Missed Stimulus Payments In PA? Here's What You Need To Know.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Missed Stimulus Payments in PA? Here's What You Need to Know.

Are you a Pennsylvania resident who believes you missed out on a stimulus payment? You're not alone. Many Pennsylvanians are still trying to navigate the complexities of the various stimulus programs rolled out in recent years. This guide provides crucial information on how to determine if you're eligible for any missed payments and what steps you should take.

The COVID-19 pandemic spurred unprecedented economic relief efforts, resulting in several rounds of stimulus checks. These included:

- Economic Impact Payments (EIP): These were the direct payments issued under the CARES Act, American Rescue Plan, and other related legislation.

- Additional Child Tax Credit (ACTC): This program provided enhanced payments for qualifying children.

Determining if You Missed a Payment:

The first step is to determine if you were eligible for any of these programs and if you received the full amount. Eligibility criteria varied across the different stimulus programs, typically based on income, filing status, and the number of dependents. Key factors to consider include:

- Your Income: Income thresholds were in place for each stimulus payment. Even if you earned below the threshold in one year, you may have been above it in another.

- Filing Status: Single filers, married couples filing jointly, and heads of households all had different eligibility requirements.

- Dependents: The number of qualifying children significantly impacted the amount of the stimulus payment received.

- Your Tax Filing Status: You must have filed your taxes to be eligible for the stimulus payments. If you didn't file, you may have missed out.

How to Check Your Payment Status:

The IRS website is the most reliable source for checking your stimulus payment status. You can use the IRS's Get My Payment tool to track your payments. You will need your Social Security number, date of birth, and filing status.

What to Do if You Believe You Missed a Payment:

If the IRS's Get My Payment tool indicates you are missing a payment or that the amount received is incorrect, you should take the following steps:

- Gather Your Tax Information: Collect all relevant tax documents, including W-2s, 1099s, and tax returns for the relevant years.

- Review the IRS Eligibility Requirements: Carefully review the specific requirements for each stimulus program to ensure you meet all criteria.

- Contact the IRS: If you believe you're eligible for a missed payment and have confirmed your eligibility, contact the IRS directly. You can reach them by phone or through their online channels. Be prepared to provide all necessary documentation.

- Seek Professional Assistance: If you're struggling to navigate the process, consider seeking assistance from a tax professional. They can help you gather the necessary documentation and guide you through the process.

Key Considerations for Pennsylvania Residents:

Pennsylvania's state government didn't offer a separate stimulus program directly mirroring the federal initiatives. Focus your efforts on verifying your federal stimulus payment status.

Don't Delay! The deadlines for claiming missed stimulus payments may vary. Act promptly to investigate your eligibility and pursue any potential payments you may be owed. The longer you wait, the more challenging the process may become.

Keywords: PA stimulus payments, missed stimulus, stimulus check, Economic Impact Payments (EIP), American Rescue Plan, IRS, Get My Payment, Pennsylvania stimulus, COVID-19 stimulus, tax refund, tax relief, missing stimulus money

This article is for informational purposes only and should not be considered legal or financial advice. Always consult with a qualified professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Missed Stimulus Payments In PA? Here's What You Need To Know.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

Pacers Playoff Hopes Siakams Perspective On The Cleveland Series

May 08, 2025

Pacers Playoff Hopes Siakams Perspective On The Cleveland Series

May 08, 2025 -

King Charles And Albanese Live Federal Politics Updates And Labor Faction Tensions

May 08, 2025

King Charles And Albanese Live Federal Politics Updates And Labor Faction Tensions

