MicroStrategy's STRK Preferred Stock: Risks And Rewards Of Its Bitcoin Approach

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's STRK Preferred Stock: Navigating the Risks and Rewards of a Bitcoin-Heavy Strategy

MicroStrategy (MSTR), a business intelligence company, has made headlines for its aggressive Bitcoin (BTC) acquisition strategy. This bold move, while generating significant buzz, has also introduced considerable volatility into the company's performance, reflected in the recent introduction of its STRK preferred stock. Understanding the risks and rewards inherent in MicroStrategy's Bitcoin-centric approach is crucial for investors considering adding STRK to their portfolios.

What is MicroStrategy's STRK Preferred Stock?

MicroStrategy's Series A Convertible Preferred Stock (STRK) offers investors a unique opportunity to gain exposure to the company's performance, heavily intertwined with the price of Bitcoin. Unlike directly purchasing MSTR stock, STRK provides a potentially leveraged play on Bitcoin's price movements. However, it's crucial to acknowledge the complexities and potential downsides.

The Allure of Bitcoin: Potential Rewards

MicroStrategy's bullish stance on Bitcoin stems from its belief in the cryptocurrency's long-term value as a store of value and a hedge against inflation. The potential rewards for STRK investors are significant:

- Bitcoin Price Appreciation: If Bitcoin's price rises substantially, MicroStrategy's Bitcoin holdings increase in value, potentially boosting STRK's value.

- Diversification: For investors seeking exposure to Bitcoin without directly owning it, STRK offers a degree of diversification.

- Potential for High Returns: The leveraged nature of STRK could amplify gains if Bitcoin's price appreciates significantly.

The Volatility Factor: Significant Risks

However, the inherent volatility of Bitcoin introduces substantial risks:

- Bitcoin Price Volatility: Bitcoin's price is notoriously volatile, subject to wild swings driven by market sentiment, regulatory changes, and technological developments. A sharp decline in Bitcoin's price could severely impact MicroStrategy's balance sheet and, consequently, STRK's value.

- Liquidity Concerns: The relatively new nature of STRK could lead to lower liquidity compared to established securities, making it difficult to buy or sell quickly at desired prices.

- Company-Specific Risks: MicroStrategy's business performance beyond its Bitcoin holdings also contributes to STRK's performance. Challenges in the business intelligence sector could negatively impact its overall valuation.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies poses a significant risk. Changes in regulations could impact Bitcoin's price and MicroStrategy's operations.

Analyzing the STRK Investment Decision

Investing in MicroStrategy's STRK preferred stock requires a careful assessment of your risk tolerance. It's not a suitable investment for risk-averse individuals. Consider these factors before investing:

- Your Investment Horizon: A long-term investment horizon is crucial to mitigate the impact of Bitcoin's short-term volatility.

- Risk Tolerance: STRK is a high-risk, high-reward investment. Only investors comfortable with substantial potential losses should consider it.

- Diversification Strategy: STRK should be a small part of a well-diversified portfolio. Over-exposure to Bitcoin through STRK could lead to significant losses.

Conclusion:

MicroStrategy's STRK preferred stock presents a unique investment opportunity for those seeking leveraged exposure to Bitcoin's price movements. However, the inherent risks associated with Bitcoin's volatility and the company's strategic focus cannot be ignored. Thorough research and a clear understanding of your risk profile are paramount before considering this investment. Consult with a financial advisor to determine if STRK aligns with your investment goals and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's STRK Preferred Stock: Risks And Rewards Of Its Bitcoin Approach. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Legal Troubles Mount For Phoenix Suns Employee Litigation Persists Under New Ownership

May 20, 2025

Legal Troubles Mount For Phoenix Suns Employee Litigation Persists Under New Ownership

