025 -

F1 Imola Qualifying Tsunodas Rollover Crash And Aftermath

May 18, 2025

F1 Imola Qualifying Tsunodas Rollover Crash And Aftermath

May 18, 2025 -

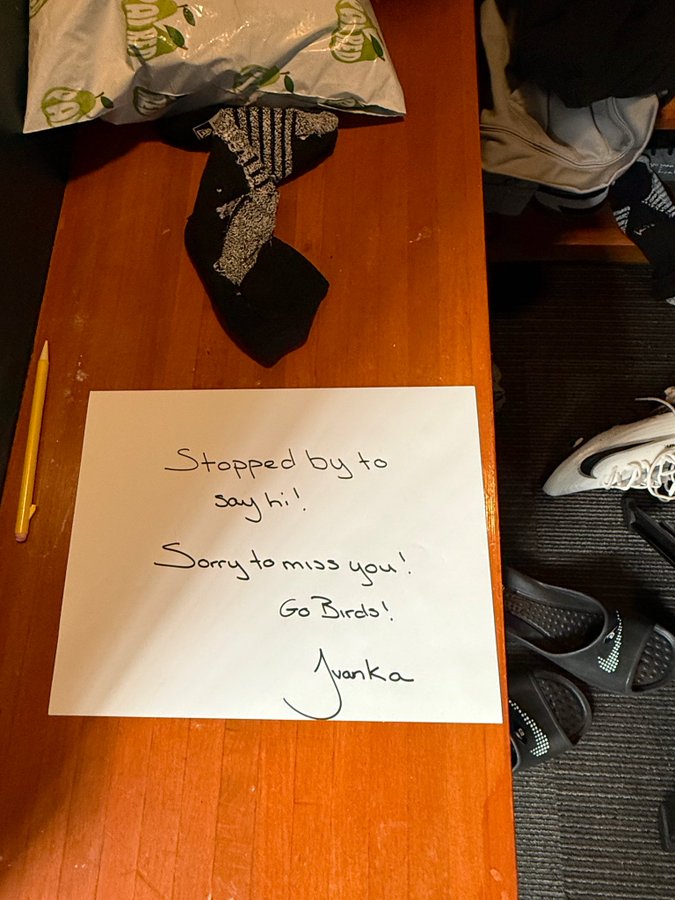

Mystery Message Ivanka Trump Leaves Note For Lsu Football Player Eli Ricks

May 18, 2025

Mystery Message Ivanka Trump Leaves Note For Lsu Football Player Eli Ricks

May 18, 2025 -

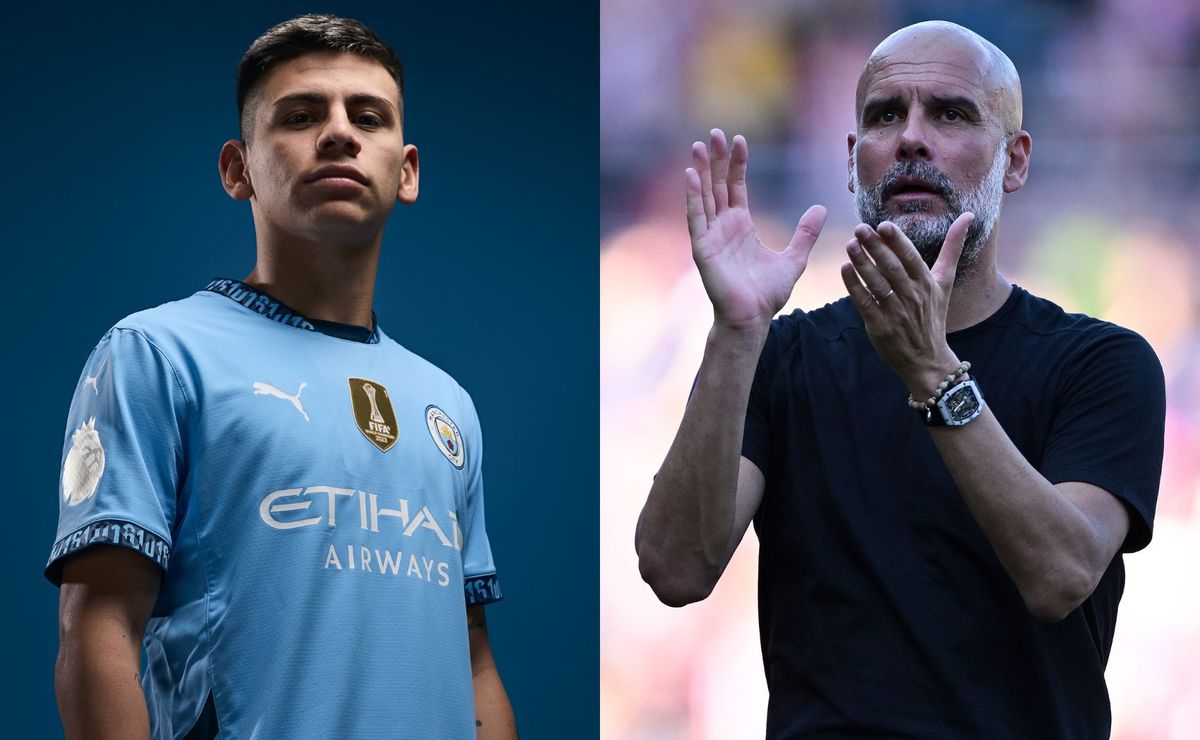

La Premier League Bajo Fuego Guardiola Denuncia Programacion Injusta Tras Nueve Anos

May 18, 2025

La Premier League Bajo Fuego Guardiola Denuncia Programacion Injusta Tras Nueve Anos

May 18, 2025 -

Guardiolas Decision Echeverri Benched For The First Time At Manchester City

May 18, 2025

Guardiolas Decision Echeverri Benched For The First Time At Manchester City

May 18, 2025