Mixed Bag For Singapore Banks In Q1 2024: Net Interest Margin Fluctuations Balanced By Gains In Wealth And Trade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mixed Bag for Singapore Banks in Q1 2024: Net Interest Margin Fluctuations Balanced by Gains in Wealth and Trade

Singapore's banking sector delivered a mixed performance in the first quarter of 2024, with fluctuating net interest margins (NIMs) offset by strong growth in wealth management and trade finance. While rising interest rates initially boosted profits, the impact was uneven, highlighting the complexities faced by financial institutions in the current economic climate.

Net Interest Margin: A Tale of Two Halves

The fluctuating NIMs tell a significant part of the Q1 story. Several major banks reported a slight dip in NIMs compared to the previous quarter. This decrease, while modest for some, reflects the ongoing challenges in managing lending rates and deposit costs in a rapidly changing interest rate environment. The impact of global economic uncertainty and potential recessionary pressures also played a role in the cautious lending behavior observed in some sectors. Analysts predict further NIM compression in the coming quarters as competition intensifies and deposit costs continue to adjust. However, others believe that the current NIMs are still profitable and represent a sustainable level.

Wealth Management: A Bright Spot in a Challenging Landscape

Despite the complexities in the lending sector, the wealth management segment emerged as a significant driver of growth for Singapore's banks in Q1 2024. Increased client activity, particularly in investment banking and private banking services, contributed to strong fee income. This sector benefitted from both sustained high-net-worth individual (HNWI) activity and a broader increase in investment activity across various asset classes. The growth in this area underscores the importance of diversification within the financial sector. Banks are increasingly positioning themselves as comprehensive wealth management providers, offering a range of services beyond traditional banking.

Trade Finance: Navigating Global Uncertainty

Trade finance also contributed positively to the overall performance of Singapore's banks. Despite global trade uncertainties stemming from geopolitical tensions and inflationary pressures, Singapore's strategic location and robust financial infrastructure continued to attract significant trade flows. Banks profited from facilitating these transactions, highlighting the resilience of the trade finance sector in the face of economic headwinds. The growth in this sector further solidifies Singapore's position as a leading global financial hub.

Looking Ahead: Navigating the Uncertain Future

The performance of Singapore's banks in Q1 2024 presents a nuanced picture. While NIM fluctuations caused some concern, the robust performance in wealth management and trade finance offered a much-needed counterbalance. The coming quarters will likely bring further challenges, requiring banks to adapt their strategies and carefully manage their risk exposure. The key to success will be in diversifying revenue streams, embracing digital innovation, and proactively managing the evolving regulatory landscape. Factors to watch include further interest rate adjustments, global economic growth, and geopolitical developments.

Key Takeaways:

- Mixed Q1 results: Fluctuating NIMs offset by strong wealth management and trade finance growth.

- NIM compression: Potential for further NIM compression in the coming quarters.

- Wealth management surge: Strong growth driven by HNWI activity and broader investment increases.

- Resilient trade finance: Singapore's strategic location continues to attract trade flows, despite global uncertainty.

- Future outlook: Banks need to adapt to navigate future economic challenges.

This diverse performance underscores the resilience and adaptability of Singapore’s banking sector, demonstrating its ability to navigate a complex and ever-evolving global financial landscape. The continued success of the sector will depend on its capacity for innovation, risk management, and strategic diversification.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mixed Bag For Singapore Banks In Q1 2024: Net Interest Margin Fluctuations Balanced By Gains In Wealth And Trade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