May 20, 2025 -

Amazons Echo Show 15 Competitor Smaller Cheaper Smart Display Takes On Google

May 20, 2025

Amazons Echo Show 15 Competitor Smaller Cheaper Smart Display Takes On Google

May 20, 2025 -

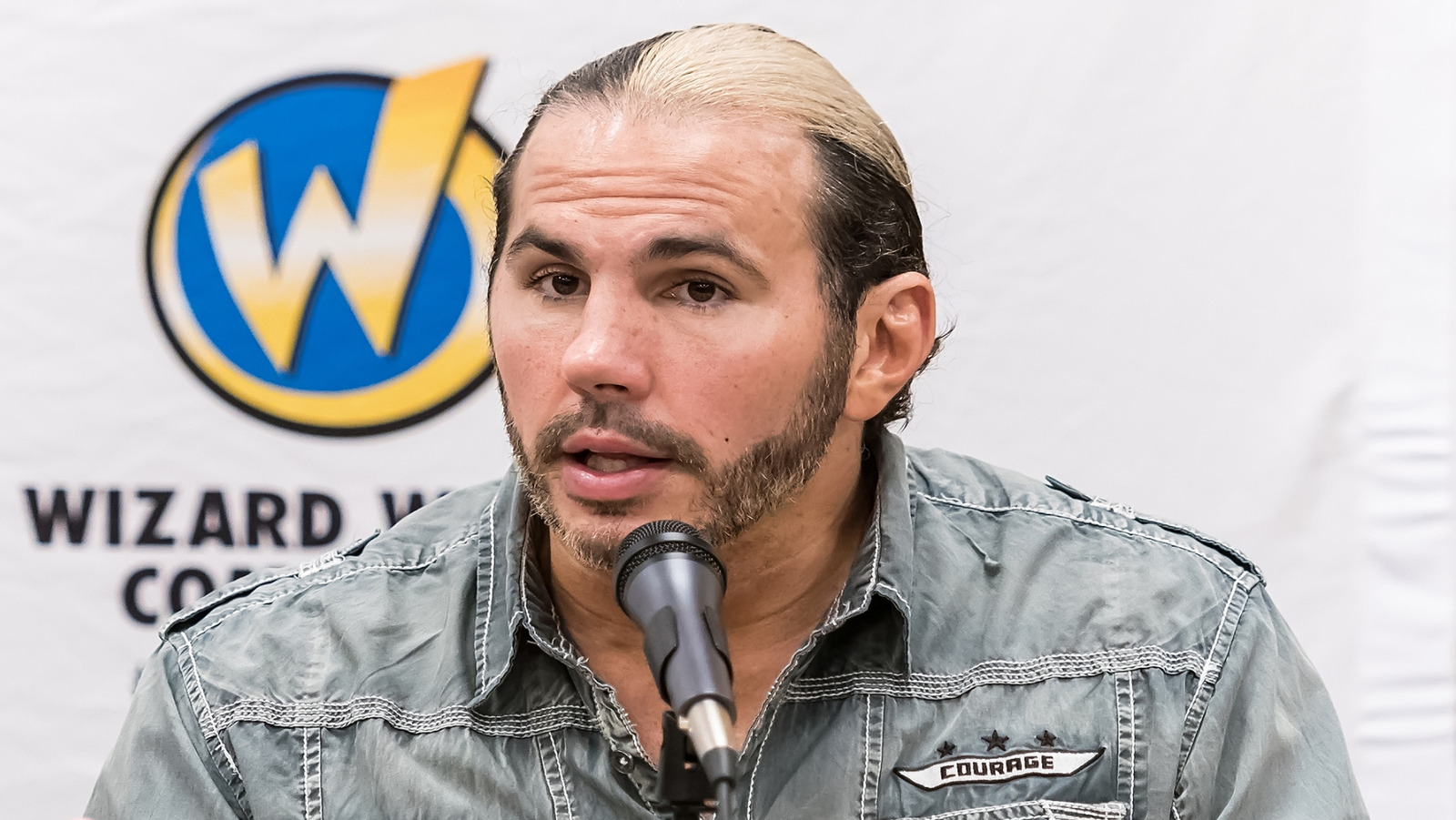

Wwe Releases Matt Hardys Experienced Perspective And Career Advice

May 20, 2025

Wwe Releases Matt Hardys Experienced Perspective And Career Advice

May 20, 2025 -

Survivor Quebec Le Public Choisit Le Gagnant Moins D Un Mois Avant La Finale

May 20, 2025

Survivor Quebec Le Public Choisit Le Gagnant Moins D Un Mois Avant La Finale

May 20, 2025 -

Abhishek Sharmas Match Winning Knock Srh Vs Lsg Highlights Ipl 2025

May 20, 2025

Abhishek Sharmas Match Winning Knock Srh Vs Lsg Highlights Ipl 2025

May 20, 2025