May 08, 2025 -

Mad Scientist Monster Identity Revealed On The Masked Singer Finale

May 08, 2025

Mad Scientist Monster Identity Revealed On The Masked Singer Finale

May 08, 2025 -

Thunders Game 1 Collapse Shai Gilgeous Alexanders Reaction

May 08, 2025

Thunders Game 1 Collapse Shai Gilgeous Alexanders Reaction

May 08, 2025

Latest Posts

-

Pakistan Minister Tarars No Terror Camps Assertion Challenged

May 08, 2025

Pakistan Minister Tarars No Terror Camps Assertion Challenged

May 08, 2025 -

Fact Check Fails Pakistani Ministers Statements Challenged On Air

May 08, 2025

Fact Check Fails Pakistani Ministers Statements Challenged On Air

May 08, 2025 -

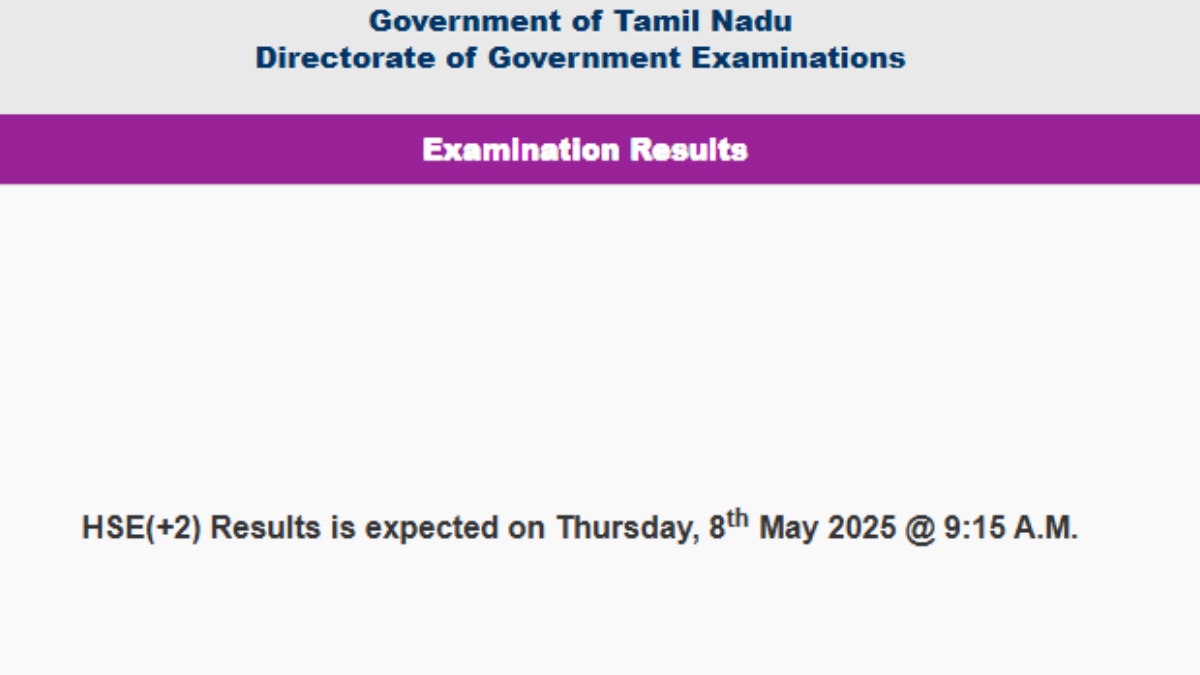

Tngde Declares Tn Hsc 2 Results 2025 Check Your Score On Tnresults Nic In

May 08, 2025

Tngde Declares Tn Hsc 2 Results 2025 Check Your Score On Tnresults Nic In

May 08, 2025 -

Ligue Des Champions Victoire Historique Du Psg Face A Arsenal Rendez Vous En Finale Contre L Inter

May 08, 2025

Ligue Des Champions Victoire Historique Du Psg Face A Arsenal Rendez Vous En Finale Contre L Inter

May 08, 2025 -

Final Destination Bloodlines Oldest Person Ever Set On Fire In A Film Stunt

May 08, 2025

Final Destination Bloodlines Oldest Person Ever Set On Fire In A Film Stunt

May 08, 2025