De Nino A Adulto El Increible Viaje De Una Decada

May 05, 2025

De Nino A Adulto El Increible Viaje De Una Decada

May 05, 2025 -

How To Vote On American Idol 2025 May 4th And 5th Live Shows

May 05, 2025

How To Vote On American Idol 2025 May 4th And 5th Live Shows

May 05, 2025 -

Tesla Austin Robotaxi A June 2025 Launch Date Announced

May 05, 2025

Tesla Austin Robotaxi A June 2025 Launch Date Announced

May 05, 2025 -

Enrico Galiano Sogni Di Carta Presentazione Libro A Nardo

May 05, 2025

Enrico Galiano Sogni Di Carta Presentazione Libro A Nardo

May 05, 2025 -

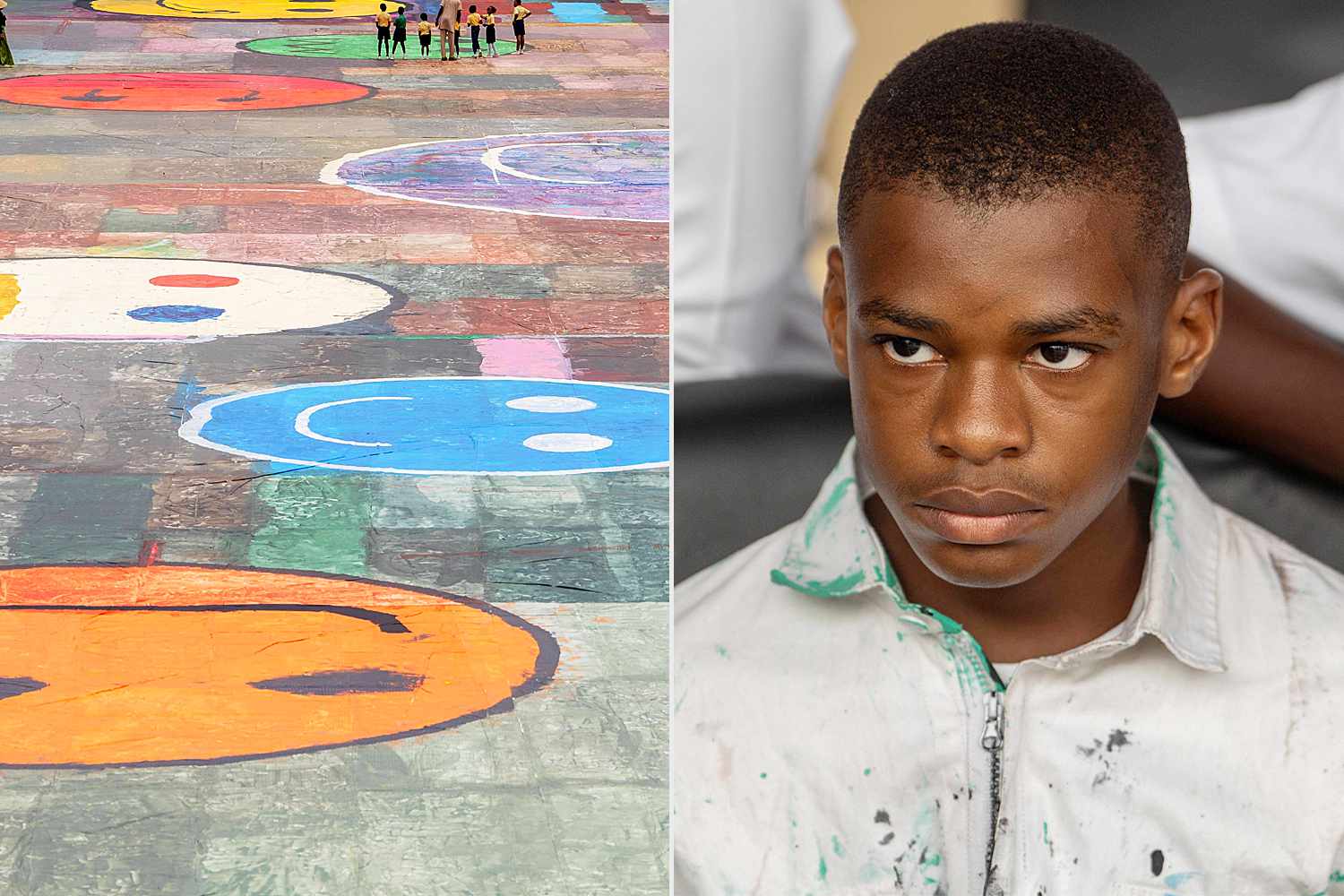

15 Year Old Creates Worlds Largest Canvas An Autism Triumph

May 05, 2025

15 Year Old Creates Worlds Largest Canvas An Autism Triumph

May 05, 2025